Finance

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

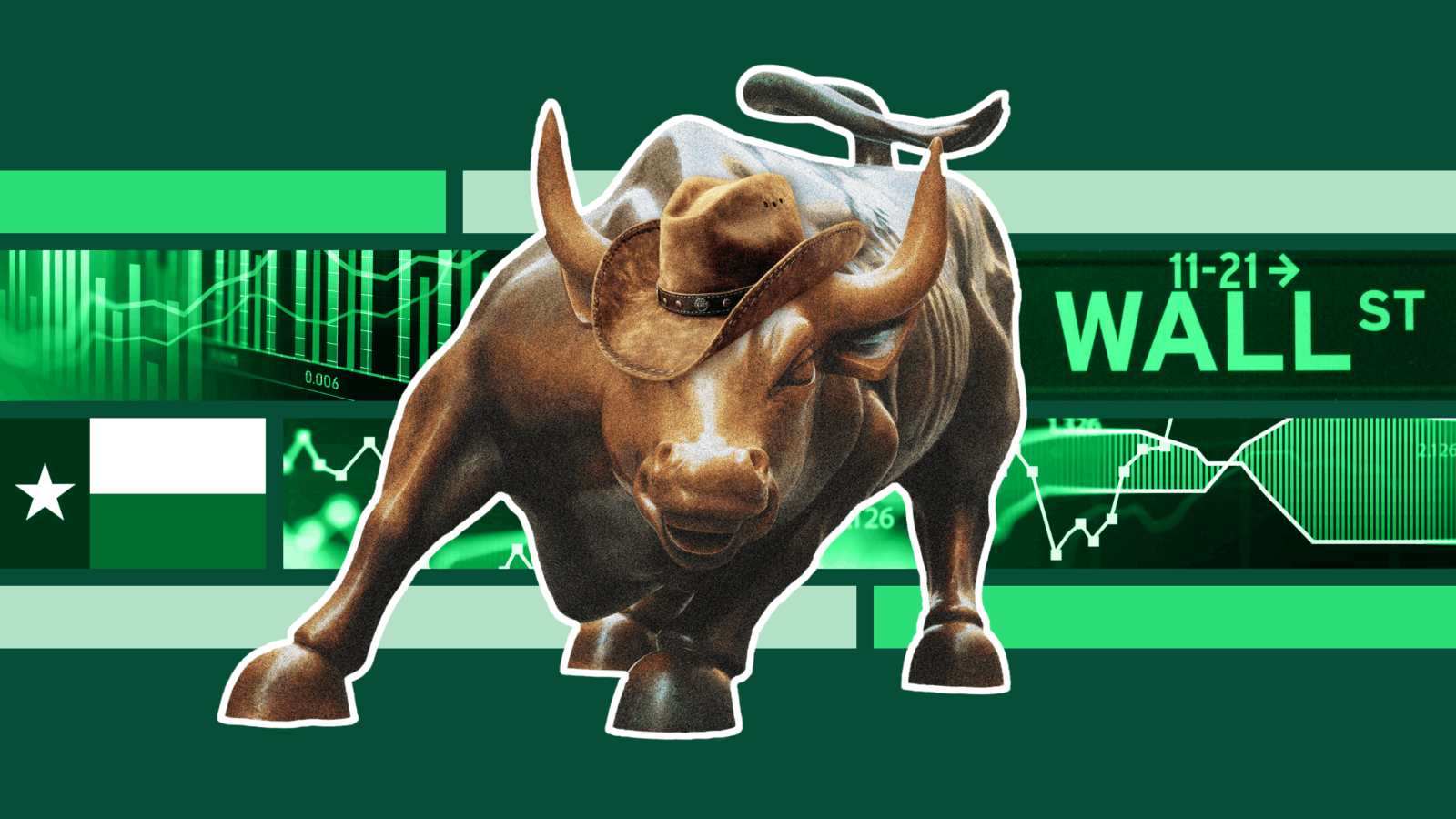

Why Stock Exchanges Want a Piece of Texas, ‘The Wall Street of the South’

Photo illustration by Connor Lin / The Daily Upside, Photos by Andrey Krav via iStock and Muhammad Abdullah via Freepik