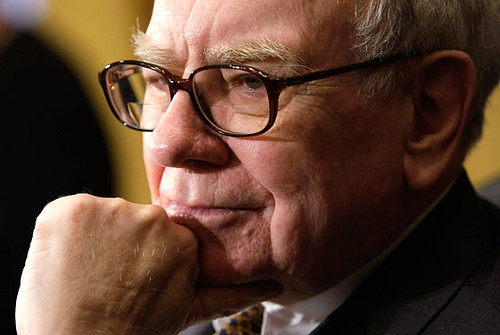

Berkshire Hathaway Has Built a Massive Mountain of Cash

Berkshire Hathaway’s third-quarter earnings report on Saturday revealed how Warren Buffett weathered the past three months.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

The Oracle thinks cash is divine.

Berkshire Hathaway’s third-quarter earnings report on Saturday revealed how Warren Buffett’s massive conglomerate weathered a three-month period in which Wall Street and Corporate America came to grips with the reality of “higher-for-longer” interest rates. The short answer: not great.

Warren’s War Chest

Berkshire posted a significant investment loss of $23.5 billion in the quarter, due to its stake in Apple, which dipped roughly 12% in the quarter, as well as drops in holdings of American Express, Coca-Cola, and Bank of America. Meanwhile, Berkshire remained a net seller of stocks for the fourth straight quarter, including a sale of more than 12 million Chevron shares just ahead of its $53 billion acquisition of Hess — which, given Chevron’s subsequent stock skid, proved to be a wise bet. Between share sales and investment losses, Berkshire’s portfolio value dropped to $319 billion from $353 billion at the end of Q2.

But the very same rising interest rates that bedeviled Berkshire’s corporate investments proved to be a major boon for its insurance business. Berkshire scored $1.7 billion on interest income it was earning on its insurance investments, adding to its total of more than $5 billion in the past year — more than the total interest it’s earned on its cash reserves in the past three years combined. Operating income — the profits earned from its wholly owned businesses like Geico and BNSF Railway — climbed to nearly $11 billion from just under $8 billion a year ago.

That’s allowed Warren and friends to sit on the largest cash war chest in company history:

- The $157 billion amassed in cash reserves marks a healthy improvement from the $147 billion three months earlier. It also bests the $149 billion record that the company set in the third quarter of 2021.

- That money may soon be put to good use. In an interview last week with The Wall Street Journal, Buffet’s longtime partner/buddy Charlie Munger said there is “at least a 50/50” chance the pair complete another major acquisition in the near future.

Sweet Relief: For Wall Street’s mere mortals outside of Omaha, it was a giddily good week. After central bankers in both the US and ECB paused their relentless rate-hiking campaign and Labor Department data showed a hiring slowdown, investors boosted both stocks and Treasuries, fueling a nearly 6% gain in the S&P 500. That marks the best week since November 2022. Despite words of caution from Fed Chair Jay Powell, Wall Street seems assured that “higher for longer” means rates will at least stay precisely this high, but not any higher.