Trump’s Moonshot Ignites Nuclear Stocks Rally

Russia and China have already announced plans for a joint-base small modular nuclear react on the moon by the mid-2030s.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

There’s shooting for the moon, and then there’s this.

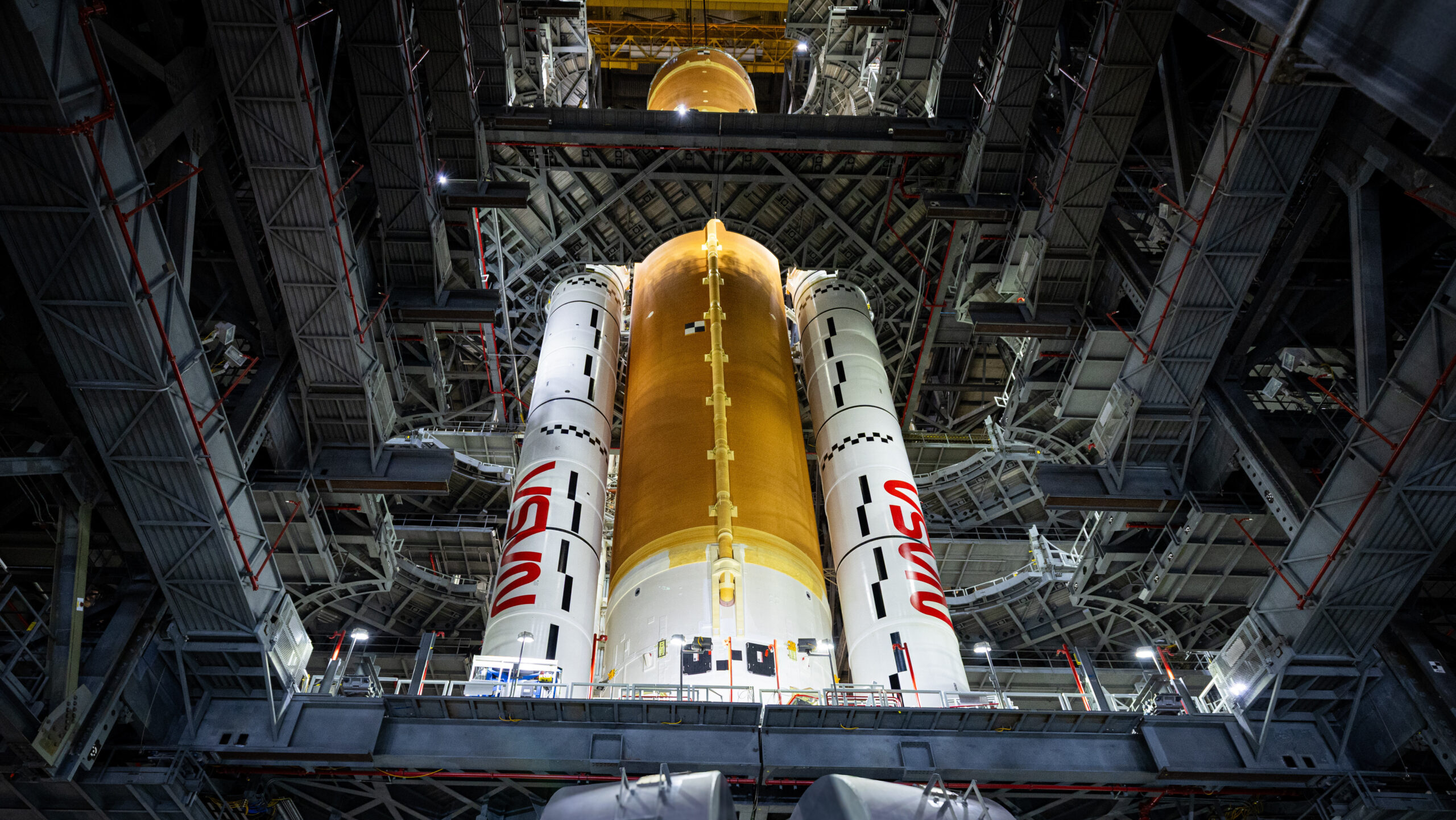

Nuclear energy firms enjoyed an across-the-board share-price surge on Tuesday after US Transportation Secretary and interim NASA Secretary Sean Duffy confirmed the space agency has fast-tracked plans to operate a small modular reactor (SMR) on the moon by the first quarter of 2030.

Moonrakers

NASA’s actually playing catch-up. Russia and China have already announced plans for a joint-base SMR on the moon by the mid-2030s, and Duffy said in a statement that could result in a “keep-out zone” that might inhibit the US’s own lunar nuclear ambitions. The plan is to launch an SMR capable of generating at least 100 kilowatts of energy. Here on Earth, that’s small potatoes, about enough to power a subdivision of roughly 80 homes. But on the moon, where sunshine for solar power is scarce and batteries quickly run dry, that small Earth step could be a giant leap for long-term lunar vacations and research trips. The idea isn’t exactly new, either: In 2022, NASA awarded multiple contracts to draw up initial designs for a moon SMR.

Hence, NASA’s fast track includes the appointment of an agency official to oversee the effort within the next 30 days and a request to commercial companies for proposals within the next 60 days. The chance at winning a lunar lottery ticket has investors declaring liftoff for the entire industry:

- Shares in Oklo, an SMR developer that plans on getting its first Earthbound reactor online by late 2028, surged nearly 10% on Tuesday. Meanwhile, competitors Nano Nuclear Energy and Nuscale Power saw stock pops of more than 7% and 5%, respectively.

- The Global X Uranium ETF, which tracks companies involved in uranium mining, climbed more than 2% on Tuesday, mirrored by a similar gain for the more broadly-focused VanEck Vectors Uranium+Nuclear Energy ETF.

BWXceptional: Of course, the nuclear sector was having a premier year before its ambitions got extraterrestrial, as ravenously power-hungry AI data centers create newfound demand for nuclear energy at home. For more proof of a nuclear revival, just look at the late-Monday earnings report from BWX Technologies, a leading supplier of nuclear reactor components and the primary nuclear contractor for the US Navy. The company reported a 9% increase in government operations revenue, a 24% increase in commercial operations revenue, and raised its guidance for the rest of the year. That proved enough to push its share price up more than 17% on Tuesday and for William Blair analyst Jed Dorsheimer to call the company “our most robust pure play in nuclear.” In other words, the company is practically glowing right now.