LVMH Clocks in With L’Epée 1839 Acquisition as CEO Takes Surprise Stake in Rival

LVMH Moët Hennessy Louis Vuitton acquired Spiza, the parent of high-end Swiss watchmaker L’Epée 1839, on Monday.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

LVMH Moët Hennessy Louis Vuitton showed impeccable timing: On Monday, the French luxury house acquired Spiza, the parent of high-end Swiss watchmaker L’Epée 1839, as it seeks to right-side a year of mediocre stock performance.

High-End Slowdown

“It’s not like you have to drink the ocean” — ce n’est pas la mer à boire — is the French expression for when something shouldn’t be that hard. And selling the world’s nicest things — LVMH owns Bulgari, Christian Dior, and Hublot, among others — to the world’s richest people doesn’t seem like it ought to require imbibing the Pacific. Nevertheless, Bain forecasts flat global luxury sales this year, worsening the trend from last year, when sales grew a modest 4% to €362 billion ($388 billion). By comparison, from 2021 to 2023, sales rose 24% from 2019 levels.

Bain wrote in a report earlier this month that beyond the obvious factors — uncertainty in the US and Chinese economies — a “self-inflicted” “creativity crisis” and price hikes are contributing to the slowdown. LVMH, which reported just 3% sales growth to €20.7 billion ($22 billion) in Q1, can at the very least count the Spiza acquisition as a potential jolt to creativity and prestige:

- L’Epée 1839 is renowned for its elaborately engineered watches and clocks, like the Time Machine, which are essentially mechanical sculptures that (unsurprisingly) cost around $30,000 apiece. The terms of the acquisition were not disclosed, but the deal follows in the footsteps of one leading competitor.

- LVMH’s Swiss rival Richemont has seen its stock rise around 24% since the start of the year, outperforming LVMH (up just .44%) and France’s Kering (down 18%) on the strength of its jewelry and watch brands Cartier, Van Cleef & Arpels, and Piaget, which have helped it weather the year better than the competition.

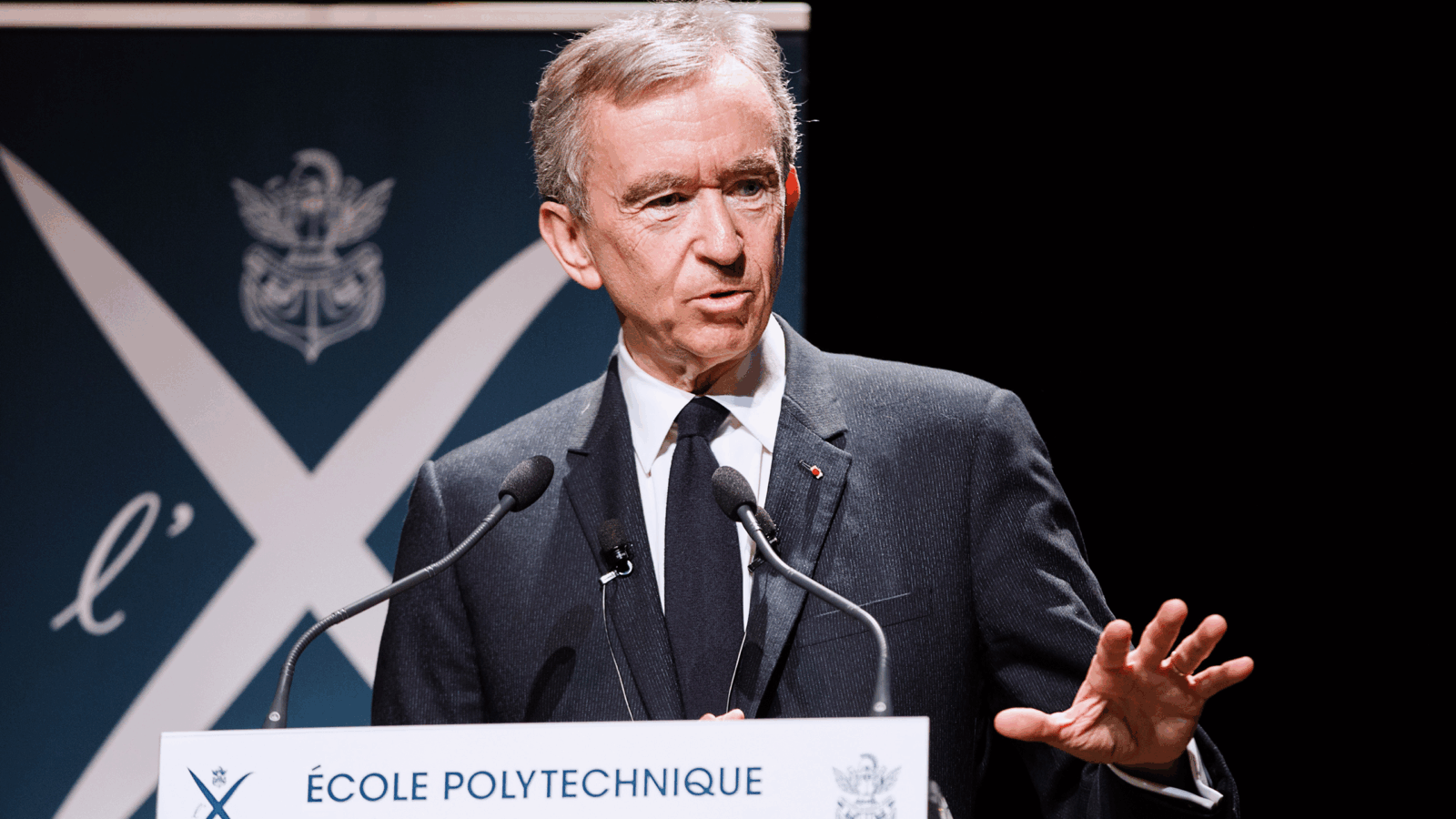

If You Can’t Beat ‘Em, Rejoins-les: Not to be outdone, LVMH’s CEO — Europe’s richest man, Bernard Arnault — has also taken a stake in Richemont, according to a Bloomberg report (the stake is too small to require public disclosure). A decade ago, Arnault and LVMH previously surprised design house Hermès when he built up a 23% stake through a web of intermediaries.

Expensive Chick: And as if obscenely priced handbags, watches, jewelry, and champagne weren’t enough, last week LVMH acquired a majority stake in 100-year-old Parisian bistro Chez L’Ami Louis, a Mecca for gourmands with wallets as fat as their guts. According to an image of the eatery’s menu, posted on Tripadvisor, a single roast chicken will set you back a whopping €94 ($100) — we’ll stick to the Costco poulet roti.