Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

The swashbuckling activist short seller that’s made life a nightmare for Lordstown Motors, Draftkings, Nikola, Clover Health, and others is really upping the ante.

On Wednesday, Hindenburg Research — famous for tanking stocks with high profile allegations of fraud — put out a “bounty” on its latest target. The reward: $1 million in cash for information on major cryptocurrency player Tether.

Is Tether Tethered to Anything?

Tether’s namesake cryptocurrency is the most valuable stablecoin in the world, with a $69 billion market cap. There’s just one problem: stablecoins are supposed to be pegged to real-world assets like fiat currencies or commodities, but how this works with Tether is unclear.

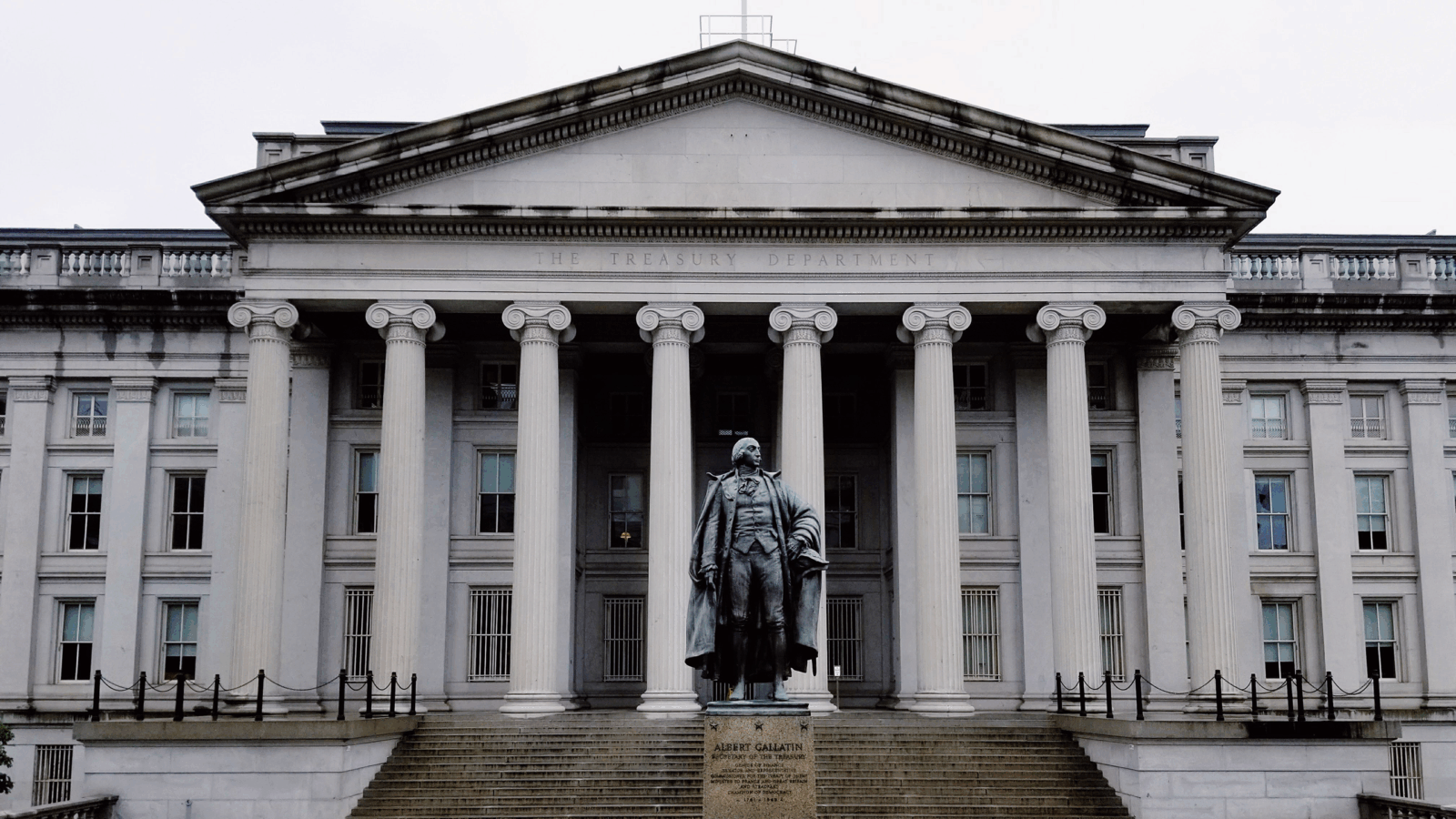

Tether claims it keeps cash reserves of equal value to the stablecoins it issues, but regulators say that’s not necessarily true. The US Commodities Futures Trading Commission (CFTC) fined the company $41 million last week after it discovered that, from 2016 to 2018, Tether had reserves worth only 27.6% of its issued stablecoins.

Enter Hindenburg, which said Wednesday that it will furnish anyone who can provide full details on Tether’s reserves with a $1 million “bounty.” The short seller is not the type to mess around:

- Electric vehicle (EV) manufacturer Nikola’s CEO resigned last year after Hindenburg accused the company of widespread fraud. He’s now facing federal criminal charges.

- The CEO and CFO of EV giant Lordstown Motors resigned this year after Hindeburg accused the company of publishing fictitious order numbers. Lordstown subsequently disclosed it’s under investigation by the Justice Department and negotiated a $400 million hedge fund bailout.

- This summer, Hindenburg accused sports betting firm DraftKings of operating in black markets and selling to “mobs.” That prompted SEC subpoenas, which DraftKings said created “potential for significant damages.”

Who’s Behind Hindenburg?: Despite its headline grabbing theatrics, Hindenburg is a tiny firm of five led by Nathan Anderson, a former due diligence analyst at several broker-dealer firms. He was mentored by Harry Markopolos, the investigator who exposed Bernard Madoff’s infamous Ponzi scheme. Unlike other cases where it stood to profit, Hindenburg said it doesn’t hold any betting positions on Tether, Bitcoin, or other cryptocurrencies.