Quantum Computing Stocks Power Upward on Hopes of Multimillion-Dollar US Investment

The Commerce Department is reportedly in talks with top quantum computing companies about awarding at least $10 million to each company.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

A Commerce Department official denied that the agency plans to invest in several quantum-computing companies in exchange for equity, according to CNBC, but that didn’t stop the stocks’ upward climb. The Wall Street Journal reported Wednesday that the US government agency was talking with top quantum companies including IonQ, Rigetti Computing and D-Wave Quantum about awarding at least $10 million to each.

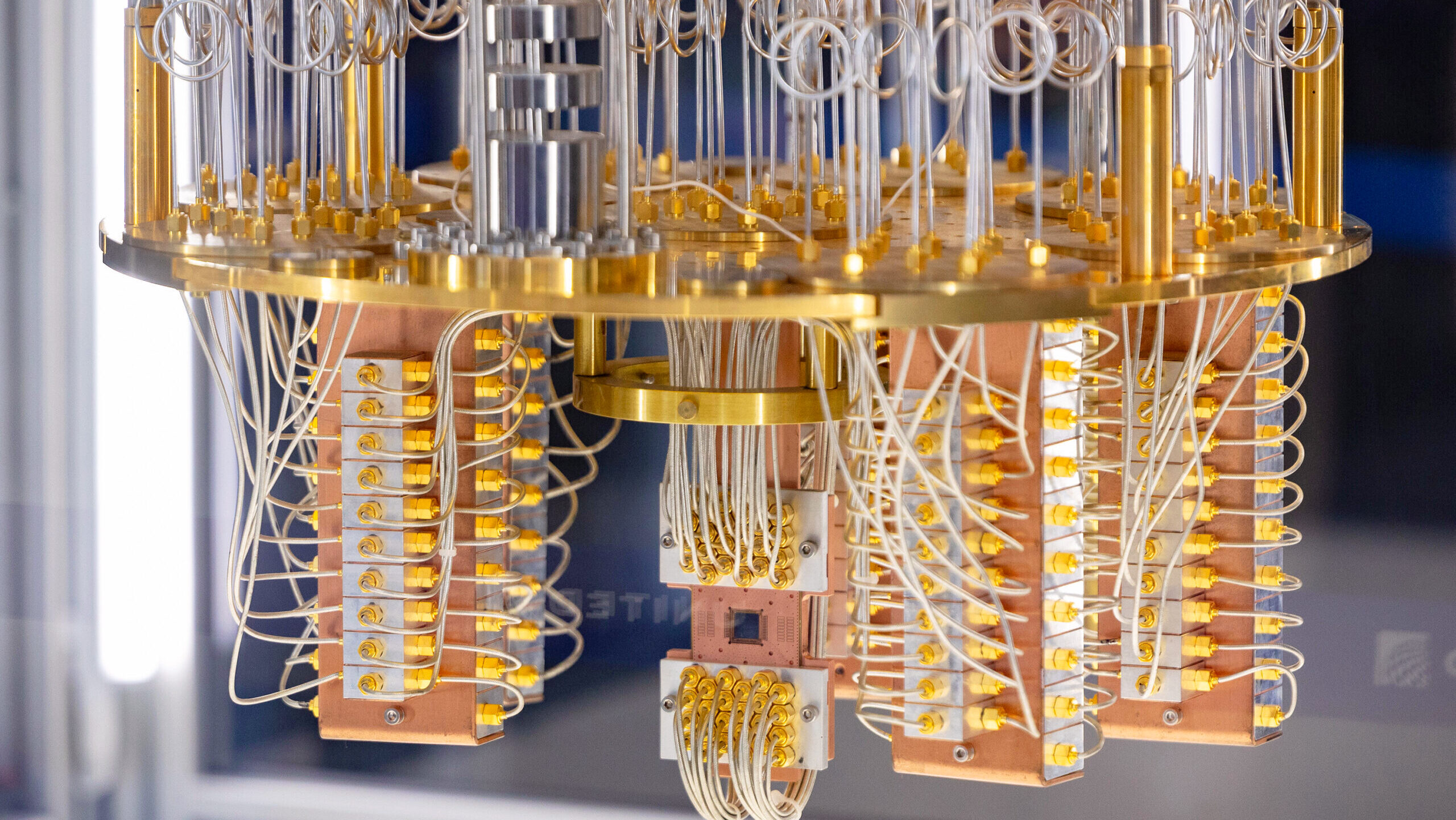

The report stoked investment in the sector, suggesting the government would throw its weight behind the next-gen technology. Quantum computers, which can solve complex problems eons faster than traditional computers, are expected to impact industries ranging from pharmaceuticals to finance.

But when this tech will start to have practical applications isn’t clear; experts have guessed anywhere from five to 20 years. Despite the blurry timeline, investors have piled into quantum stocks in 2025, pushing the top companies to market caps of $10 billion to $20 billion.

Quant Stop The Feeling

Quantum companies have made a series of breakthroughs this year. The latest: Google on Wednesday said its quantum computer produced a verifiable result 13,000 times faster than a traditional computer, which could accelerate advances in drug discovery and materials science. Microsoft and Amazon, meanwhile, have unveiled quantum chips, while IBM has shared a roadmap to developing a fault-tolerant quantum computer by 2029.

While this week has been volatile for quantum stocks, which dipped and then rose again after the Journal’s report, it’s clear investors are stoked:

- D-Wave has led the charge, with its shares rising more than 223% this year as of yesterday’s close. Meanwhile, Rigetti’s up 98% and IonQ has jumped 38% this year. Smaller players that are also said to be in talks for federal funding, including Quantum Computing, have posted year-to-date gains, too.

- Microsoft, IBM and other companies, along with governments like China’s, have poured billions into quantum’s potential. Investors juiced quantum-focused startups with about $2 billion last year, McKinsey found. The industry’s expected to make as much as $100 billion in revenue in the next decade. But it has a long way to go: Quantum companies garnered less than $750 million last year.

Land of the Funds: The Trump admin has been on a funding spree in the president’s second term, securing sizable stakes in five publicly traded companies, including rare earths processor MP Materials and chipmaker Intel. Though the Trump admin denied it’s in talks to fund quantum companies, it’s definitely keeping a close eye on the tech. Not only does quantum computing have the potential to juice the economy in a major way, but it could also pose a national security threat, possessing the power to crack encryption and access sensitive data.