Finance

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

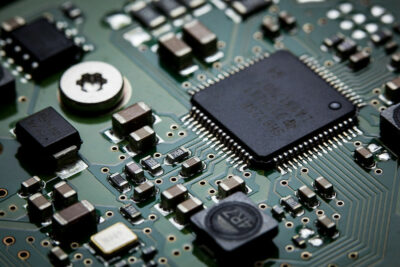

JPMorgan Invests Over $200 Million in Attempt to Clean Up the Planet

(Photo Credit: Andreas Felske/Unsplash)

-

Jamie Dimon Says Enough Is Enough

(Photo Credit: Bio Photos/Flickr)