Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Venture capitalists are putting their money where their travel plans are.

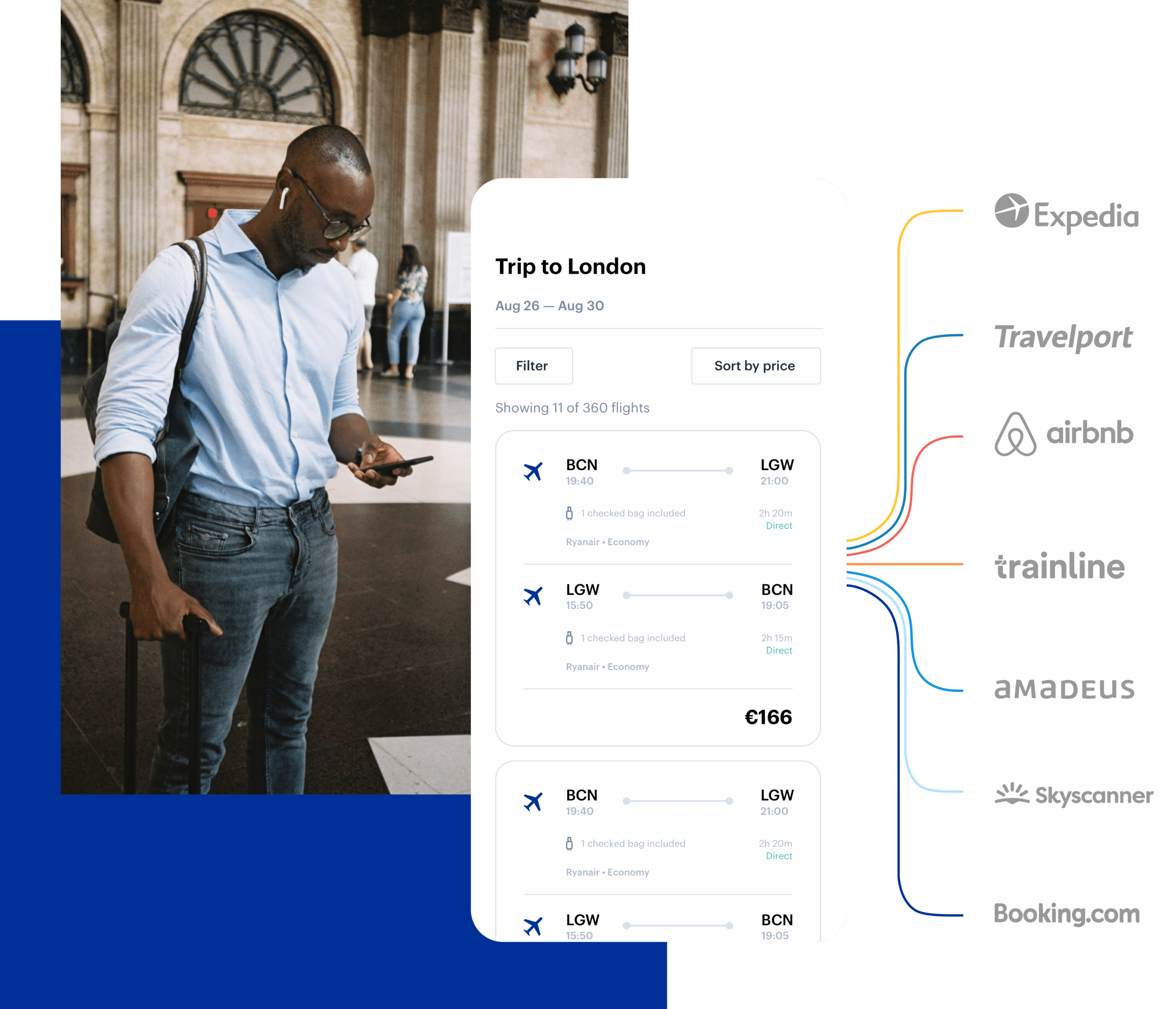

On Thursday Barcelona-based TravelPerk, which books flights and manages travel expenses for small and medium-sized enterprises through its online platform, became the latest beneficiary. The company raised $160 million in a new funding round.

“It’s Not a Belief Anymore”

Corporate travel management was already a competitive space with major legacy players like SAP and then, earlier this year, California startup TripActions raised $155 million at a $5 billion valuation.

While some cut back during the pandemic — Tui cut 8,000 jobs, for example — TravelPerk kept its staff on board and went full court press on customer acquisition.

- TravelPerk grew its customer base by 80% in 2020, in part by rolling out new products tailored to the Covid age. One, Travelsafe, shows data on Covid travel restrictions and another, FlexiPerk, refunds 80% on trips cancelled last minute.

- This year, TravelPerk has seen a 70-75% recovery in domestic flights in the U.S. compared to pre-pandemic levels.

“The reality is travel is coming back. It’s not a belief anymore, it’s actually visible in the numbers,” Avi Meir, TravelPerk’s CEO, told CNBC. “Most flights are not 100% full yet but we’re talking about an industry that was 10-15% exactly one year ago.”

Travel Operators Carry Heavy Debt Loads: While travel management firms are poised to accelerate with new cash injections, the major travel operators and manufacturers are in a much tighter position.

- Boeing reported its sixth consecutive quarterly loss on Wednesday, and its debt now stands at $64 billion, up from $39 billion a year ago.

- Carnival more than doubled its debt in the last year to $33 billion from $14 billion. Southwest Airlines doubled its debt, and Delta and United saw theirs swell 50 per cent.

Each will have to cope with servicing drastically inflated debt loads as they try to restart and invest in their core businesses.

the takeaway

The travel uncertainty isn’t over yet, with the pandemic rising in India and vaccine rollout lagging in Europe.