Industries

-

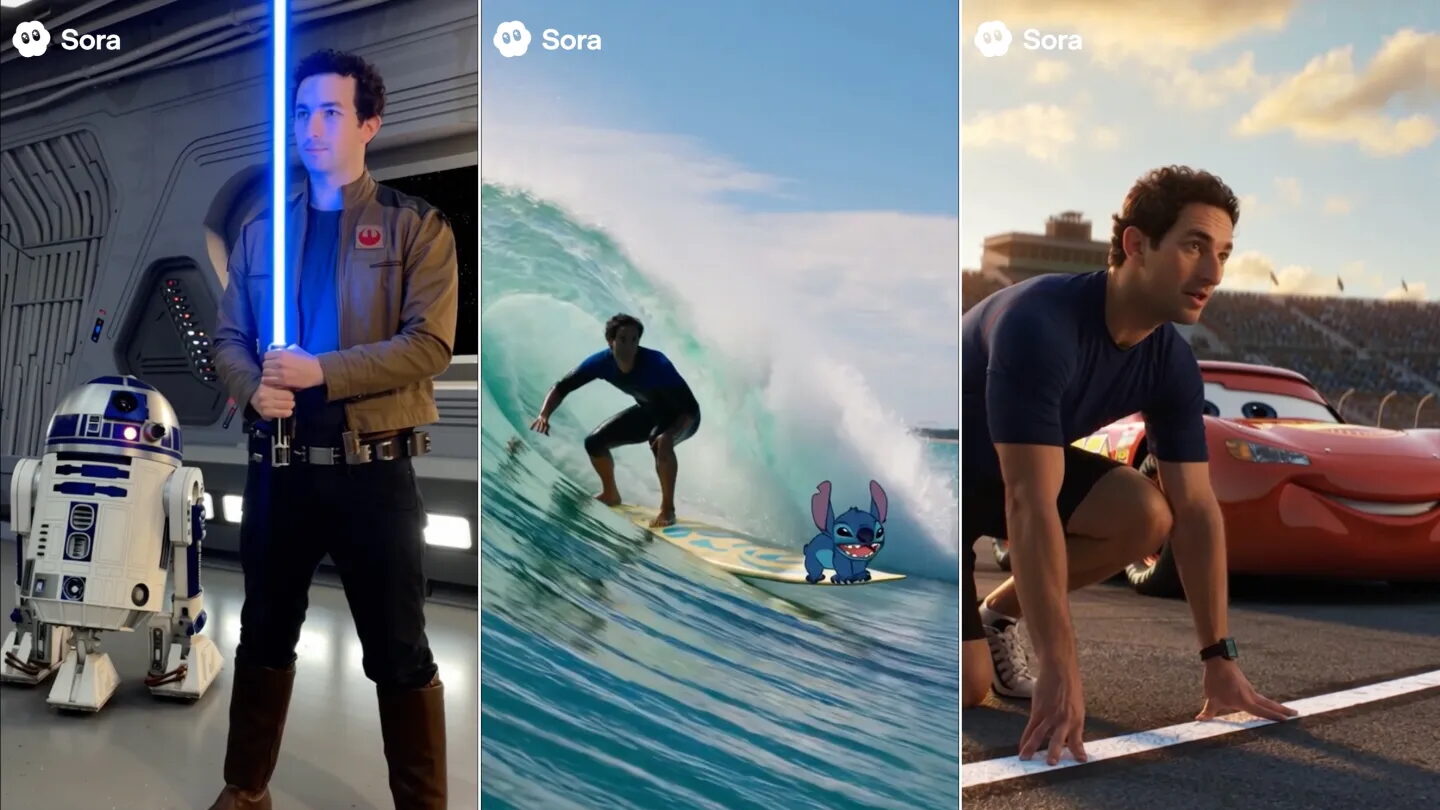

Disney Licenses Play Dates for Mickey Mouse, ChatGPT in $1B OpenAI Deal

Photo via Disney/OpenAI

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.