Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Larry Bird versus Magic Johnson. Coca-Cola versus Pepsi. The Beatles versus The Stones. Some rivalries stand the test of time, and, in the business world, few have soared to the competitive heights of aerospace manufacturers Boeing and Airbus.

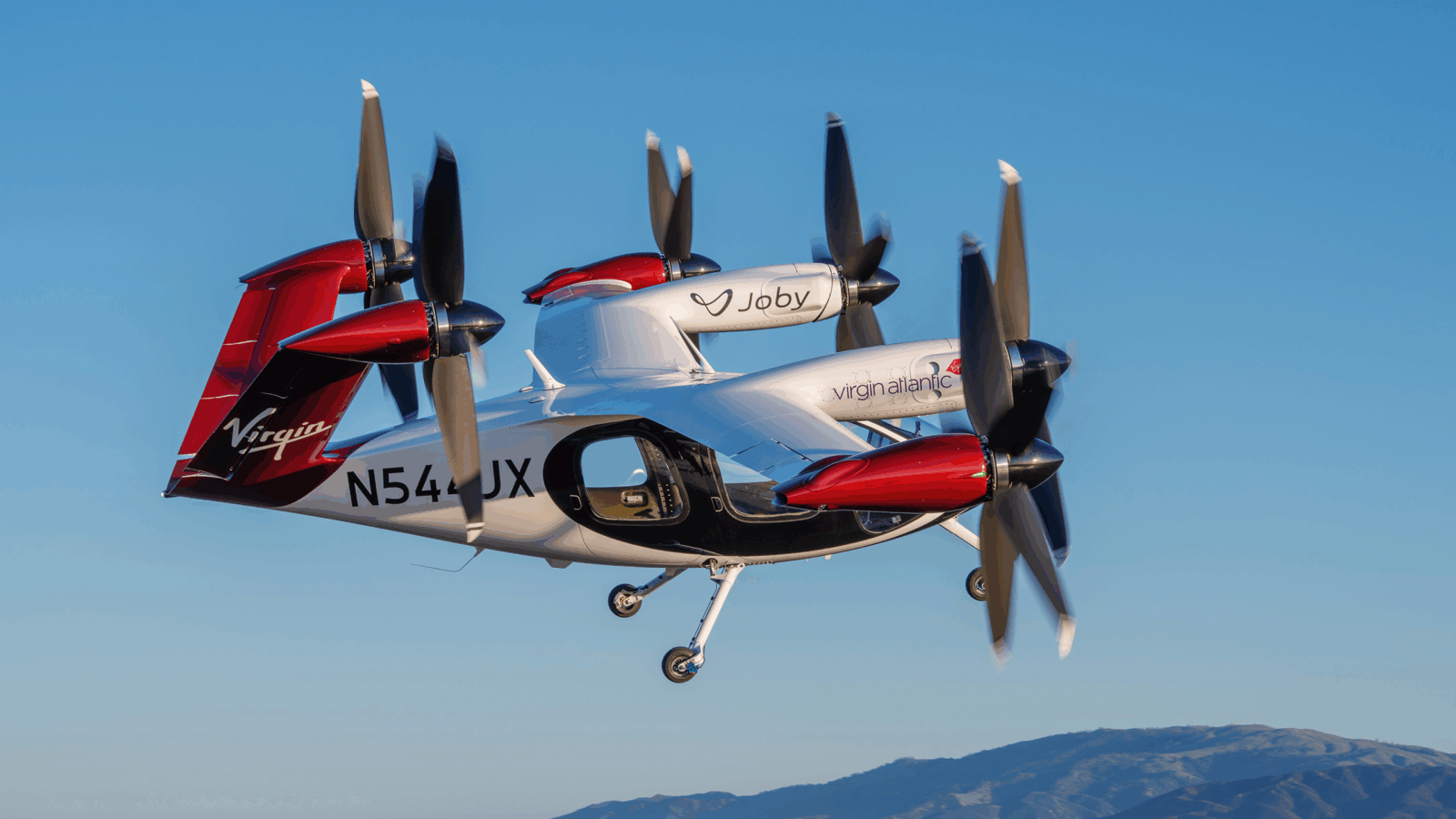

After slipping behind its European rival in a key market segment, Boeing announced a major deal with Delta on Monday. But it still needs to make up considerable ground — or should we say altitude? — to catch the competition.

Major Turbulence

The pandemic (literally) grounded the airline industry, shaking supply chains while zapping demand for new aircraft. Boeing’s own problems — quality control issues with deliveries of its wide-body 787 Dreamliner and two fatal crashes that called into question the safety of its 737 Max planes — made matters worse. As the industry resumes cruising speed in the post-pandemic era, Airbus has pulled ahead in sales of single-aisle aircraft, one of aviation’s most important sectors.

Delta’s purchase of 100 Boeing’s 737 Max 10 aircraft, with an option for 30 more, marks the first deal between the major industry players in over ten years. For Boeing, the sale provides much-needed tailwinds to catch its biggest rival:

- Airbus’ A320 family of jets has overtaken Boeing’s 737 line as the bestselling aircraft ever, and data from aviation consultancy firm Cirium shows the former controls 59% of “firm order backlog” market share. In June, Airbus beat Boeing for a $37 billion contract with three of China’s top airlines to deliver 290 A320neo planes.

- In May, Airbus reaffirmed plans to increase monthly production of A320 jets to 65 per month by mid-2023, up from 50, and 75 per month by 2025. Boeing, weighed down by $45 billion in net debt, is struggling to reliably produce 31 of its 737 Max jets every month.

“[Boeing] lost huge market share and existing customers are being lost to Airbus, which is why I don’t understand why they sit there and do nothing,” Michael O’Leary, CEO of Boeing client Ryanair, told the Financial Times.

The Best Defense: Boeing may have one more feather in its cap. The company is investing in new combat fighters as the US Air Force holds a secret competition for next-gen fighter jets — even though Boeing hasn’t designed front-line combat planes in over 30 years. It could boost the company’s $26 billion defense and space business and stabilize its nose-diving stock, down almost 30% so far this year. You know what they say: the best offense is a good defense contract.