The S&P 500’s strength this year reflects momentum offset by risk.

In its Midyear ETF Market Outlook, State Street Investment Management breaks down what’s driving equities in 2025. On one side, it’s a tale of solid fundamentals supported by AI infrastructure and earnings growth. On the other, elevated risks tied to valuations, rate shifts, and geopolitical instability weigh on sentiment.

Report author Michael Arone, State Street Chief Investment Strategist, explains why recent gains may be sustainable, and why investors should be watching for clouds.

See how today’s moves compare to past cycles, what sectors are up, and which signals matter most for the months ahead.

Q: For the rest of 2025, what factors could support or challenge S&P 500 performance?

A: Increasing clarity on trade agreements, a free cash flow windfall from the One Big Beautiful Bill Act, resumption of the Federal Reserve’s (Fed) rate cutting cycle, solid corporate earnings growth, and the fulfillment of the tremendous promise from massive Artificial Intelligence (AI) spending could propel the S&P 500 further for the rest of this year.

Yet, the S&P 500 is in the thick of a seasonally challenging performance period. Lofty valuations and euphoric investor sentiment could make it difficult for the stock market to advance much further this year.

Risks to the rally that began on April 9 include potential negative impacts from significantly higher tariffs, a stubborn Fed’s reluctance to lower interest rates producing an unwanted recession or unintentional capital market catastrophe, disappointing earnings results, and underwhelming AI outcomes.

But the factors supporting the S&P 500’s performance likely trump the challenges for the remainder of 2025.

Q: With markets near all-time highs, what historical parallels concern you most?

A: In 2025, the S&P 500 is following two consecutive years of strong 20+ percent returns, mirroring a similar pattern observed in 1998 during the technology-media-telecom (TMT) bubble.1 In 1998, the market was driven by excitement about dot-com stocks. Today, investors have an insatiable appetite for AI stocks.

Concerns about market concentration and sky-high valuations, especially for technology stocks, plagued both periods. As they did in 1998, signs of speculative excess and euphoric sentiment carry significant risk of investor disappointment if the stock market fails to meet today’s rising expectations.

Despite solid economic growth in both years, capital markets suffered through bouts of substantial volatility and growing geopolitical risks. The TMT bubble endured for 15 more months, finally bursting in March 2000.

Today, the cost of abandoning US stocks is still quite high. US stocks generate return-on-equity (ROE) of about 19% and pay out 72% of earnings via dividends and net buybacks. As a result, investors are pocketing 14% of the equity base every year. In Europe, that number is 9% and in Japan it’s 5%.2 Compounding that differential over time is compelling. Investors need to be certain that the profitability of the US is eroding before rushing to the exit.

The death of US exceptionalism has been greatly exaggerated.

Q: The Magnificent Seven represent over 30% of the S&P 500’s market cap but have underperformed the index in 2025. How should investors view this?

A: Investors have been begging for greater participation in the stock market rally from stocks outside of the Magnificent Seven (Mag-7) and, so far this year, their wish has been granted. The fact that the S&P 500 has climbed 8.6% through July 31 with the performance of the Mag-7 lagging the benchmark3 should be embraced and celebrated by investors.

As the earnings growth gap between the Mag-7 and the rest of the market narrows, it should create room for less expensive stocks with solid earnings growth to participate more fully in the stock market rally. Broader participation is a healthy outcome and could enable the bull market to last longer.

Industrials, led by the Aerospace & Defense industry, has been the top performing sector through July 31.4 Rising geopolitical tensions, a sizeable increase in the US defense budget, and the Trump administration asking the world to share more equally in the burden of global military security has resulted in a massive increase in defense spending.

Utilities is the second-best performing sector year to date.5 Demand for electricity is projected to increase significantly in the coming years, driven by data centers supporting AI. The Utilities sector is undergoing a transformation to modernize infrastructure and integrate clean energy sources.

The Technology and Communication Services sectors, where most of the Mag-7 stocks are housed, have also bested the S&P 500 so far this year.6 Outstanding earnings growth and excitement about the potential of AI has fueled the outperformance. It’s a positive sign that the Technology and Communication Services sectors have outperformed while the Mag-7 stocks have underperformed. It underscores the incredible investment opportunities in AI beyond just the Mag-7 stocks.

Finally, the Financials sector, led by the Banks industry, beat the S&P 500 through July 31.7

Investors should embrace broader participation beyond the Mag-7 from more sectors, industries, and stocks. It’s a welcome outcome that could prolong the bull market.

Q: With concentration risks rising, when does broad market exposure through the SPDR® S&P 500® ETF Trust (SPY) actually become riskier than picking stocks?

A: Despite growing concentration concerns in recent years, it would be extremely rare for broad market exposure like the S&P 500 to become riskier than picking stocks.

As of July 31, the Mag-7 represents a little less than 34% of the S&P 500. That leaves slightly more than 66% of the S&P 500 in stocks other than the Mag-7. That provides ample room for the benefits of diversification from holding a broad market benchmark like the S&P 500.

But investors don’t just own the S&P 500. They often own stocks; bonds; and real assets including gold, alternatives, and, increasingly, private investments in diversified investment portfolios.

When it comes to equity allocations, they invest in small-cap, mid-cap, international developed, and emerging markets stocks alongside their S&P 500 exposure. These additional equity allocations further amplify the benefits of diversification in investment portfolios.

Meanwhile both professional and do-it-yourself investors have failed to pick winning stocks consistently and repeatedly. More than 84% of US equity large-cap funds underperformed the S&P 500 over the past 10 years through December 31, 2024.8 The results get even worse when adjusted for risk.

For more than 30 years, the performance, diversification benefits, liquidity, and total cost of ownership of S&P 500 exposure through SPY has been far superior to foolishly trying to pick individual stocks.

Q: Interest rate expectations change frequently based on economic data. Which S&P 500 sectors are most sensitive to these changes?

A: Long-term US interest rates have been volatile this year. The 10-year Treasury yield is determined by economic growth expectations, inflation expectations, and term premium. For a variety of reasons, all three have swung wildly in 2025. As a result, 10-year Treasury yields have been stuck in a range between 3.8% – 4.8%.

Changes in interest rate expectations can have a big impact on the performance of the S&P 500 sectors. The Financials, Real Estate, Consumer Discretionary, Utilities, and Technology sectors are the most sensitive to changes in interest rate expectations.

Investor expectations are increasing that the Fed will soon resume the rate cutting cycle that began in September 2024. Sectors and industries that benefit from lower interest rates such as Technology, Financials, Consumer Discretionary, and Utilities have been rallying in recent months.

Q: Geopolitical tensions and trade policies are creating uncertainty for multinational corporations. How are S&P 500 companies actually responding in terms of supply chains or strategic shifts?

A: Rising geopolitical tensions and evolving trade policies are impacting S&P 500 companies, forcing them to strategically adjust their operations. Second quarter earnings results have demonstrated the resourcefulness of corporate leaders to manage through mayhem.

Companies have been resilient. Many of them have even expanded profitability through periods of maximum uncertainty. And today, corporate profit margins are near record highs. Importantly, the results are broad-based, with nearly all sectors widening margins this year.

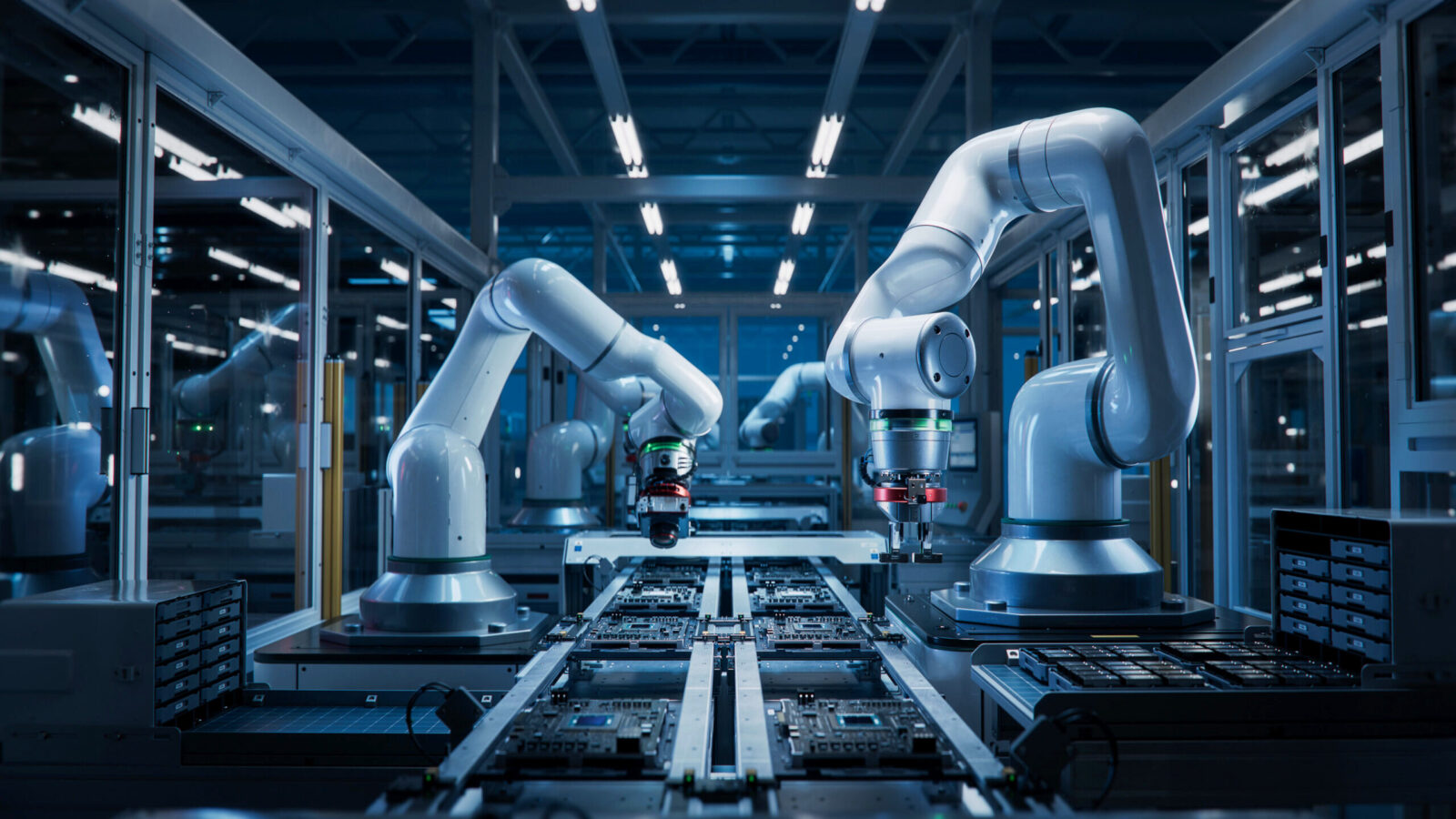

S&P 500 companies are reducing their dependence on single-country manufacturing hubs, particularly China, by diversifying their supplier networks and moving production to alternative locations. Nearshoring, reshoring, and friendshoring are all playing critical roles in helping companies reduce supply chain risks and improve responsiveness to changing market demands.

S&P 500 companies are shifting their supply chain strategies from solely minimizing cost to prioritizing resilience and the ability to absorb and recover from disruptions. Export controls and technology restrictions are forcing companies to rethink cross-border R&D collaboration and potentially shift their efforts. Mergers, acquisitions, and partnerships bolster their capabilities in areas less susceptible to geopolitical disruptions.

Comprehensive risk assessments that consider political stability, trade policies, and regulatory frameworks are becoming increasingly important for companies when determining where to operate.

These responses indicate that S&P 500 companies are adapting to the evolving global landscape by pursuing more robust, resilient, and geographically diversified supply chains and strategic operations.

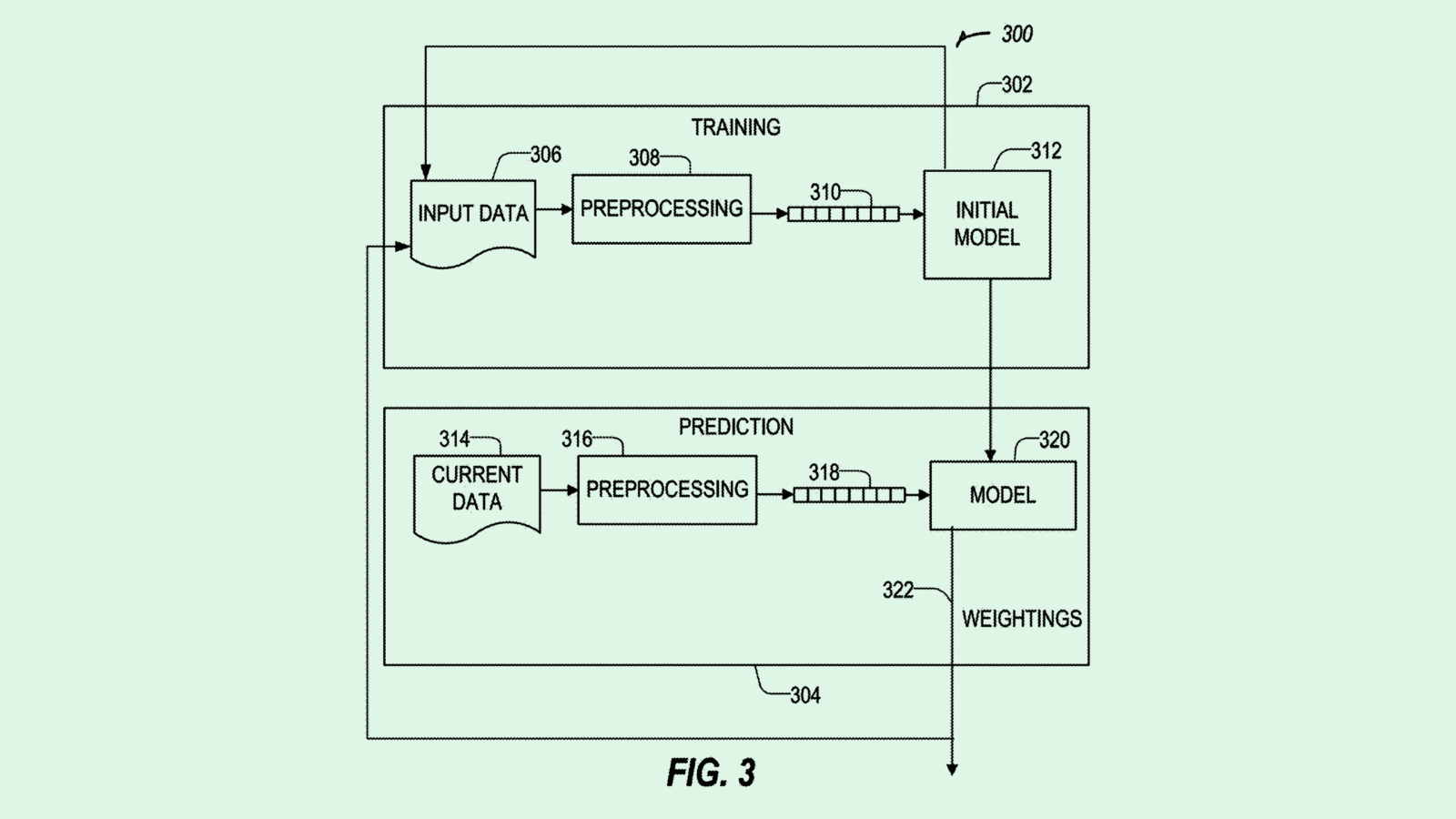

Q: AI has driven outperformance in tech stocks, but valuations are under scrutiny. Beyond the hype, how are major companies actually deploying AI investments and what ROI are they seeing?

A: Mag-7 companies are projected to spend $350-$400 billion on AI infrastructure and innovation this year, including data centers, proprietary chips, and cloud platforms.

Microsoft and Meta reported second quarter earnings results at the end of July. Microsoft has invested about $56 billion into AI infrastructure over the past 12 months. During that time Microsoft’s Azure cloud grew 39%, surpassing analysts’ forecasts and generating over $75 billion in annual revenue in the second quarter. Microsoft’s market capitalization exceeded $4 trillion, just the second company to reach that milestone, underscoring investor confidence in its AI strategy.

Meta plans to spend $72 billion this year and $100 billion in 2026 on AI capital expenditures (capex). The stock soared following its earnings announcement, highlighting investor perception of ROI from advertising efficiency gains driven by AI.

S&P 500 constituent, Emerson Electric, uses AI for robotics, predictive maintenance, and automation in manufacturing and supply chains. S&P 500 financial companies like JP Morgan, Goldman Sachs, Bank of America, and PayPal use AI for risk, trading, fraud detection, and compliance.

Walmart uses AI to enhance the customer experience and optimize its operations. AI uses include personalized online shopping, improving inventory management, streamlining supply chains, and empowering employees.

AI is transforming healthcare billing by automating and optimizing various processes, leading to increased efficiency, greater accuracy, and cost savings. AI systems can handle tasks like medical coding, claims processing, and fraud protection, while reducing manual effort and human error. Healthcare billing executives think that AI solutions could help boost industry profit margins by 30-40%.

Goldman Sachs predicts that AI-driven productivity gains could lift S&P 500 profits by 30% over the next decade. But enormous capex spending is putting downward pressure on near-term margins and sky-high expectations pose risks to the enthusiasm surrounding AI.

Q: With inflation pressures ongoing, which S&P 500 companies or sectors are successfully passing costs to consumers versus absorbing them?

A: Consumer staples and household brands have implemented modest price hikes across key products to protect margins and boost profits despite inflationary pressures. This includes companies such as Procter & Gamble, Coca-Cola, Kimberly-Clark, Hershey, General Mills, and Tyson.

Healthcare insurers, managed care, and mature pharmaceuticals companies all have been able to routinely pass on rising costs to consumers. Semiconductor companies are also raising prices due to limited global supply and soaring demand from AI and cloud infrastructure. The Mag-7 have also demonstrated pricing power, scale, and margin resilience amid tariffs and inflation pressures.

Airlines, media, travel, and retail apparel companies are unable to raise prices. Consumers are sensitive to price hikes in these areas, and demand is weakening, resulting in a shift toward cost-cutting instead of price increases.

Many service sector firms report rising input costs, but they can’t pass them on due to intense competition. Surveys show services pricing sentiment softening, while manufacturing remains only modestly able to protect margins from rising input costs.

So far, operational excellence is largely offsetting inflationary pressures and could set up companies to benefit if or when price pressures recede.

Access the performance and diversification of S&P 500 exposure through SPY.

Footnotes

1Bloomberg Finance, L.P., as of July 31, 2025.

2 Global Portfolio Strategy May 2025, Empirical Research Partners, May 23, 2025.

3 Bloomberg Finance, L.P., as of July 31, 2025.

4 Bloomberg Finance, L.P., as of July 31, 2025.

5 Bloomberg Finance, L.P., as of July 31, 2025.

6 Bloomberg Finance, L.P., as of July 31, 2025.

7 Bloomberg Finance, L.P., as of July 31, 2025.

8 Bloomberg Finance, L.P., as of July 31, 2025.

Important Risk Information

State Street Global Advisors (SSGA) is now State Street Investment Management. Please click here for more information.

Investing involves risk including the risk of loss of principal.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the

ETFs net asset value. Brokerage commissions and ETF expenses will reduce returns.

Distributor: State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC, an indirect wholly owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. Certain State Street affiliates provide services and receive fees from the SPDR ETFs. ALPS Distributors, Inc., member FINRA, is the distributor for DIA, MDY and SPY, all unit investment trusts. ALPS Portfolio Solutions Distributor, Inc., member FINRA, is the distributor for Select Sector SPDRs. ALPS Distributors, Inc. and ALPS Portfolio Solutions Distributor, Inc. are not affiliated with State Street Global Advisors Funds Distributors, LLC.

Before investing, consider the funds’ investment objectives, risks, charges and expenses. To obtain a prospectus or summary prospectus which contains this and other information, call 866.787.2257 or visit ssga.com. Read it carefully.

Not FDIC Insured * No Bank Guarantee * May Lose Value

8257154.1.1.AM.RTL SPD004071

Expiration 08/31/26