Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

A lot can change in a month.

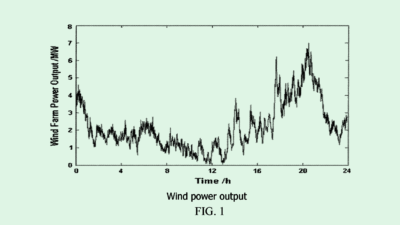

The International Energy Agency dramatically slashed its projections for oil demand Thursday, now predicting the rest of 2021 will see 500,000 fewer barrels per day of growth than the agency forecast just a month ago.

Romance, however, is still in high demand: the rapid spread of the Delta coronavirus variant, which has already pushed major economies in Asia into retreat, has dating apps like Bumble buzzing with activity.

Man Seeking Hydrocarbons

Oil prices have been on a tear most of this year, climbing from $50 in January to reach pre-pandemic highs of $78 by July, as broadening signs of an economic rebound gave energy producers a glimmer of hope.

But after Opec’s major oil producers — persuaded by the IEA’s earlier, rosier projections — agreed to increase output by 400,000 barrels per day, the rise of the Delta variant sent Asian economies backpedaling, sapping oil demand:

- The simultaneous supply glut and demand crunch have sent oil prices down 6% this month.

- Asia isn’t the only area of concern. After global oil demand surged to 3.8 million barrels per day in June, the IEA said demand “abruptly reversed course” last month, dipping 120,000 barrels per day.

Cheap Date: With restrictions ramping up across parts of the world, apps like Bumble and Tinder have grown rapidly as people increasingly turn to virtual dating. On Wednesday, Bumble said its app was downloaded 2 million times in the second quarter, an 18% year-over-year increase. Revenue also climbed 38% to $186 million, beating Refinitiv IBES estimates of $179 million. “When COVID accelerates and loneliness climbs, people turn to us for connections,” explained Bumble CEO Whitney Wolfe Herd.

Gas Station Relationship Drama: While oil prices are down slightly this month, Americans are still paying $3 a gallon at the pump. That led the White House to plead with OPEC on Wednesday to push out more supply. With the hindsight of the IEA’s revised demand projections, that’s looking doubtful.