JPMorgan

-

Calamos Launches First Autocallable ETF

Photo via Kris Tripplaar/Sipa USA/Newscom

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

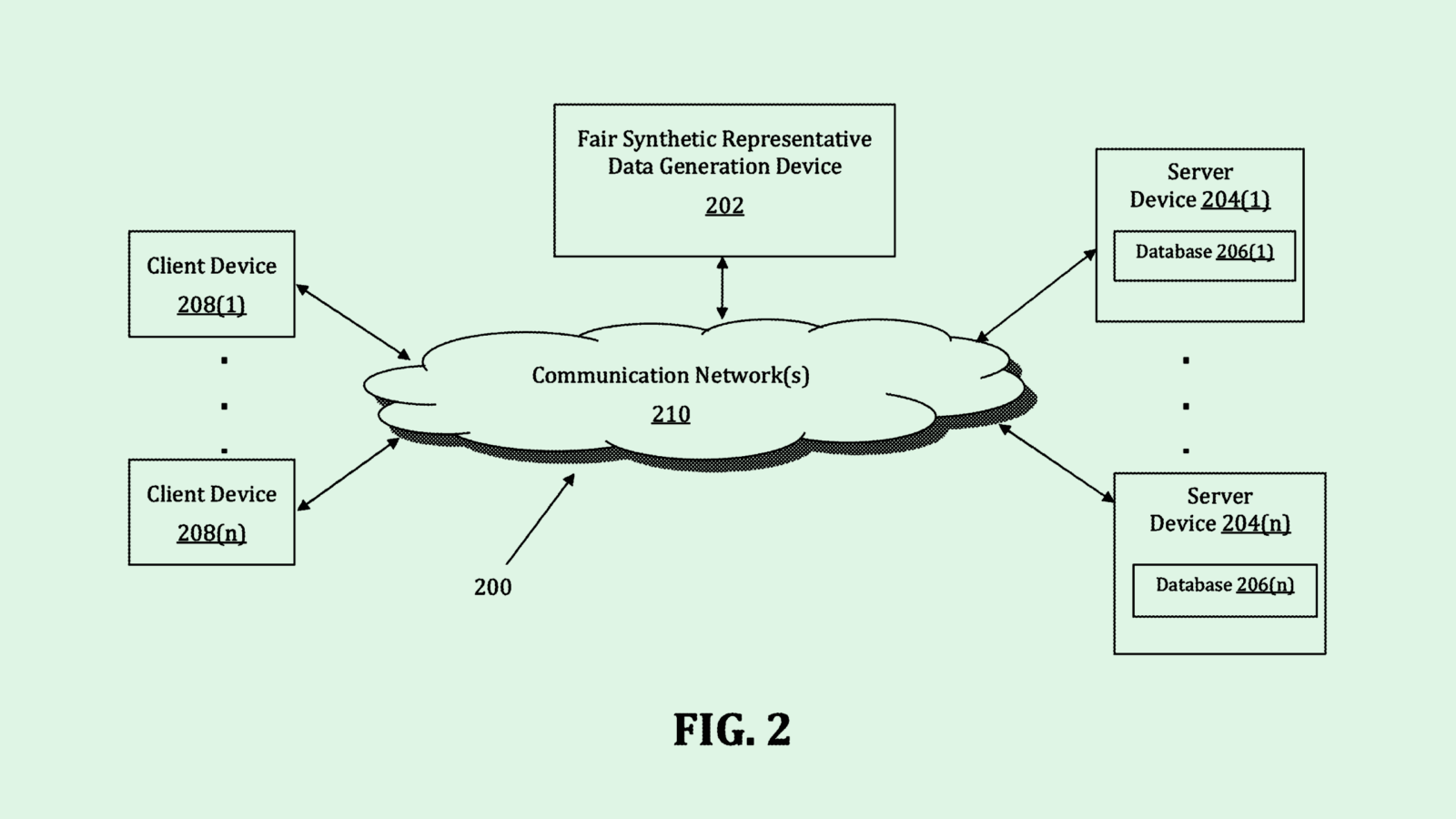

JPMorgan Chase Patent Tackles Synthetic Data Bias

Photo via U.S. Patent and Trademark Office