Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

America’s loss is Denmark’s gain. Weight loss, that is.

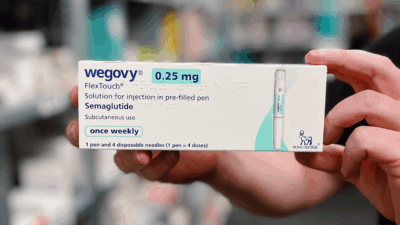

The US obsession with skinny-down pills Ozempic and Wegovy has turned Danish drugmaker Novo Nordisk into that country’s biggest company. So big, in fact, it’s reshaping the entire national economy, according to an analysis published Thursday by the Wall Street Journal.

Have a Danish

Novo Nordisk’s market value stands at some $419 billion, roughly double that of Pfizer, and about on par with American titans like Exxon, Walmart, JPMorgan, and Johnson & Johnson.

It’s also more than the entire GDP of Denmark and roughly 10 times the country’s second-biggest company, transportation and logistics player DSV. And when one company looms so large, it’s impossible to not create economic ripple effects:

- Denmark’s currency, the krone, is pegged to the euro — meaning monetary policy and interventions from Copenhagen’s central bankers is almost always in lockstep with the European Central Bank.

- But US sales have been so strong, bringing in a massive influx of American dollars, the krone’s value has now jumped in comparison to the euro.

“Because the pharmaceutical industry’s exports have grown so much, it’s creating a big influx of currency into the Danish economy,” Danske Bank director Jans Naervig Pedersen told the WSJ. In turn, Denmark’s central bank has kept its interest rates below the ECB’s — which means US customers are essentially helping Danish citizens score cheap mortgages.

Ballooning Bottom Line: Wegovy and Ozempic are projected to generate $6.1 billion of revenue this year for Novo Nordisk, which could soar to nearly $15 billion in 2027, according to FactSet. Morgan Stanley recently raised its estimated value for the market of anti-obesity drugs by 2030 to $77 billion. But not everyone is having it. Ozempic is expensive — roughly $1,350 a month per patient — and its meteoric rise has forced some employers to nix it from health insurance plans. The University of Texas System, recently ended coverage of the drugs after its expenses tripled in roughly 18 months. That’s not the kind of skinnying-down that Novo Nordisk is hoping for.