Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

…of fiduciary duty.

If you’d like to skip over this last story on Robinhood — do not fret it — a Netflix docuseries is without a doubt already in the works

Gone In A Flash

Robinhood, the seven-year-old brokerage unicorn with a mission to “democratize investing,” has found itself in hot water.

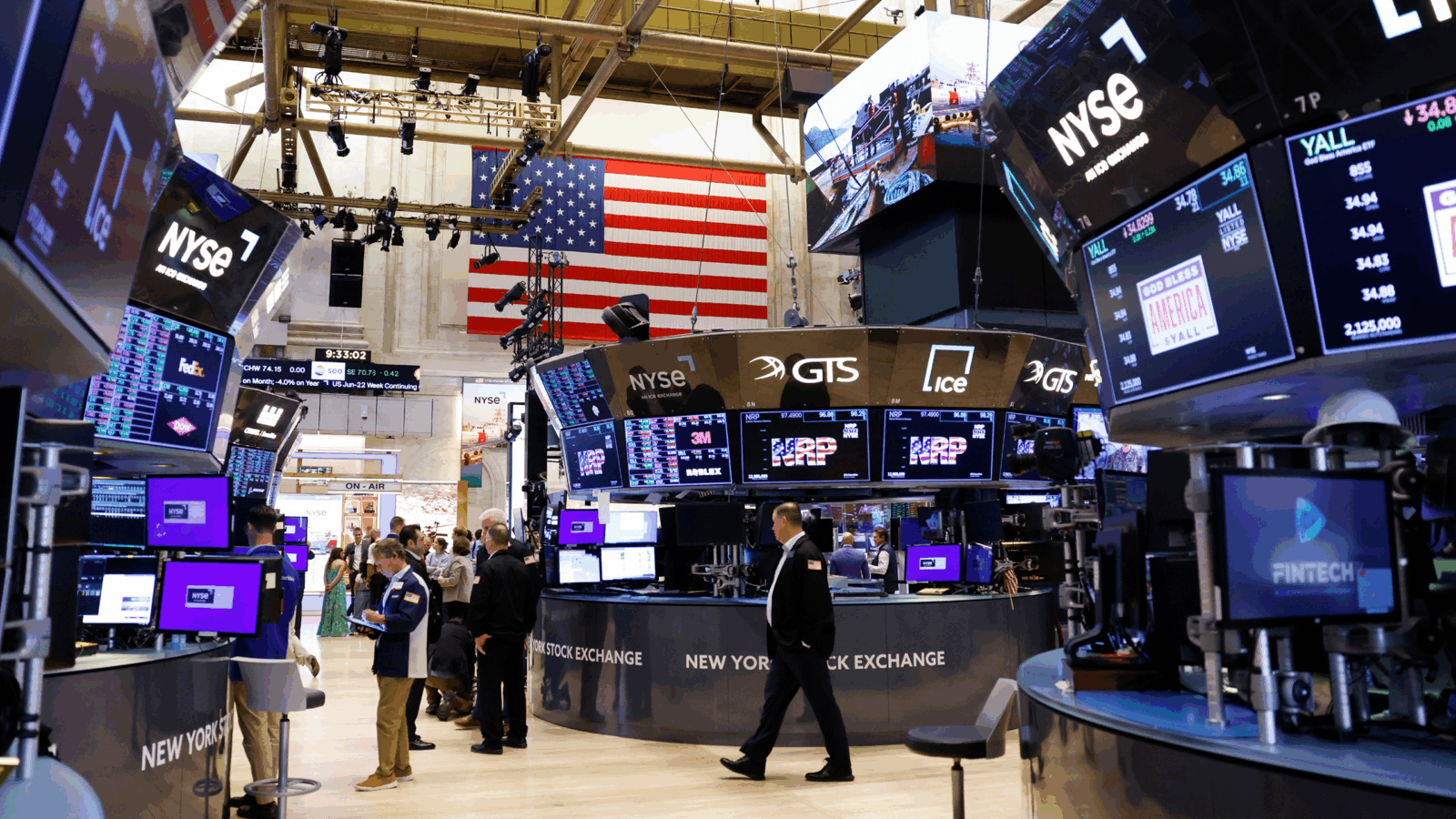

Yesterday Robinhood and a long list of other brokerage firms clamped down on certain trading activity in highly volatile securities including GameStop and AMC. Carefully worded press releases assured investors the trading limitations were designed to protect customers and preserve stability during a surge in trading.

But Folks Weren’t Thrilled: Trading restrictions were put in place for traders looking to buy, not sell. The resulting share price action was precitible (as is typically the case when there are more sellers than buyers), shares in GME and AMC fell precipitously.

While it is not uncommon for brokerage firm to raise margin requirements during a volatile period, a full-fledged ban in a high profile security is much less common. The public backlash was swift:

- Alexandria Ocasio-Cortez, a member of the Financial Services Committee, demanded an investigation into, calling it “unacceptable.”

- Dave Portnoy of Barstool Sports echoed the same view.

The Takeaway:

While multiple class action lawsuits were filed in, legal experts say users will have very little recourse.