-

Unshackled Wells Fargo Fights to Regain Momentum Lost in Penalty Box

Photo by João Vincient Lewis via Unsplash -

Countries Fight Over Periodic Table as China Hoards Rare Earths

Photo by Getty Images via Unsplash -

There’s Almost 600K More Millionaires. That’s Not Necessarily a Good Thing

Photo by Kateryna Hliznitsova via Unsplash -

Goldman, Morgan Stanley, JPMorgan Layoffs to Hit Northeast

Photo by David Jones via Unsplash -

Wedbush and Dan Ives Launch AI Revolution ETF

Photo by Christina Morillo via Pexels -

Klarna’s BNPL Debit Card Goes Head-to-Head With Banks

Photo via Andre M. Chang/ZUMAPRESS/Newscom -

Thoma Bravo’s $34B Win Leaves PE Rivals Choking on Exhaust Fumes

Orlando Bravo, founder and managing partner of Thoma Bravo. Photo by Joe Budd via CC BY-SA 4.0 -

Palantir Becomes Trump Trade’s Big Winner

Photo via Richard B. Levine/Newscom -

Investors Turn to Defined Outcome ETFs Amid Market Turmoil

Photo by Austin Hervias via Unsplash -

Not Taking Single-Stock ETFs for Granite

Will Rhind, CEO of GraniteShares. -

Advisors Say $1,000 ‘Trump Accounts’ Won’t Benefit Families Who Need Help Most

Photo by Natilyn Hicks via Unsplash -

Wall Street Braces for More Investors Dissing Dollar

Photo by Niconor Brown via Unsplash -

Bristol Myers Paying BioNTech Up to $11.1B in Cancer Drug Team-up

Photo by Victor Golmer via iStock -

Soups Heat Up for Campbell’s as Snacks Grow Stale

Photo by Calle Macarone via Unsplash -

Bitcoin Rules for Now, but the Crypto Landscape Is Vast

Photo by Michael Förtsch via Unsplash -

RIA Headcount, AUM Shattered Records in 2024

Photo by Getty Images via Unsplash -

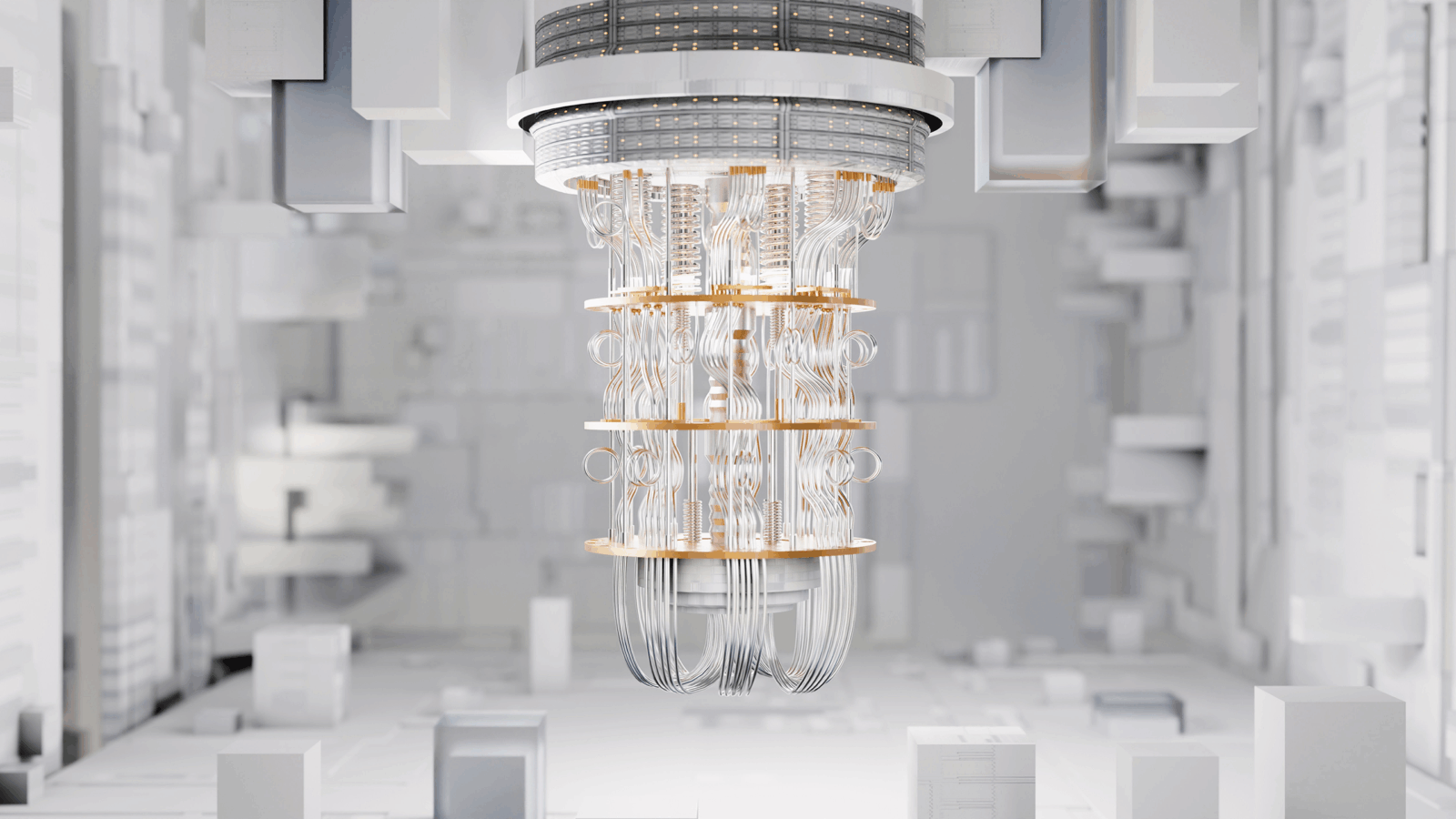

Grayscale Wants in on Quantum Computing ETFs

Photo by Galina Nelyubova via Unsplash -

Shifting Away from Search, Businesses Need to Keep Up With the AI ‘Answer Economy’

Photo by Solen Feyissa via Unsplash -

How Enterprises Can Fortify Cybersecurity ‘Weak Links’

Photo by JHVEPhoto via iStock

Advisor Upside

Financial advisor news, market insights, and practice management essentials.

-

Big Tech Is Still Grappling With AI’s Energy Problem

Photo by Aldward Castillo via Unsplash -

How the ‘Bot Epidemic’ Threatens Enterprise Security

Photo by Getty Images via Unsplash -

DeepMind Patent Gives AI Robots ‘Inner Speech’

Photo via U.S. Patent and Trademark Office

Delivering exclusive news and sharp analysis on finance and investing—all for free.