RV Having Fun Yet? The Ups and Downs of Camper Economics

In addition to offering mobile headquarters for families on vacation, recreational vehicle sales are a pretty good indicator of the economy.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Gross domestic product. Inflation. Treasury bill rates. Consumer spending. Household accounts. Money supply. The CBOE Volatility Index. The Big Mac Index. Vibes.

There are so many ways to measure the economy.

But, in these final weeks of summer, it would be wrong not to embrace the warm weather, the chlorophyll-flush vegetation, and the sunsets after 5 p.m. in order to look to that all-important indicator: RVs.

In addition to offering a way of life for road tripping retirees and mobile headquarters for families who prefer holidaying at Yellowstone over seeing billboards for the eponymous TV series in Times Square, recreational vehicle sales are a pretty good indicator of the economy, and offer a unique view into how one industry that was turbocharged during the pandemic is trying to reset its long-term stability.

Also, as about 70% of US public school students were back in class this time last year, according to Pew data, it’s a reminder to the 30% of families out there that there’s still time for one last escape before the kids are back to preparing book reports on Lois Lowry and John Steinbeck.

“RVs do extraordinarily well in predicting business cycles because they’re such a big, volatile consumption piece for most American consumers,” economist Michael Hicks of Ball State University told American Public Media’s Marketplace earlier this year.

With new towable trailers costing anywhere from $20,000 to $100,000 and motorhomes $50,000 to well into the hundreds of thousands, RVs are big purchases, meaning sales are sensitive to economic headwinds and consumers’ perceptions of the economy — a so-called vibecession would do sales no favors.

They’re also overwhelmingly debt-backed. Jon Ferrando, the CEO of Fort Lauderdale-based Blue Compass RV, which owns 103 RV dealerships in 33 states, told Reuters last year that 80% of customers finance their purchases. That makes the industry especially sensitive to interest rates.

RVs also simply represent a lot of people. There are 11.2 million RV-owning US households as of 2021, a 62% increase in the past 20 years, according to the National RV Dealers Association. More than a fifth of the market, according to the Association, is now made up of 18- to 34-year-olds.

Meanwhile, there remains a large, outdoorsy consumer base to be won over: 92 million American households identified as campers in 2022, according to a survey by Kampgrounds of America, up from 79 million in 2019.

The Business of Wheel Estate

While most workers whose jobs went remote during the pandemic traded an office for their study — or a splayed-out position on the couch — and some traded San Francisco for Denver or NYC for Miami, a record number of Americans figured it was high time they get in touch with America’s seemingly endless roads and landscapes.

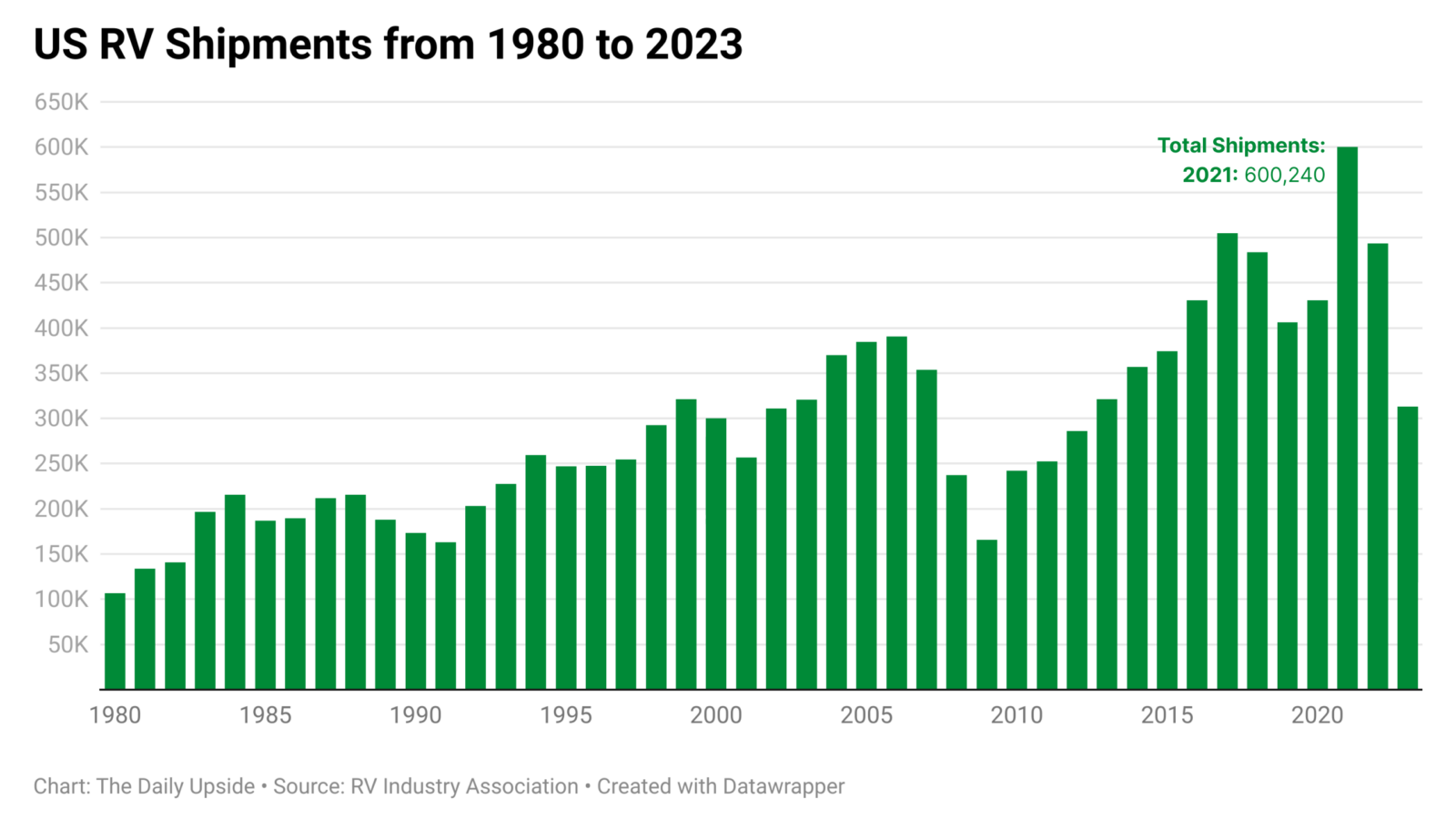

RV shipments rose a whopping 40% in 2021, the first full year of the pandemic, to a record 600,000. That’s up from 430,000 the year before, when sales were still well above historic norms, according to RV Industry Association data. They remained strong in 2022, with 493,000 shipments making for the third-best-selling year since 1980.

Last year, however, the numbers fell faster than a bald eagle swooping down for its supper in Olympic National Park. There were just 313,000 shipments, the fewest since 2012.

Overall consumer spending on recreational vehicles — excluding motorcycles, bicycles, pleasure boats, and pleasure aircraft — also fell, slinking to $46 billion last year, down from $53 billion in 2022 and $50 billion in 2021. However, that was still well above the back-to-back $33 billion in 2018 and 2019 and $38 billion in 2020, according to Commerce Department data.

There are plenty of factors that likely contributed: high interest rates, which don’t help with the high number of RV purchases that are financed; the fact that so many consumers bought into the RV space during the pandemic and a to-be-expected reset; inflation, causing consumers to behave more frugally; and, of course, the so-called vibecession that loomed over consumer sentiment for much of 2023 as the public’s general attitude about the economy was muted.

This year, in spite of all that, things have turned up so far, even without the expected interest rate cuts that could start as early as next month.

According to a survey of manufacturers by the RV Industry Association, 25,300 units shipped in June this year, the latest month for which figures are available, about 5% more than in the same period last year. The total number of shipments in the first half of the year, roughly 179,000, were 8.4% above the first half of 2023.

Earlier in June, the RV Industry Association revised its 2024 and 2025 forecasts, projecting 2024 RV shipments between 329,900 to 359,100 units and 2025 shipments between 374,200 to 408,600 units.

“This new forecast reinforces our cautious optimism that the worst of the impact from interest rate increases are behind us, and that we’ll see a continued rise in shipments through the remainder of this year and into next year,” CEO Craig Kirby said.

Off With a Hitch?

For the biggest publicly traded firms in the RV space, the boom-and-bust cycle of the last four years has been, well, boom and bust.

After making $2.4 billion in annual revenue in 2020, Minnesota-based RV manufacturer Winnebago made $3.6 billion in 2021 and $5 billion in 2022 before falling back to $3.5 billion last year. The company’s share price is down about 21% this year.

In June, the company reported revenues of $786 million in the third quarter of its 2024 fiscal year, down 12.7% year-over-year and below analysts’ estimate of $806 million. In his comments on the results, Winnebago CEO Michael Happe noted RV dealerships have been closely monitoring inventory levels since sales contracted and interest rates have remained high, which impacts the business of manufacturers even as RV sales have ticked up nationally. Winnebago’s gross profit of $118 million in the quarter was down 22% year-over-year.

“While outdoor industry market conditions remain challenged given inconsistent retail patterns and sustained dealer discipline relative to field inventory levels, we are generally pleased with the resiliency of our portfolio,” Happe, whose firm announced an ambitious $4.5 billion to $5 billion revenue target for 2024, said.

Thor Industries, the Indiana-based RV manufacturer, has also flagged “challenging market conditions” in North America this year. In June, Thor cut its fiscal 2024 revenue outlook to $9.8 billion to $10.1 billion, down from an estimate of $10.0 billion to $10.5 billion. Third-quarter sales amounted to $2.8 billion, down slightly from $2.9 billion during the same period in 2023.

“Until a strong market does return, we will continue to be disciplined with production and will continue to work with our independent dealers to maintain a steady, albeit depressed, retail pull-through by focusing our production on floorplans and price points that resonate with consumers in the current environment,” CEO Bob Martin said upon the release of the third quarter results. Shares in Thor are down roughly 12% this year.

Meanwhile, RV-makers and dealers are no doubt pleased that the latest inflation reading of 2.9%, the lowest since March 2021, has rolled out a red carpet for Federal Reserve rate cuts next month. Markets are currently pricing a 100% probability of a rate cut, according to the CME FedWatch Tool, and the only thing in doubt is whether the Fed will proceed with a 25 basis point cut or a more aggressive 50 basis points.

A cut of any size, of course, will make borrowing cheaper, which can boost consumer spending and corporate balance sheets. In the case of the RV industry, that could mean earning greenbacks from orange, yellow, and red — friendlier loans unlocked just in time for fall foliage.