Optimism Overpowers Market Uncertainty Following US-China Trade Thaw

The US and China shocked the world in announcing a 90 day trade truce, turning weeks of uncertainty into a day of optimism.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

For weeks now, a single word has seemingly driven economic activity every day, upending equities, bond markets, currencies, corporate forecasts and more. That word: “uncertainty.” On Monday, a new word finally entered the trending lexicon: “optimism.”

After the US and China announced a 90-day trade truce struck in Geneva over the weekend, investors bet Monday that a full-blown tariff war between the economic superpowers is now unlikely. The ensuing optimism drove the S&P 500 3.2% higher, kicked off a drawdown in defensive market positions, eased recession fears, and more.

Well, That Was Unexpected

Virtually no one expected weekend talks between the two superpowers to end with the US agreeing to slash duties on Chinese imports to 30% from 145% for 90 days and China making a similarly dramatic reduction in tariffs on American goods to 10% from 125%. And, in the split second it took officials to hit send on a joint statement, the risk appetite generated by optimism, for at least one day, took the place of uncertainty.

There was the Nasdaq, up 4%, signalling a banner day for tech and chip stocks like Meta (up 7.9%) and Nvidia (up 5.4%). There was the small-and-mid cap Russell 2000, up 3.4%, signalling optimism in firms that are more vulnerable to economic downturns. There was Hong Kong’s Hang Seng Index, up 3%, and the onshore CSI 300 index, up 1.1%, which – like US indexes – have erased losses since President Trump’s “Liberation Day” tariffs announcement sent markets reeling. And Europe’s Stoxx 600 joined the cheery mood, rising 1.2%. (Although, on Tuesday, the Hang Seng shed 1.8% as investors continued to digest the news — other regional bourses in the Asia-Pacific like Japan’s Nikkei, which rose 1.4% on Tuesday, sustained the optimistic rally.)

Defensive positions also eroded Monday with spot gold falling 3%, a Treasury selloff pushing the 10-year yield up to 4.454%, and the Japanese yen, British pound and euro losing appeal as safe haven currencies. The US Dollar Index, which tracks the value of the dollar relative to a basket of foreign currencies including those three, rose 1.4%. ING analysts wrote that the credit space is about to witness “a very busy month for supply” — construction equipment giant Caterpillar was one of several firms selling debt on the investment-grade bond market Monday amid the return of risk appetite. However, where risk has returned, there’s one notable institution that could use the market optimism to exercise even greater caution:

- Federal Reserve Chair Jerome Powell has long said the central bank, which held interest rates steady last week, will play it safe until it has “further clarity” on tariffs — and the 90-day tariff pause between China and the US now has an Aug. 10 expiration date.

- Given the Fed’s new operating window, investors pushed back their bets on an initial rate cut this year to September, with the CME Fedwatch showing an expectation of just two rate cuts amounting to a half-point reduction in 2025.

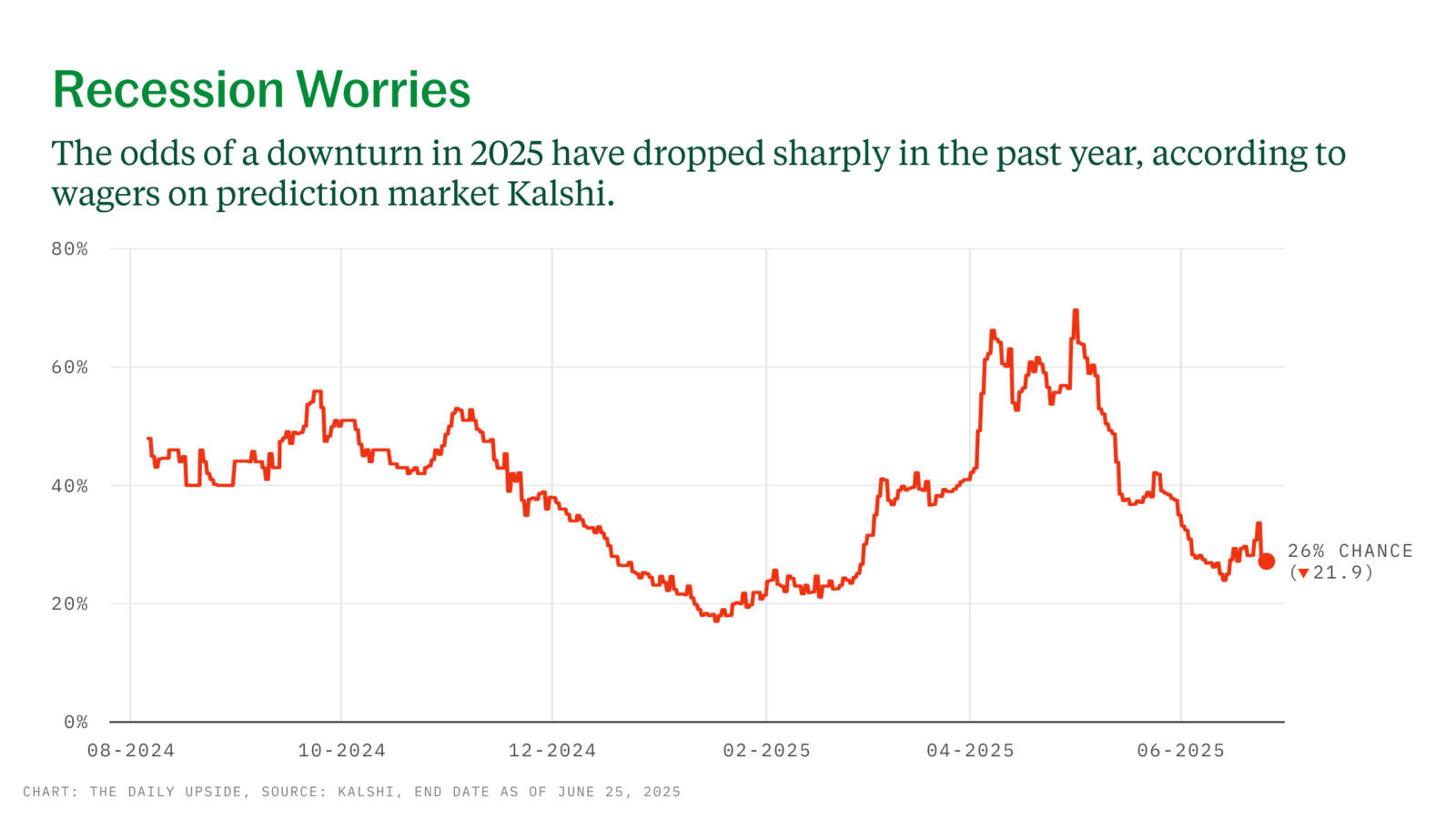

What’s Next: No location has been set, but Treasury Secretary Scott Bessent told CNBC he expects to meet with Chinese officials “in the next few weeks” to “get rolling on a more fulsome agreement.” Already, the macro optimism has eased recession forecasts: Oxford Economics said Monday the chances of a recession in the next 12 months fell to 35% from 50%. Betting markets Polymarket and Kalshi, which both predicted a more than 50% chance of a recession in 2025 at the end of last week, placed the odds at roughly 40% on Monday.