Personal Finance

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

PayPal “Fairness-Aware” Model Patent Highlights Bias Issues in Financial AI

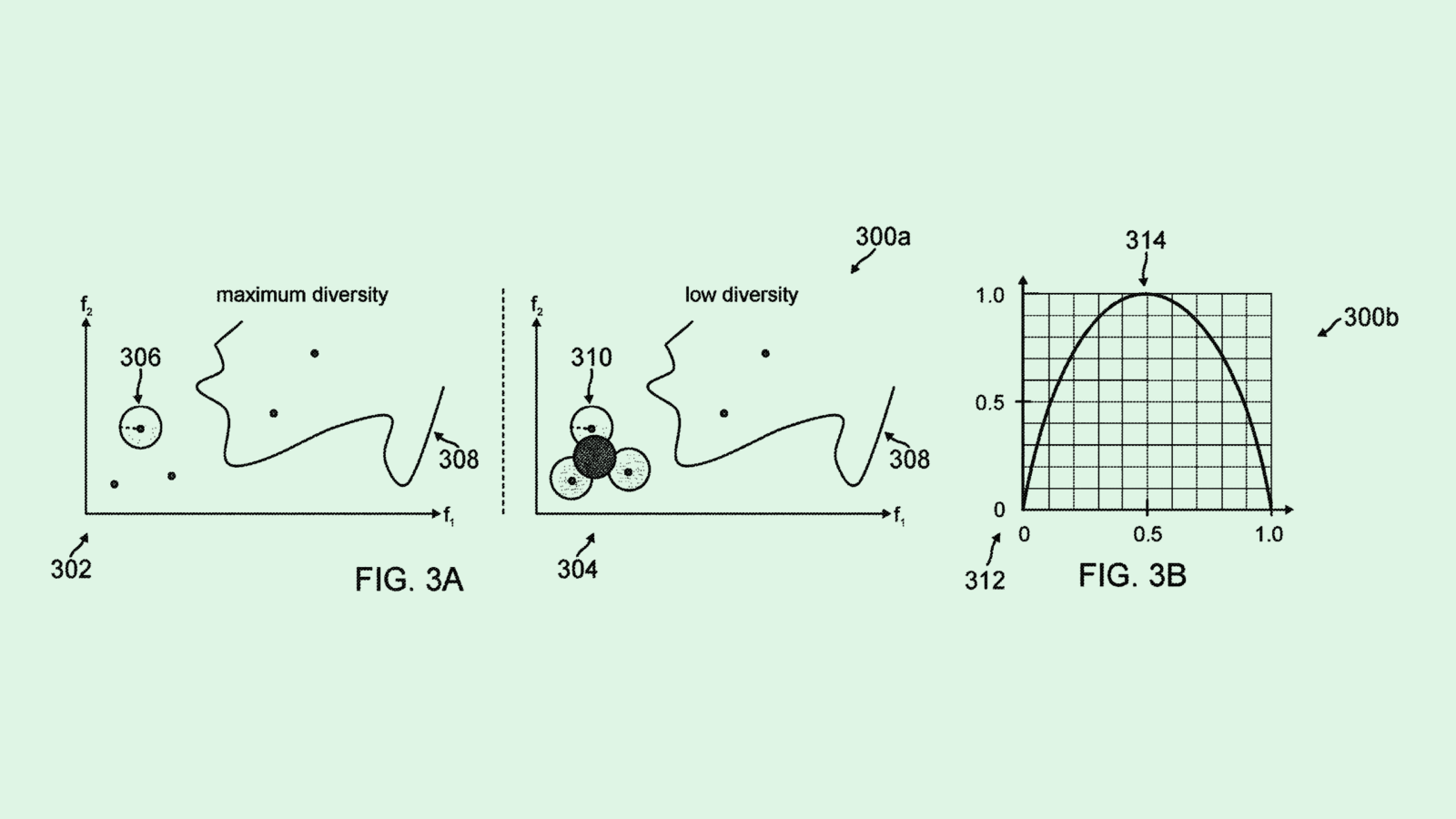

Photo via U.S. Patent and Trademark Office