Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

It was classified as an annual general meeting, but what happened when Berkshire Hathaway shareholders got together Saturday doubled as a roast.

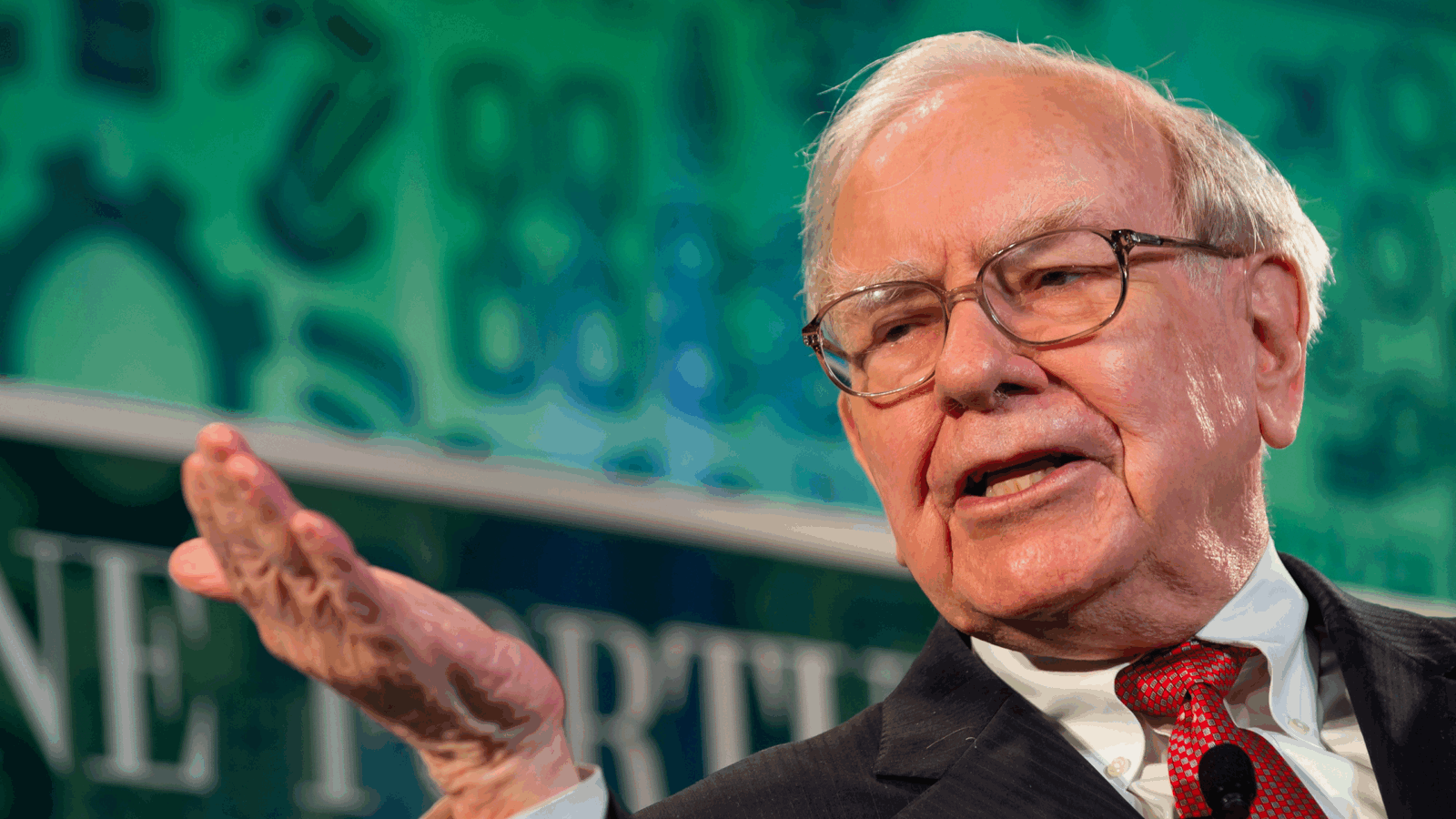

Berkshire CEO Warren Buffett and his deputy, Charlie Munger, delivered withering broadsides at three of the biggest trends in investing.

A Buffet of Dough, But Inflation Looming

Berkshire, which is often seen as an indicator of U.S. economic performance because of its gigantic $282 billion stock portfolio, reported a huge surge in profits.

The company made $11.7 billion profit in the first quarter after losing $49.7 billion in the same period a year earlier, when the global pandemic hammered markets:

- Buffett cautioned, however, that personal incomes climbed a record 21.1%in March from the previous month, driving what he sees as already “very substantial inflation.”

- Berkshire’s total cash pile swelled to $145.4 billion from $138.3 billion at the end of 2020 and income from its core operating businesses – it owns Dairy Queen, Geico and BNSF railroad among others — rose 19.5% to $7 billion.

“This has been a very unusual recession,” said Buffett. “Right now, business really is very good in a great many segments of the economy.”

Fighting Words

As for their views on the hot trends driving markets of late, Buffet and his deputy didn’t hold back. SPAC mergers were called “shameful,” Bitcoin “disgusting” and trading app Robinhood “isn’t admirable.

- “There is nothing illegal to it, there’s nothing immoral, but I don’t think you build a society around people doing it,” said Buffett, on Robinhood and trading apps that have driven speculative consumer investing.

- “I think I should say modestly that the whole damn development is disgusting and contrary to the interests of civilization,” said Munger, on Bitcoin, which he added was a “currency that’s useful to kidnappers and extortionists.”

- Buffet said SPAC mergers “won’t go on forever, but it’s where the money is now and Wall Street goes where the money is.” Enger went a step beyond, calling them “a moral failing, it’s not just stupid, it’s shameful.”

Why It Matters: Buffet is arguably the world’s most famous investor, and his words are taken as gospel by many in the business community. They also give cover to regulators who are considering regulating the industries Buffett and Munger criticized.