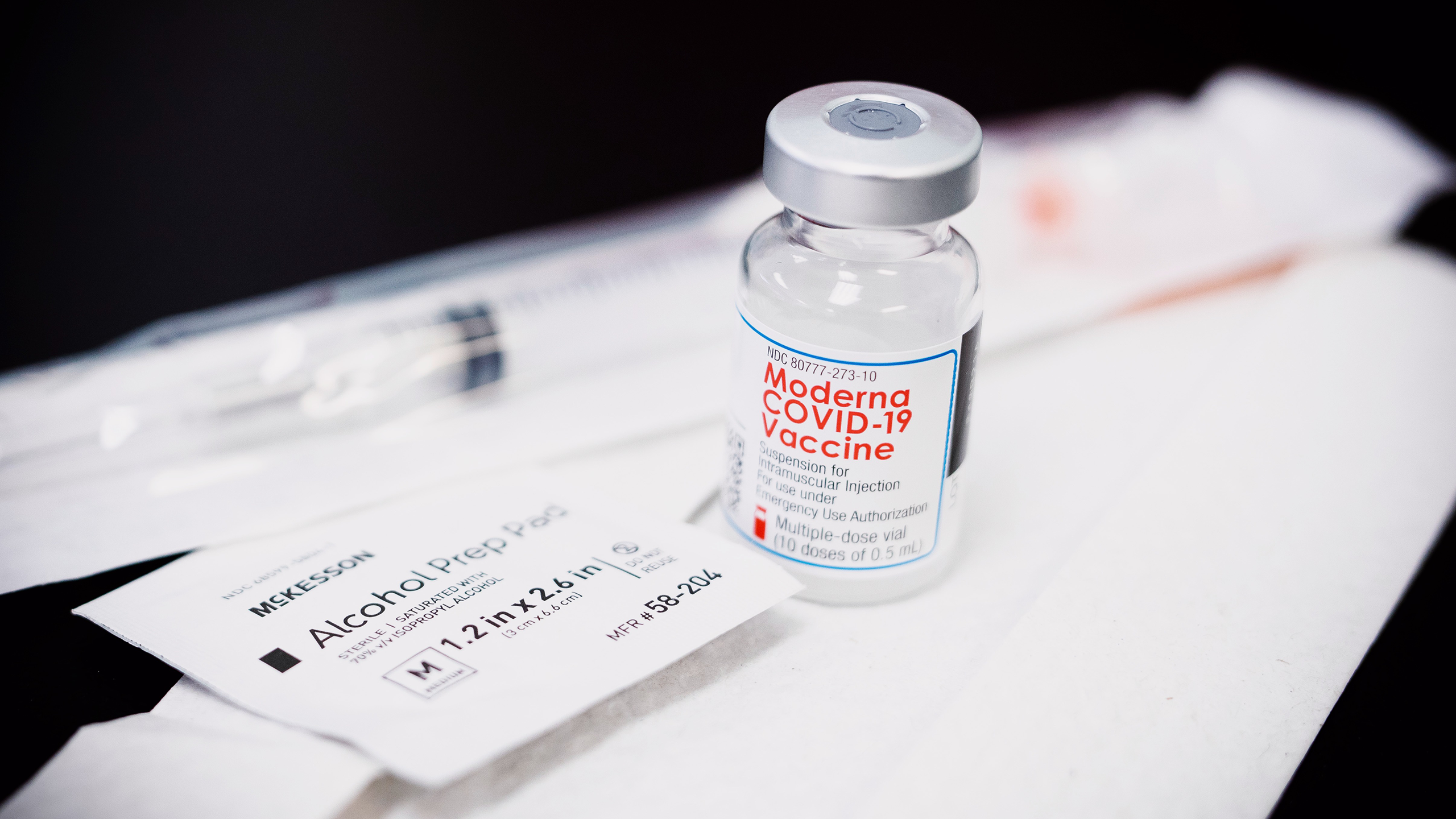

Moderna Moves to Maintain its mRNA Momentum

The company’s stock ran higher after the company buoyed investors’ hopes that its technology will boost a lineup of new popular drugs.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Moderna is in vaccine purgatory.

With its Covid-19 vaccine so last year and its RSV vaccine — widely expected to receive approval from the US Food and Drug Administration sometime before July — still on the horizon, the biotech giant exists between eras. Still, despite a massive downturn in revenue from a year ago, Moderna still beat analysts’ fourth-quarter expectations on Thursday, with investors optimistic about a rosy RSV-driven future to come.

Jab Left, Jab Right

Call it the great resetting of expectations, or the end of pandemic-era boom times. The waning Covid years have effectively crushed Moderna’s overall respiratory franchise (waning being a relative term; the two weeks after Christmas saw roughly 35,000 Covid hospitalizations each, per the CDC). Full-year revenue for the unit in 2023 fell by about two-thirds to $6.7 billion, and the company said Thursday that it expects revenue to tumble again to about $4 billion in 2024. That put the company solidly in the red in 2023, with a loss of $4.7 billion after posting an $8.4 billion profit in 2022.

Still, Moderna reported an unexpected profit of $217 million in its most recent quarter. Combined with out-with-the-old, in-with-the-new optimism, it was enough to spark a 15% share price bump. Despite its RSV vaccine being a relative late-comer on the emerging market, investors still may have reason to believe Moderna’s version will have a competitive advantage:

- A recent late-stage trial suggested its RSV vaccine candidate may have slightly lower durability than the competition, but the company is championing its overall efficacy and safety. More importantly, Moderna is touting its use of mRNA technology to create a pre-filled syringe vaccine, while competitors require multiple preparatory steps — a perk the company hopes could make its version a favorite among pharmacists.

- GSK’s RSV vaccine, Arexvy, did $1.5 billion in sales last year, while Pfizer’s Abrysvo recorded $890 million; some analysts believe the overall RSV vaccine market could see annual sales of $10 billion within a few years.

Think Different: Moderna touts its RSV vaccine as just one of several uses of mRNA technology that it says is still its baseline appeal for investors. The company has 45 products in development, with nine already in late-stage trials — including a flu-covid combo vaccine that some see as a potential blockbuster. “I believe 2024 will be a year where many observers of Moderna go from thinking of us as a Covid vaccine company to seeing Moderna as an mRNA platform company with several products approved and more progress on the way for 2025 and beyond,” Chief Executive Stéphane Bancel said during the earnings call. If several products hit, the company could see sales growth return next year, with 2026 marking a potential return to break-even – no global pandemic required.