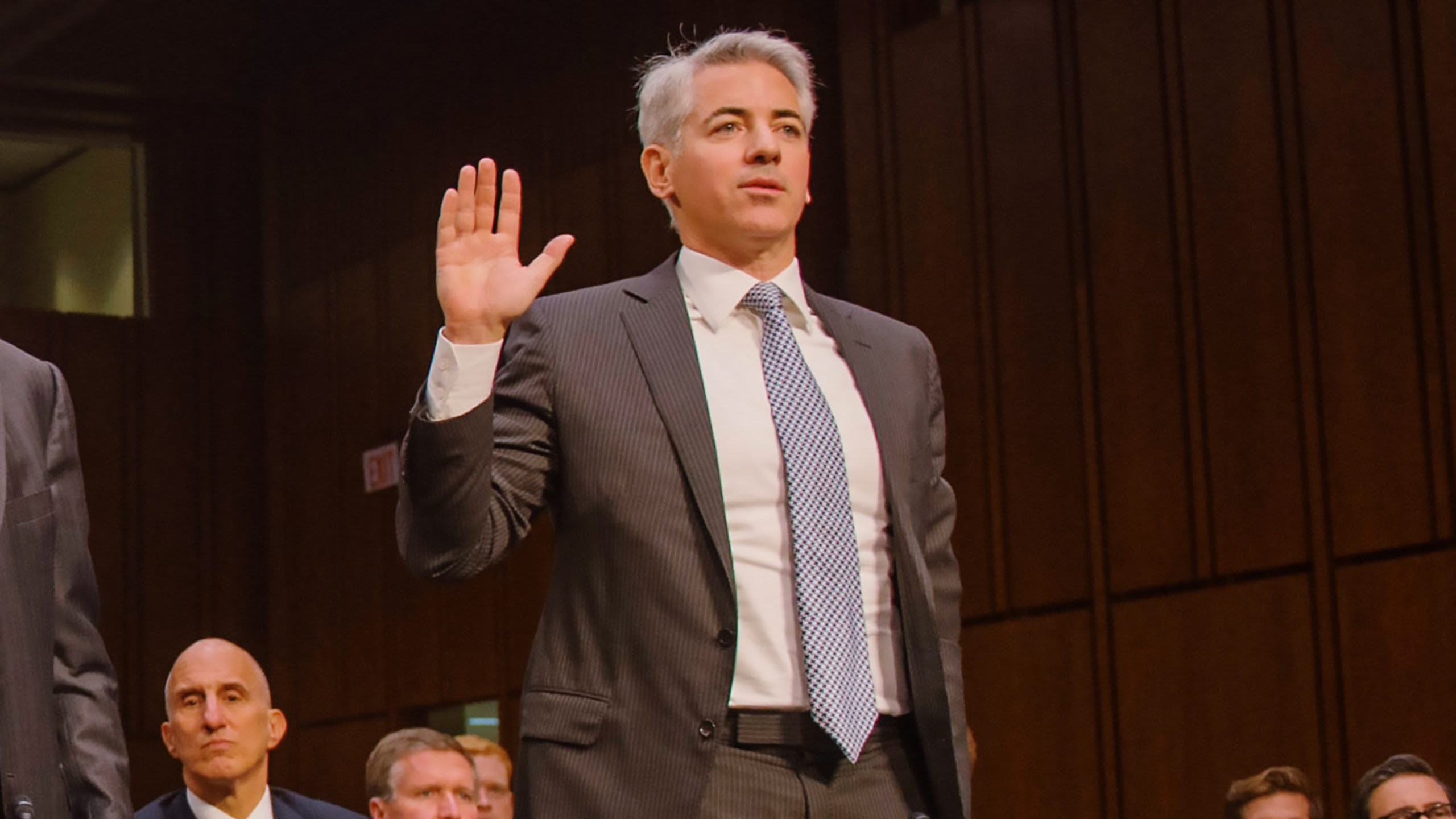

Bill Ackman’s Pershing USA Officially Slashes IPO Fundraising Target to $2 Billion

Ackman’s Pershing Square Capital Management announced that its planned IPO for a US closed-end fund will raise $2 billion.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Nothing Bill Ackman does is small or quiet. That includes his course corrections.

Ackman’s Pershing Square Capital Management announced Tuesday that its planned initial public offering for a US closed-end fund will raise $2 billion, or less than a tenth of the $25 billion he said it could raise earlier this month.

Keep a Closed Mind

Pershing Square USA, as the fund is to be named, will represent Ackman’s first new investment vehicle in 10 years, and expects to sell up to 40 million shares priced at $50 each, according to an SEC filing. But its closed-end structure raised concerns among big investors that Ackman’s initial $25 billion ambitions, which would have made for one of the biggest IPOs of all time, were aiming for Icarus-level heights.

That’s because closed-end funds — unlike open-end funds, which are traded directly through the investment company behind them — are traded on a stock exchange. While an open-end fund is usually redeemable at net asset value, a closed-end fund’s redeemable value is subject to the whims of the markets, like any other stock. And they have a record of trading at a discount, hence the concerns about flooding the market with a $25 billion raise. None of this means Pershing Square USA is unbowed:

- Pershing Square Capital has put $500 million of its own money in the fund, with Ackman betting that retail traders will have an appetite for the listing, citing his social media “notoriety” and an offering that will mimic his hedge fund, which has a 16.5% annualized net return since launching in 2003, compared to the S&P 500’s 10%. “We believe that the most important factor for creating long-term value for Pershing Square Inc is not the size of the PSUS IPO, but how it trades in the market,” Ackman wrote last week.

- A $2 billion fundraise in a closed-end fund structure is no small feat these days: There were zero new closed-end funds raised last year and only six in 2022. Underwriters including Citigroup Global Markets, UBS Securities, BofA Securities, and Jefferies have been given the option to buy an additional 6 million shares at the IPO price, which could add $300 million more to the fund.

If Past is Prologue: Pershing Square USA will begin trading on the NYSE on Aug. 6, but its parent hedge fund already has a closed-end fund trading in Europe. Pershing Square Holdings, listed in Amsterdam with a market cap of $10.4 billion, traded at just over a 20% discount of its net asset value and was up 6.4% this year as of July 23, according to the fund’s website. That’s well behind the S&P 500’s 14% return.