Europe Basks in Solid Earnings Season, But One Factor Weighs Heavy

European equities have charged out of the gate in 2025 as if they were Alexander the Great’s prized steed Bucephalus.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

European equities have charged out of the gate in 2025 as if they were Alexander the Great’s prized steed Bucephalus, rising almost 11%, according to a Société Générale analysis. This is despite Goldman Sachs, for one, forecasting just 0.8% growth in the Euro Area this year, and it’s happening in the face of potentially ruinous tarifs américains.

Taking Stock

So with the Euro Area growing at a slug’s pace and President Donald Trump talking tariffs, why are European equities partying? Start with the fact that slow growth, which has lasted for two years, means bargain valuations, something that’s drawn back foreign investors who withdrew from Europe at the start of the war in Ukraine. It doesn’t hurt that JPMorgan and Goldman Sachs have cautioned US stocks, after two barnburner years, could be overvalued.

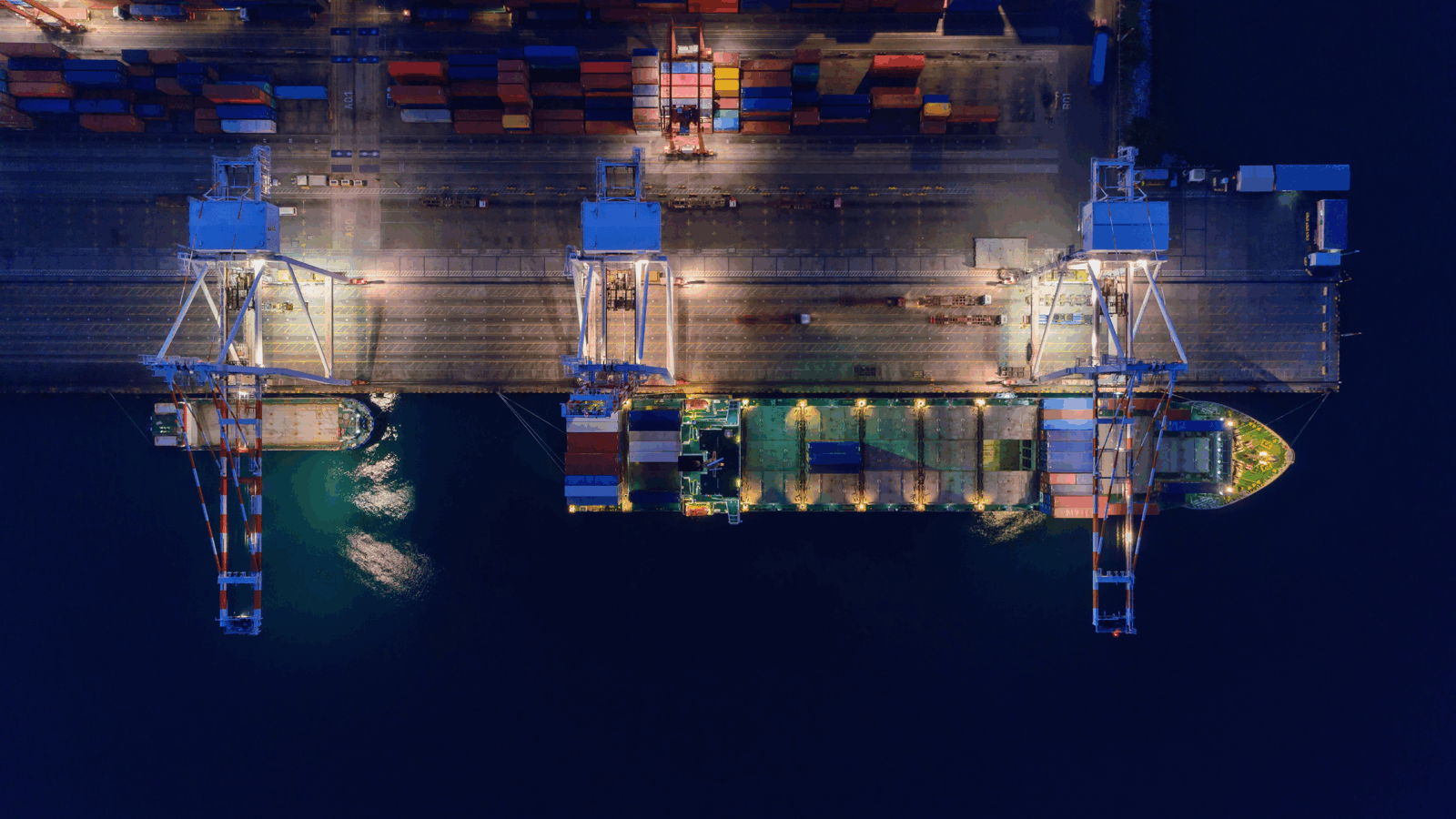

But there is also a symphony of supportive economic fundamentals. The fall in the euro in recent months, down to $1.05 from $1.12 in September, is a good sign for Euro Area exports. The rate-cut cycle has continued at the European Central Bank, while the US Federal Reserve has pressed the pause button. And tariff saber-rattling from America has made some investors optimistic Europe will unify around major projects like defense and artificial intelligence (on Monday, Euro Area defense stocks rallied as the continent’s leaders gathered in Paris for an emergency summit on Ukraine).

If things seem chirpier than expected so far, that doesn’t mean Europe is worry free:

- Goldman Sachs analysts said companies on the Stoxx Europe 600 Index beat fourth-quarter profit estimates by 4%, or “well above” historical averages — recent earnings beats have included luxury French fashion house Hermès, German conglomerate Siemens, and Swiss food and drink giant Nestlé. But companies have also slashed full-year projections by roughly 0.5% since the start of the year in what Goldman dubbed “pessimism” likely driven by tariff concerns.

- There are possible conditions that could offset these fears. It’s very likely that the conservative, business-friendly Christian Democratic Union will be the largest party in the Bundestag following this Sunday’s German election. And an end to the war in Ukraine would remove a considerable amount of geopolitical turmoil.

What’s In a Name? Europe’s not alone in trying to find its footing in our new world of tariffs, duties and levies. In a Truth Social post on Friday, Trump offered a dictionary-bending broad definition of tariffs by other countries that he said he would impose counter-tariffs on — these included value-added taxes, subsidies, and regulatory barriers. Nomura analysts said this likely exposes most major Asian economies to the counter-tariff threat, and they gave Trump’s new, unclear definition a nickname: “black box.”