Technology

-

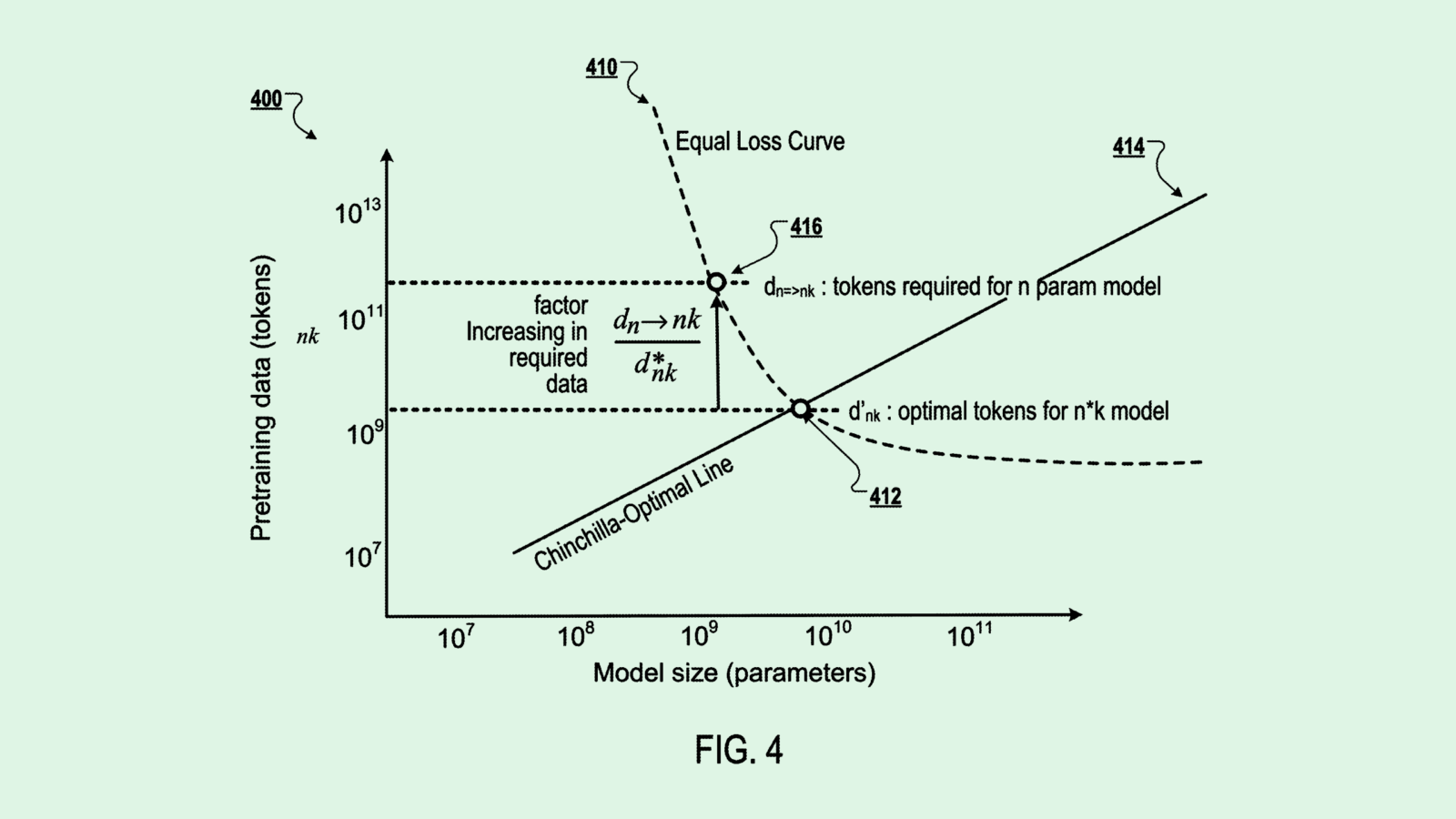

DeepMind Patent Shrinks Model Size Without Compromise

Photo via U.S. Patent and Trademark Office

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.