Y Combinator Plans to Tap Alumni to Invest in New Funds

As it raises its next trio of funds, the famed startup accelerator is inviting past members to invest, according to an Axios report.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

In the latest sign that money is harder to come by in Silicon Valley, Y Combinator is asking for a little help from its friends.

As it raises its next trio of funds, the famed startup accelerator is inviting past members to invest, according to an Axios report this weekend. The decision comes as the venture capital community continues to grapple with a world no longer fueled by ultra-low interest rates.

Howdy, Limited Partners

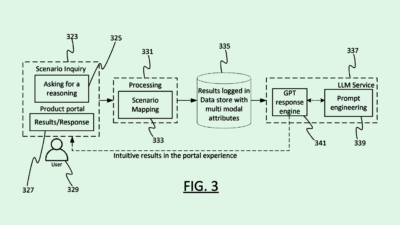

Y Combinator — which helped birth such tech mainstays as Reddit, Stripe, Dropbox, and Airbnb — is maintaining tight rules for its investors. Alumni, who will participate as limited partners, must invest a minimum of $250,000, Axios reported, which will be split across three separate funds: one for the initial checks distributed to the next incubator cohort of startups, and two others for additional capital commitments and funding rounds.

While the practice, known as the “stapling” of funds, was pretty typical during the 2010s halcyon period for VCs, it’s now a bit of a flex from one of Silicon Valley’s biggest kingmakers. In fact, venture capitalists are having a hard time finding investors at all:

- US venture capital firms raised just $9.3 billion through the first three months of the year, according to Pitchbook data recently reported by the Financial Times. That’s just 10% of what was raised throughout 2023, which itself was the worst year since 2016.

- Mega VC players have massively decreased the size of recent funds. Just over a week ago, Tiger closed its 16th fund after receiving $2.2 billion from investors; its previous fund, which closed in 2021, had raised over $12 billion.

Y Combinator is seeking to raise a cumulative $2 billion across its three funds, Forbes previously reported earlier this month.

Exit Plan: Investors have seemingly grown weary of pumping funds into the type of startups that previously thrived on access to cheap capital and the promise of a frothy IPO or M&A market. “Unless we see meaningful improvements from the exit market we’re expecting fundraising difficulties to linger and that will put downward pressure on dealmaking,” PitchBook venture capital analyst Kaidi Gao told the FT, and another anonymous chief investment officer added: “It’s tough maths for a lot of investors.”