Moderna Is Still Stuck in Post-COVID Limbo

Moderna walked a tightrope trying to convince shareholders it can both develop a new portfolio of drugs and keep costs down in the process.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Nobody wants to be a one-hit wonder — Moderna is still searching for its post-COVID chart-topper.

On Thursday, at its annual R&D Day investor event, the pharma giant walked a tightrope trying to convince shareholders it can both develop a new portfolio of drugs and keep costs down in the process. Unfortunately, shareholders opted for surgery.

Put That in Your Pipeline

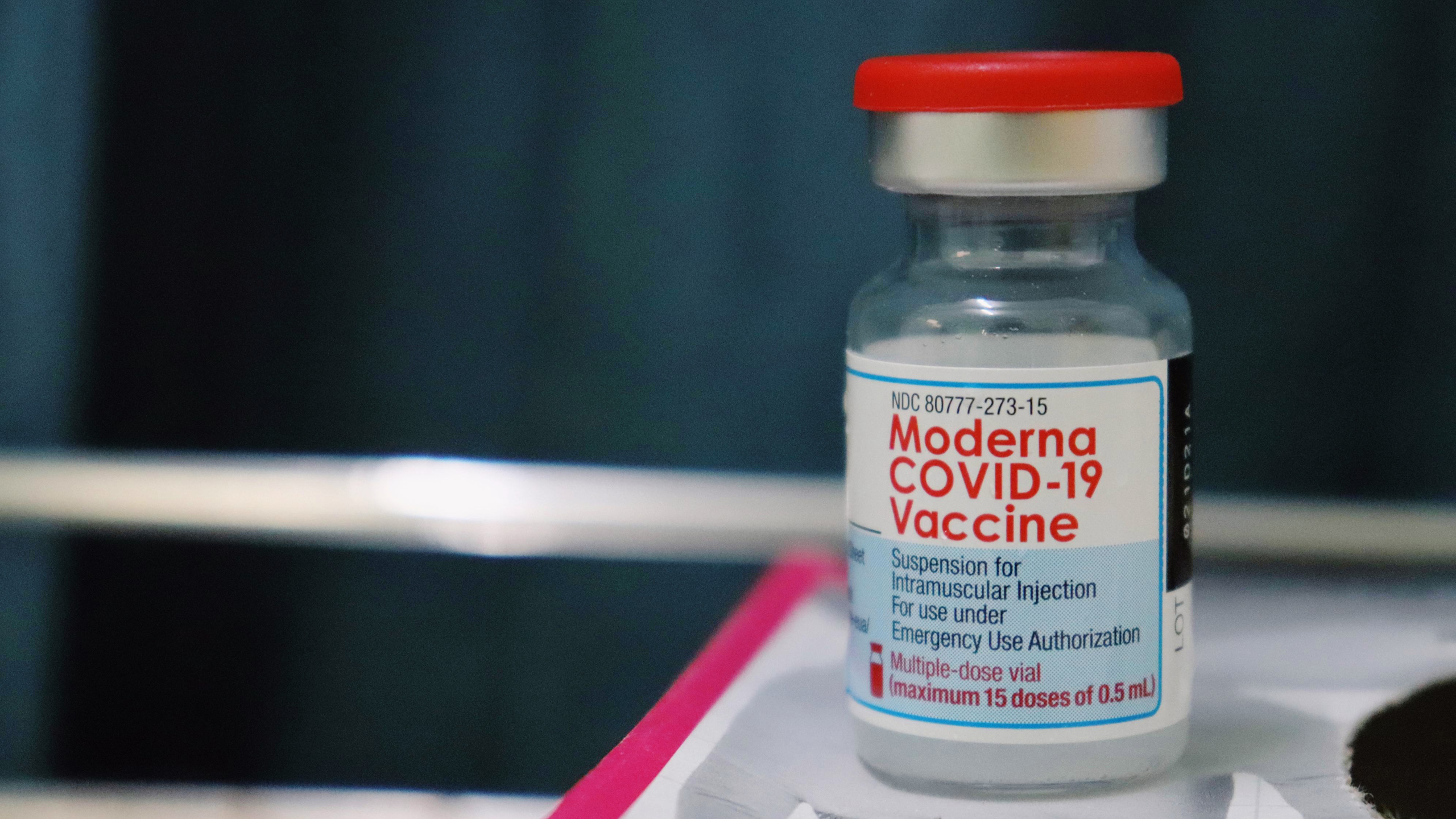

The Cambridge, Massachusetts-based COVID-19 winner currently has two products on the market: an RSV vaccine that utilizes the same mRNA technology behind its COVID-19 vaccine, and said COVID-19 vaccine. Demand for both have been tepid to say the least, forcing the company to downwardly revise its sales outlook for the year from $4 billion to a range of $3 billion to $3.5 billion. It’s also developed something of a reputation for spending more on R&D as a percentage of sales than industry peers, based in large part on confidence that its mRNA tech could eventually power a whole host of drugs. For investors, that’s becoming a headache — a message that’s been made loud and clear.

That’s why Thursday’s event, which was focused on highlighting its pipeline, still featured promises of steep cost-cutting; to assuage investor anxiety, Moderna promised to cut roughly 20% of its R&D budget over the next three years, or the equivalent of $1.1 billion from its annual budget by 2027. It’s enough to reshape how the company sees its future playing out through the rest of the decade:

- The cuts include the discontinuation of five different projects in its pipeline, though Moderna said it still expects 10 product approvals through 2027. Those include five different respiratory shots that have positive phase three trial results, led by three — including a combo flu/COVID-19 shot — that the company says it will submit for approval this year.

- Still, the firm says it now won’t reach a break-even point on an operating cash cost basis until 2028, when it expects $6 billion in revenue. That’s a delay from previous projections of a break-even point in 2026.

Shares of Moderna subsequently plummeted over 12% by market close on Thursday. The firm promised its war chest is still plump enough to last until 2028 without the need for additional equity, though not everyone is buying in. “Investors are unlikely to believe this until further credibility,” Jefferies analyst Michael Yee wrote in a note.

Trial and Error: Moderna isn’t the only pharma player that had a tough day. Roche revealed disappointing results this week from an early-stage clinical trial of a closely-watched oral weight-loss drug candidate, sending shares down roughly 2%.