Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

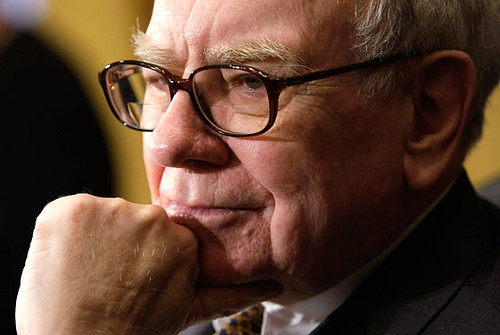

Think Cherry Coke and a Dairy Queen dipped cone. That’s how much Warren Buffett likes stock buybacks.

In the Berkshire Hathaway CEO’s latest annual letter to shareholders, the nonagenarian investing icon defended the practice of companies getting high on their own share supply, and voiced his enthusiasm for investments in American companies.

Invest in Yourself

When a company starts buying up its own securities, it’s generally to increase its stock price and benefit shareholders. Last year, American firms bought $1.26 trillion worth of buybacks, a 3% increase year-over-year, Bloomberg reported.

But opponents like President Joe Biden, Senator Marco Rubio, and BlackRock CEO Larry Fink (sometimes) believe that instead of buybacks, companies should spend money on long-term investments like research and development, capital projects, more jobs, and employee benefits packages.

The Oracle of Omaha does not agree:

- In 2022, Berkshire spent $8 billion on buybacks, which seems like a lot, but it’s considerably less than the $27 billion spent on them the year prior.

- In his letter, the 92-year-old Buffett praised companies like American Express and Apple for their bullishness on buybacks. In 2022, Apple spent a whopping $90 billion on buybacks.

“When you are told that all repurchases are harmful to shareholders or to the country, or particularly beneficial to CEOs, you are listening to either an economic illiterate or a silver-tongued demagogue (characters that are not mutually exclusive),” Buffett wrote.

America the Beautiful: The US is the world’s largest economy at a nominal GDP of $23 trillion, so it’s not absurd that Buffett would have plenty of faith in American business. Despite Berkshire Hathaway taking a roughly $18 billion liquidity hit between 2021 and 2022 mostly due to investment losses, he still remains enthusiastic about US businesses like the Alleghany holding company, which Berkshire acquired last year for $11.6 billion. “I have yet to see a time when it made sense to make a long-term bet against America,” Buffett said in the letter.