Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

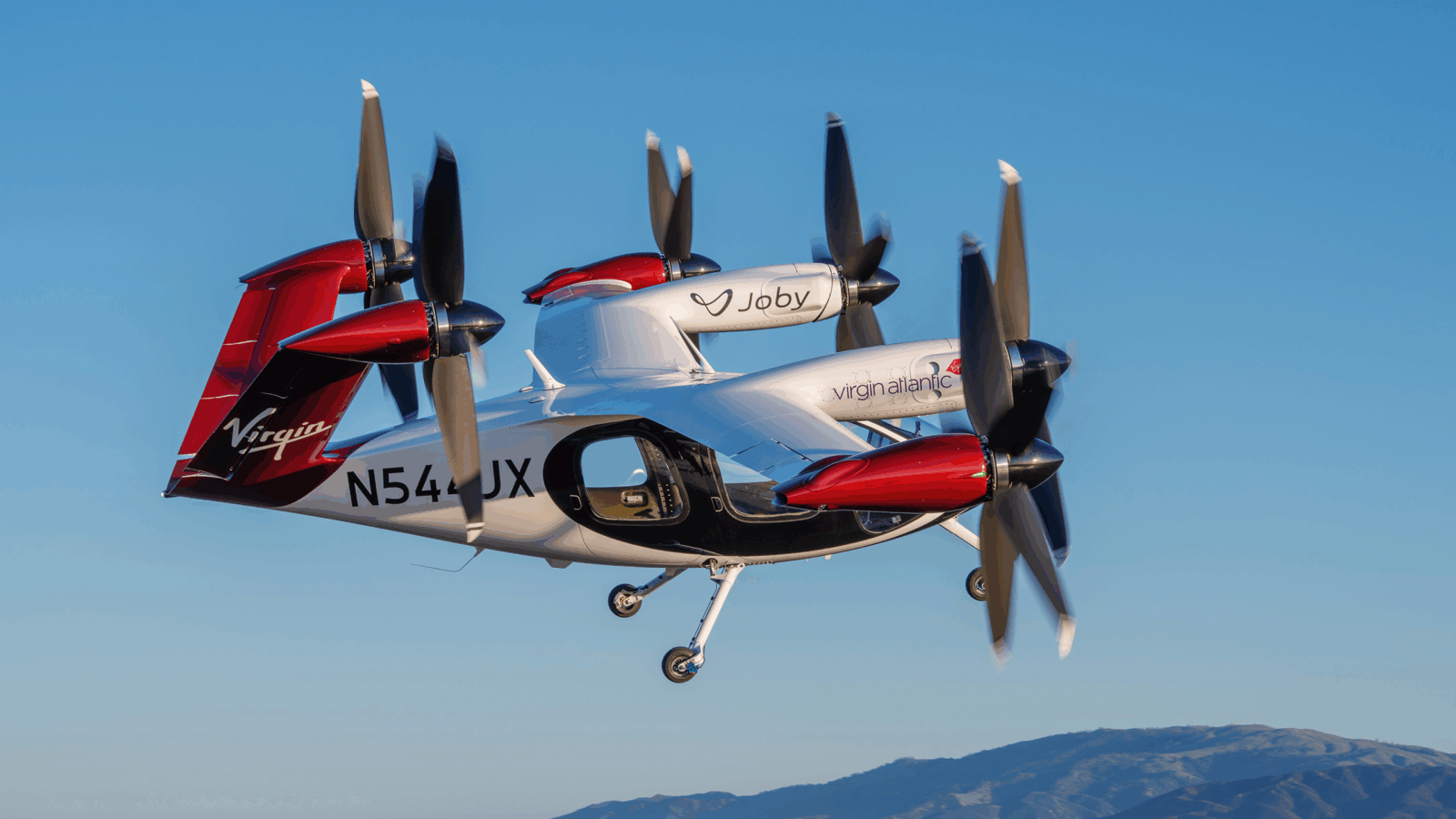

It might just be the most expensive flight of all time.

After years of development and tens of billions of dollars invested, the first-ever made-in-China passenger jet completed its maiden voyage this weekend. It just happens to have taken place during the selective US-China conscious uncoupling.

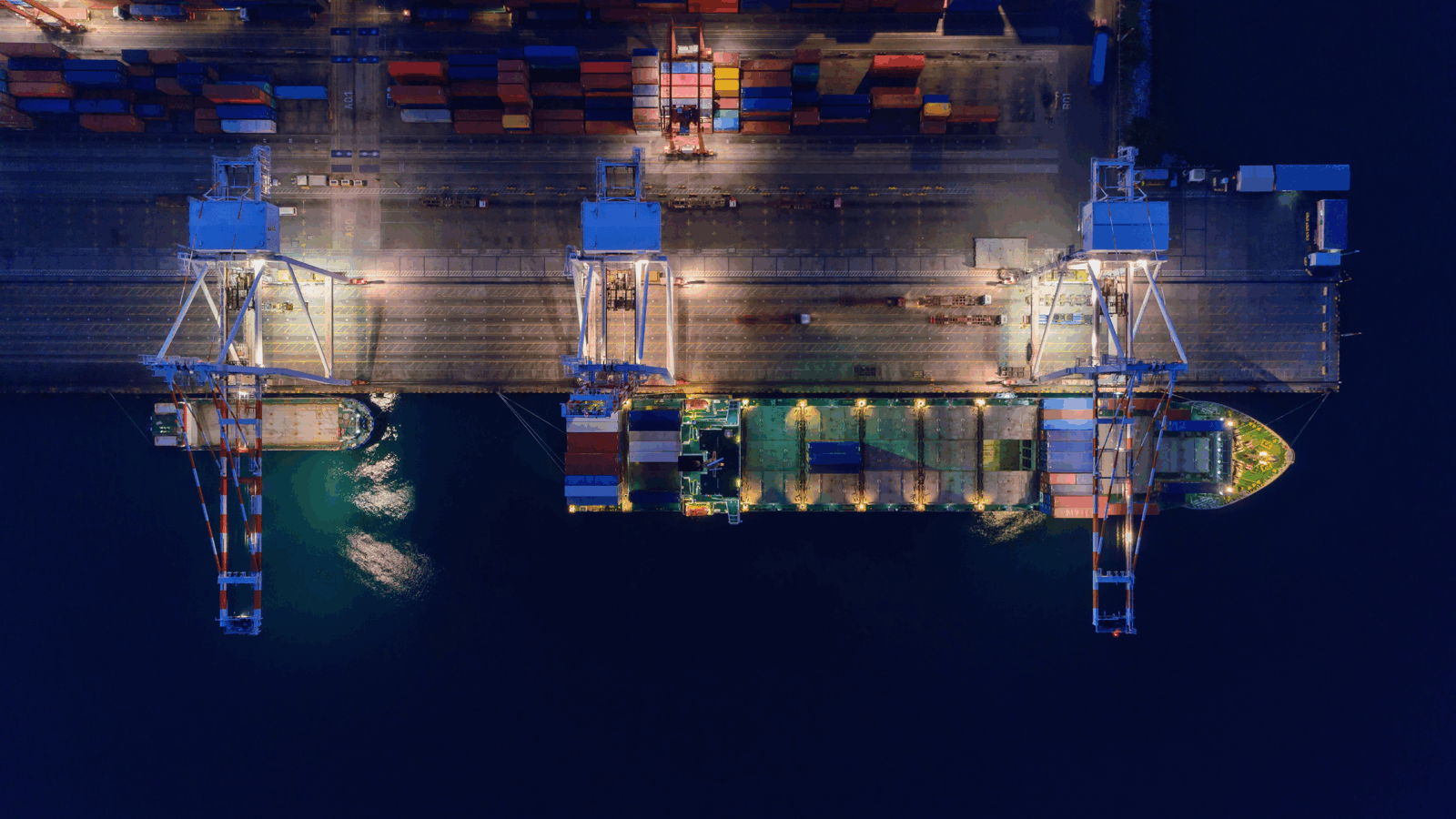

It’s Not Me, It’s You

The industrial cold war between China and the West is devolving into a war of words even as overall trade between the two nations expands. The US and its allies have recently described their heightened efforts to create critical domestic supply chains long left to China and China-adjacent territories — in particular, Taiwan’s all-important computer chip industry — as more of a “de-risking” than a “decoupling.” But to China, defining the terms of the breakup isn’t exactly relevant: “A change in words does not mean a difference in action. In essence, de-risking is hardly different from decoupling,” the state-affiliated Xinhua News Agency wrote in a commentary last week.

Public clap backs aside, China knows a thing or two about decoupling by way of developing critical industries at home. Case in point: the C919 passenger jet from insurgent state-backed aerospace manufacturer Comac, which could become a homegrown alternative to Boeing and Airbus:

- The C919’s first flight, operated by national airline China Eastern, marks the end of a long development cycle that began all the way back in 2008 and featured some $72 billion of Beijing-linked investment. The single-aisle jet seats up to 192 passengers, placing it in competition with the Airbus A320 and the Boeing 737.

- Comac already has over 1,000 aircraft orders from over 32 customers, and analysts say it could threaten the Boeing-Airbus duopoly. China alone is expected to need over 6,000 new single-aisle jets in the next 20 years, as domestic air-passenger traffic is expected to double, according to Boeing forecasts.

Still, possible setbacks remain: Neither the US nor the EU’s regulatory bodies have approved the C919 for commercial flights, and Comac still relies on Western suppliers for some critical components.

The Terminal: Speaking of decoupling, Beijing is taking its reinvigorated crackdown on foreign businesses another step further. Wind Information, the Shanghai-based developer of a Chinese Bloomberg Terminal equivalent, is slowly and quietly cutting off foreign access to certain slivers of important financial information and data, such as online retail shopping trends and land-auction records, according to a recent Wall Street Journal report. Geopolitical power players can call it decoupling or derisking, but we’ll just call it a messy breakup.