Jerome Powell is Finally Getting Specific

Simply put, Powell says he needs to wait and see June and July price data to know just how impactful and inflationary tariffs have been.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

One way to coax some timeline specificity out of Jerome “wait-and-see” Powell? Put him on the witness stand.

On Tuesday, that’s where the Fed’s top central banker spent a good chunk of his day, testifying before the House Financial Services Committee, where he clarified exactly what data he is waiting to see before moving to cut federal interest rates (today he’ll face another round of questioning from the Senate Banking Committee). The Capitol Hill field trip comes as consensus in the Fed’s ranks is starting to dissipate.

Mr. Powell Goes to Washington

Simply put, Powell says he needs to see just how impactful and inflationary tariffs are — which he says will be clearer after the release of June and July price data. Why the lag? While tariffs arrived in full force starting in April, their widely expected inflationary effect still isn’t quite reflected in consumer prices thanks to a massive amount of stock front-loading and a reluctance to raise prices for already wary consumers. For instance, Toyota had avoided price hikes on US cars up until last week, when it told Bloomberg that its automobiles would cost (a little bit) more starting in July. Consumers, meanwhile, are growing more weary: Tuesday also delivered a fresh batch of consumer confidence data courtesy of the Conference Board, which showed increased pessimism in June driven by a tough-to-crack job market. Which of course puts Powell in a corner: a turgid economy and soft job market would normally call for rate cuts, if not for signs that more inflation is the way.

Still, the central banker is leaving the door open to the possibility that tariffs won’t be as impactful as widely expected, saying Tuesday, “We’re perfectly open to the idea that the pass through [effect of tariffs] will be less than we think. And if so, that’ll matter for our policy.” That may be as much a message to inquisitive lawmakers as it is to his own underlings, some of whom are growing impatient with Powell’s approach:

- After the Fed maintained its current level of interest rates for the fourth consecutive time at its meeting earlier this month, Fed Vice Chair for Supervision Michelle Bowman on Monday said she’d support a rate cut as soon as July: “All considered, ongoing progress on trade and tariff negotiations has led to an economic environment that is now demonstrably less risky… it is time to consider adjusting the policy rate.”

- That makes Bowman the second Fed official to break ranks, after Fed Governor Christopher Waller told CNBC on Friday he sees only a small risk of tariff inflation, and that the Fed could cut rates by July.

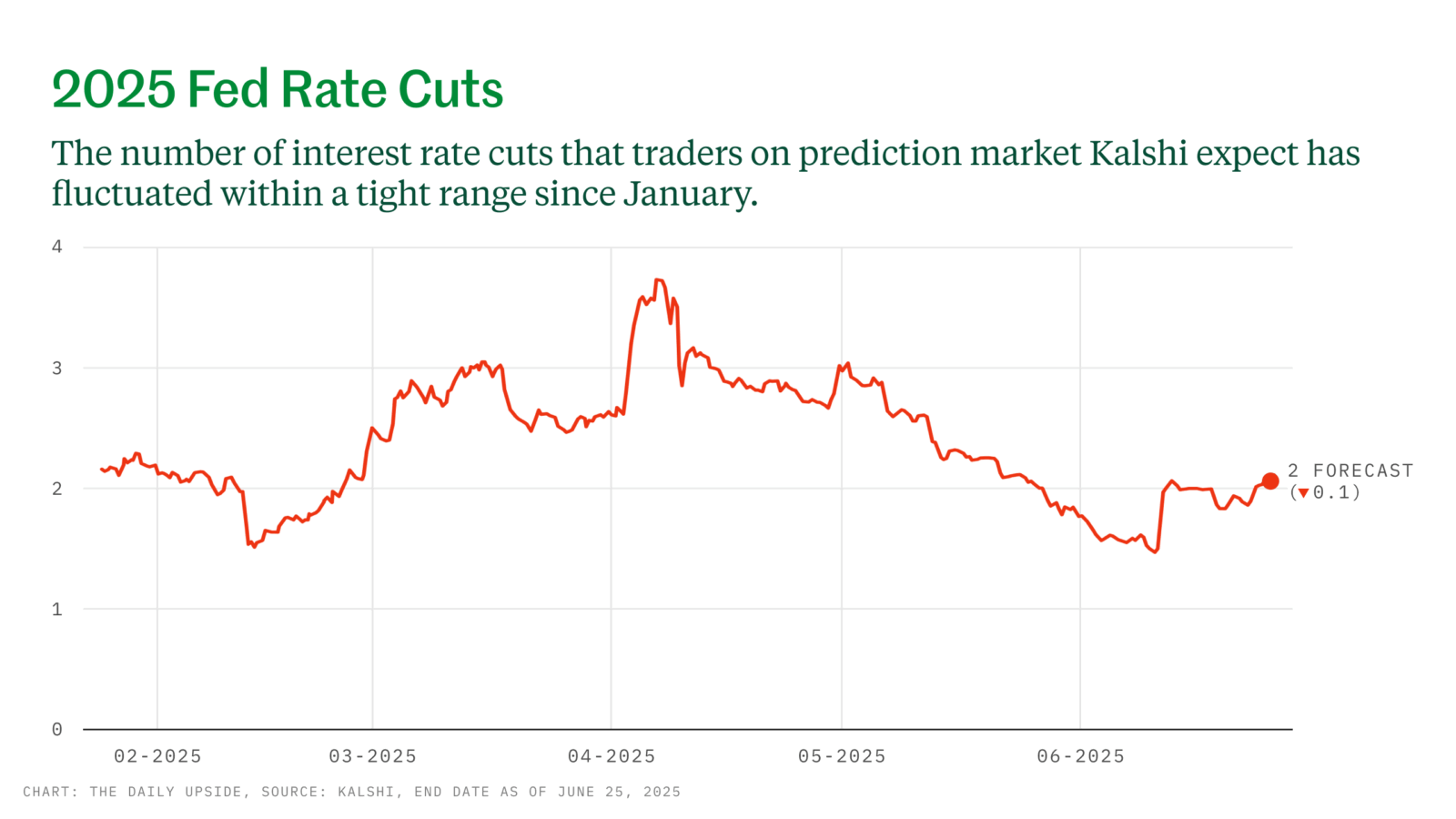

Wake Me Up When September Comes: Bowman and Waller’s remarks are just the latest sign of dissension in the Fed’s ranks. Minutes from the central bank’s June meeting last week revealed that among the 19 policymakers, 10 are projecting two rate cuts this year, two are projecting one rate cut, and seven are projecting no more cuts at all (an increase from just four members seeing no rate relief during their March meeting). Bettors on prediction market Kalshi view two rate cuts as the most likely option (though still at just 30% odds), while CME Group’s FedWatch tool shows investors are widely expecting a quarter-rate cut in both the Fed’s September and October meetings, with a nearly 40% chance of another quarter rate cut in December. Powell, as per usual, remained opaque, telling lawmakers Tuesday that “Many paths are possible here.”