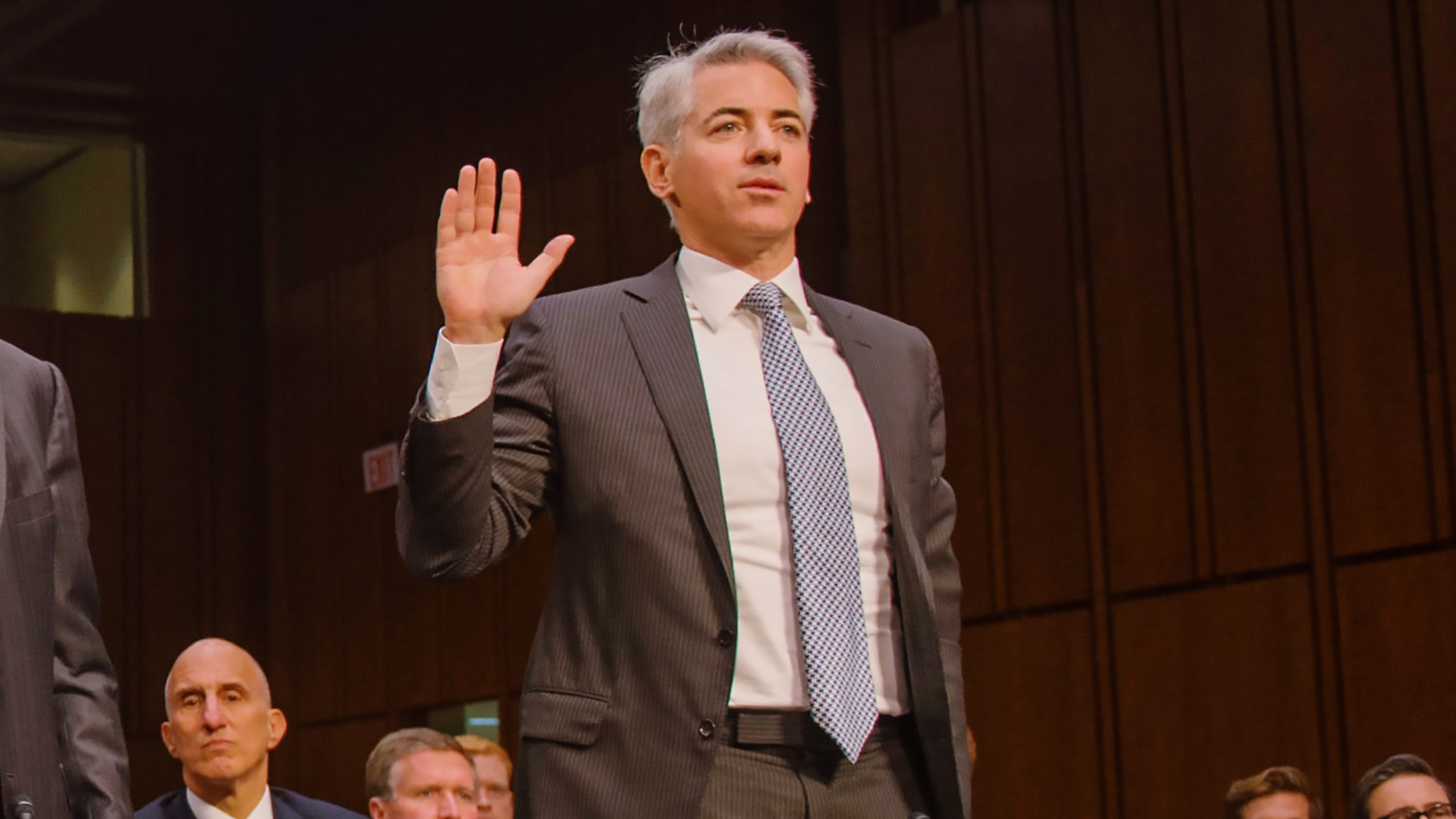

Bill Ackman’s Pershing Square Wants to Be the Next Berkshire

Pershing Square has announced a formal bid for Howard Hughes, the real estate developer where Ackman served as chairman for over a decade.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

If Bill Ackman were a boxer, he’d probably compare himself to Oleksandr Usyk, the undisputed heavyweight champion of the world. But he’s a money guy, so he’s equating himself to Warren Buffett instead.

On Monday, Ackman’s hedge fund Pershing Square announced a formal bid for Howard Hughes, the real estate developer where he served as chairman for over a decade before departing last year. With the deal, Ackman is pitching an explicit vision to build a “modern day” version of Buffet’s Berkshire Hathaway, and it’s just the latest blockbuster proposed by the unbashful billionaire and prolific Xeeter.

The Prodigal Son Returns

It’s hard to be surprised by Ackman’s interest in Howard Hughes (the company, not the reclusive billionaire). Back in 2008, Ackman took a large stake in the teetering-on-bankruptcy real estate group General Growth, banking on a post-recession property market rebound. By 2010, General Growth spun-off its portfolio of master-planned community properties as Howard Hughes, where Ackman served as the chairman of the board until April of last year. And when he left, hardly anyone thought he’d be saying goodbye for good. By August — after backing off a much-ballyhooed plan to take public a closed-end fund backed in part by retail investors who follow him on X-née-Twitter — Ackman had disclosed in paperwork filed with the SEC that he was interested in taking Howard Hughes public. Call it a retreat to comfortable territory.

Now, Ackman wants to make his dream a reality — and says the deal makes sense for both sides:

- Pershing Square already owns around 37% of Howard Hughes shares, and in a letter to the Howard Hughes board, the hedge fund offered to snap up remaining shares at $85 a pop. Shares of Howard Hughes traded at $71 on Friday and closed at $78 per share on Monday.

- Pershing Square would then use the cash flow, balance sheet, and property holdings of Howard Hughes to power large takeover deals of other companies — meaning Pershing Square intends to expand beyond its typical capacity as a minority activist.

“With apologies to Mr Buffett, [Howard Hughes] would become a modern-day Berkshire Hathaway that would acquire controlling interests in operating companies,” Ackman wrote in an investor letter on Monday. That’s some tall talk; Howard Hughes has a market cap of around $4 billion. Berkshire Hathaway? Somewhere around $956 billion.

Zombieland: Acquiring Howard Hughes isn’t the only thing on Ackman’s mind these days. The billionaire has been publicly pushing President-elect Donald Trump’s incoming administration to end the government conservatorship of Freddie Mac and Fannie Mae, where he remains among the long-suffering shareholders. First Howard Hughes, now this? Ackman must be nostalgic for 2008.