Tariff Turmoil Not ‘Rear View Mirror’ Yet: Schwab’s Liz Ann Sonders

The company’s chief investment strategist warned policy moves can take months or years to ripple through the broader economy.

Sign up for market insights, wealth management practice essentials and industry updates.

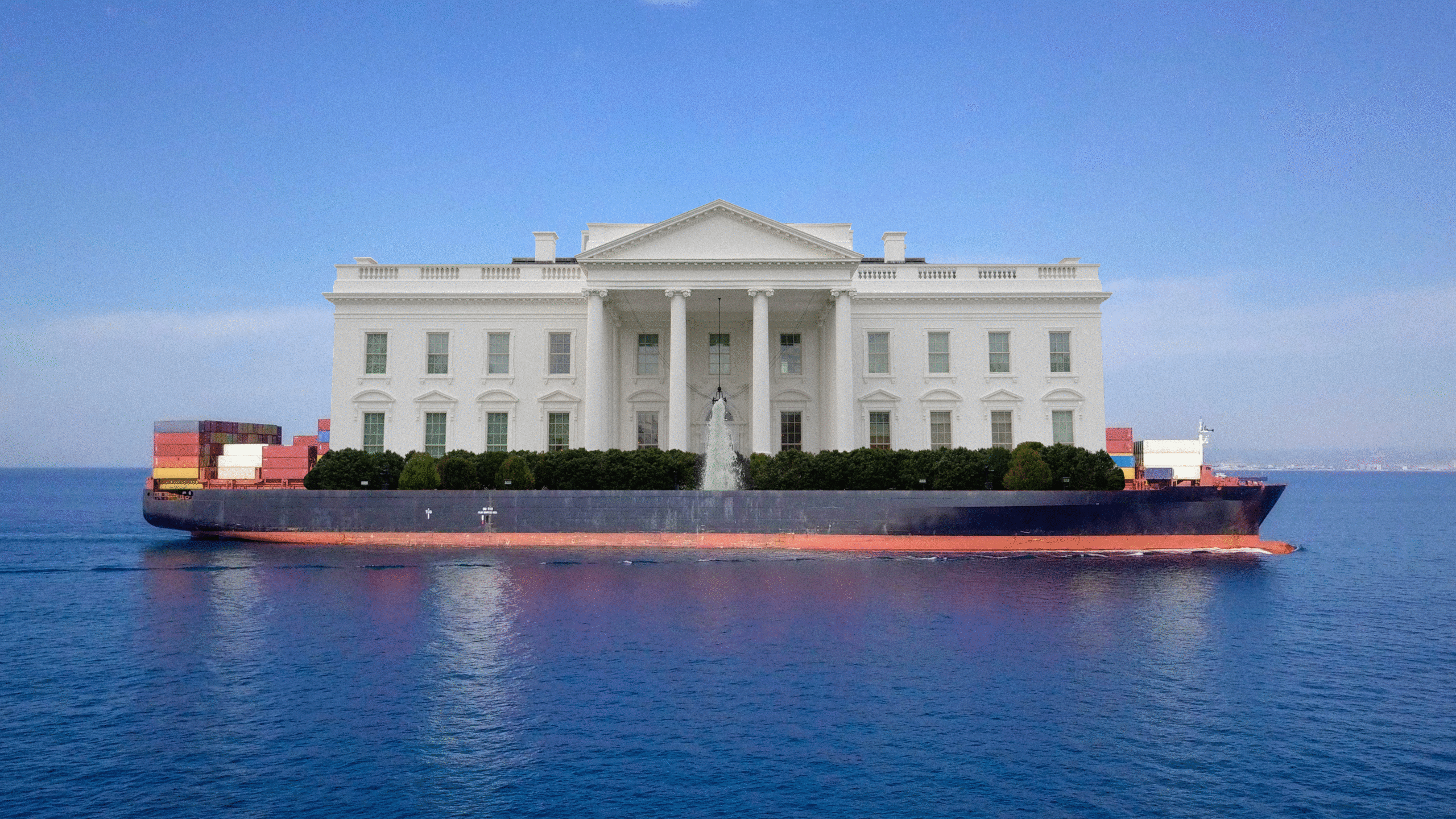

Objects in the mirror may be closer than they appear.

The S&P 500 hit all-time highs in October, shrugging off April’s Liberation Day tariff turmoil. But policy moves take months or years to ripple through the broader economy, and Liz Ann Sonders, Charles Schwab’s chief investment strategist, warns we’re not out of the woods yet. “Generally, economists make the assumption that as tariffs go up, the dollar tends to also go up, and it offsets,” she said. “With some of the tariffs, that obviously did not happen.”

Instead, equities imploded following the announcement, bond yields spiked, and the dollar plunged. “We kind of acted like an emerging market for a week, and that was the triple signal for the administration” to hit the pause button. However, supporters argue the new policies will boost manufacturing, raise revenue and spur growth. “We’re dealing to some degree in uncharted waters,” she added. “It’s an economic story that’s not rearview mirror by any means.”

Sonders spoke with Advisor Upside at the Schwab IMPACT conference in Denver in early November to explain why the story on Liberation Day is still being written.

AU: We all remember the tariff announcement turmoil. How have tariffs impacted the economy since?

LS: I’ll tell you one thing that shocks me all the time. It was about a week before April 2, and I was talking to a group of investors about tariffs and I wasn’t sure about their level of sophistication. So, I said: “Notwithstanding the headlines, like ‘Tariffs on China’ and ‘Tariffs on Canada,’ the tariffs are actually paid by the US company.” Do you know how many people came up to me to say they did not know that? There’s still a surprising number of people — or a percentage of people — who don’t know how tariffs work.

Now, maybe because of all the front-running that was done several months before the announcement, and of course we have had the delay, but estimates said companies were absorbing about 70% of the tariff cost and passing on about 30%. That ratio has now flipped. Whether it’s data from the Yale Budget Lab, or the Penn Wharton budget model or Peterson Institute, there are a lot of think tanks that are doing way more detailed work on this than I have the ability to do, and they now suggest 30% of the costs are being absorbed in whatever fashion by the company and 70% are being passed on. There are also benefits that companies received from the One Big Beautiful Bill. I’ve seen estimates that right now, the cost of tariffs that companies have paid have been about evenly offset by the benefits that have been accrued from the bill.

Is that why we haven’t seen a meaningful jump in inflation?

Well, we have. If you look at tariff-impacted categories versus non-tariff impacted categories, you do see that inflation effect. What’s missing when you just look at aggregate inflation data — especially a measure like the Consumer Price Index — a big weighting of that is Owners’ Equivalent Rent. That has been decelerating and offsetting the aggregate CPI. That shelter component offset has nothing to do with tariffs. At the same time, ongoing pressure on the tariff-impacted categories is impacting the CPI and those numbers, even though they’re coming down. But we’re not seeing it because we often look at aggregate CPI data as opposed to looking at category-level data.

Certainly members of the administration — and more broadly proponents of tariff policy — argue that tariffs are not inflationary, in the sense that inflation is measured as a rate-of-change on an ongoing basis. Instead, they say tariffs represent a one-time price level reset, but there are two problems with that argument. The first one is the descriptor of one-time, as if tariff policy has been anything resembling one-time. It’s every single day. It’s on again, off again, escalation, de-escalation. It’s for easing trade deficits. It’s for bringing manufacturing back. It’s about reciprocity. It’s about raising revenue or penalizing countries for political reasons, and more recently, they’ve been focusing on how much revenue has been raised. But if you’re also signing deals so that the tariffs can be lowered, then you no longer get the revenue side.

The other more important aspect is that the average consumer thinks about inflation simply as stuff is more expensive now than it was before. That’s how consumers think about inflation. What proponents are saying is: Don’t worry about it. It’s only a one-time price level reset. In my role, I live in the weeds of the inflation data. Stuff is more expensive. Inflation has picked back up again a little bit in the last few months, but you really pick it up if you go to the category level.

Supporters say tariffs can boost manufacturing, spur the economy, maybe help pay down debt. Any truth there?

It’s such a minuscule amount of money that’s been raised in tariff revenue relative to the size of our debt. It’s basically a rounding error to zero, so I don’t buy that argument. The argument of bringing manufacturing back to the US? That’s not really happening. The big deals that have been announced have been in play for a while. A lot of companies also put themselves in timeouts. Capex in artificial intelligence is obviously going through the roof. Non-AI capex is kind of stalled here, and I think companies are waiting to see ultimately where tariffs settle out. Then, you know, there’s a little thing called the Supreme Court.

I’m sensing you’re not a fan of resetting global trade?

I don’t believe trade deficits are an inherently awful thing. It’s divide and conquer in our world, and if there was a way to surgically look at individual trade deals and figure out a more level playing field, absolutely. But the blanket? The idea that you just put a 45% tariff (I’m just throwing out a number. I don’t remember the Cheesecake Factory menu of what all the reciprocal tariffs were) on Madagascar, for example. We ran a trade deficit with them, because they can’t afford to buy much of what we export. It’s up the value chain, but they are the largest global producer of vanilla. That gives them industry — literally and figuratively. They can’t buy stuff from us, but we get to buy vanilla from them. The solution is not a 45% tariff to be paid by US companies importing vanilla from Madagascar.

So, how does this all play out?

If the Supreme Court rules in favor of Trump, and he continues to plow ahead, and you get to some maximum effective tariff rate, I think it’s recessionary. I think it’s stagflationary. It’s hard to argue against that being the case.

Then the question is: Well, if it’s not that, and it’s watered down for whatever reason, a Supreme Court ruling, deals being struck, whatever reason, the current set of circumstances, the status quo of decent economic growth, somewhat resilient labor market, and inflation that’s not skyrocketing, I don’t think that stasis can persist if tariffs persist.