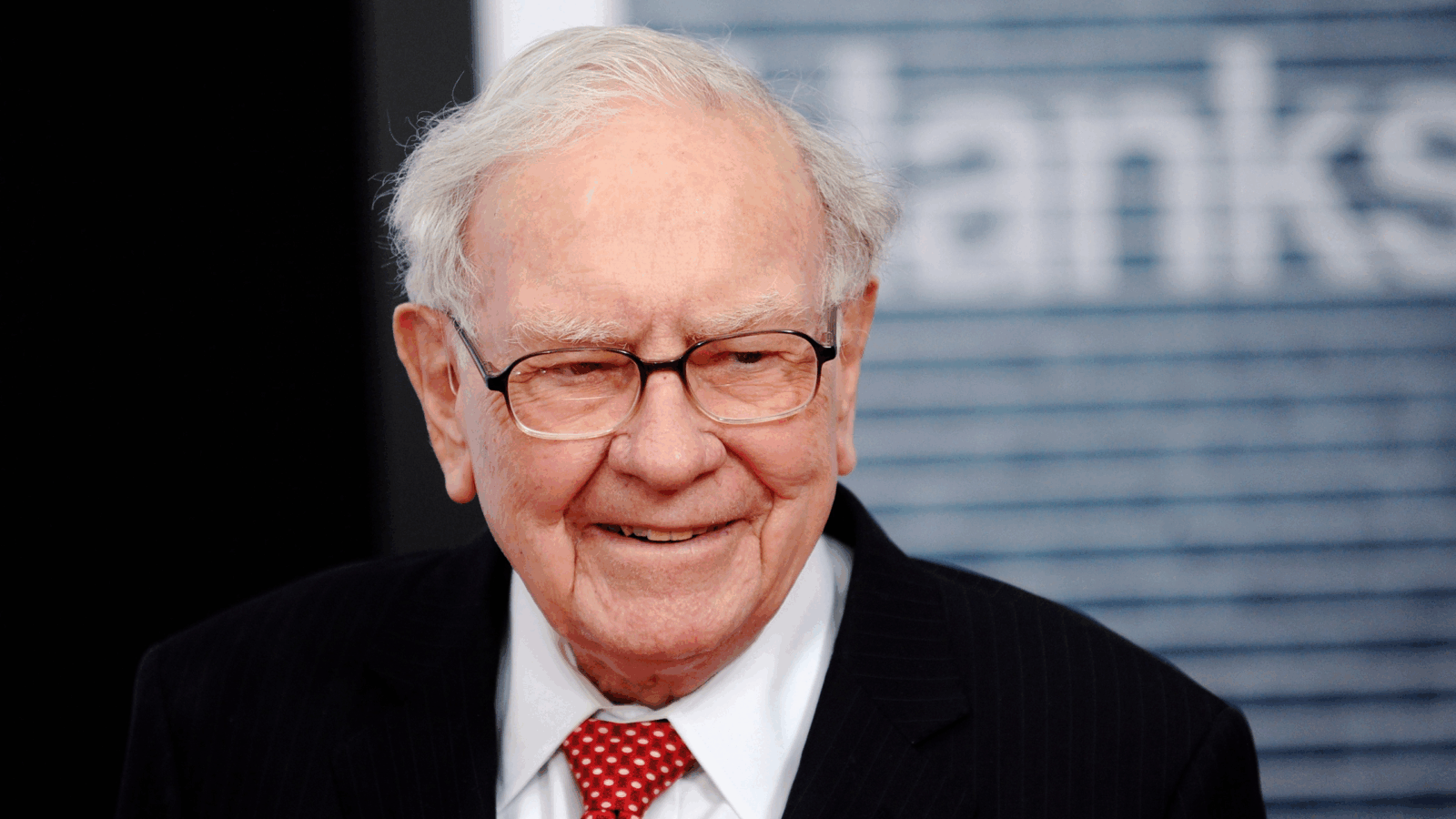

Berkshire Unloads Billions More in Stocks As Markets Ponder Buffett’s Next Move

Berkshire Hathaway sold $36.1 billion of stock in the third quarter, including several billion dollars of Apple and Bank of America stock.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Has the Oracle of Omaha delivered his prophecy? Is Warren Buffett signaling that we need to stay on the sidelines and get ourselves a cherry-topped sundae?

His Berkshire Hathaway sold a whopping $36.1 billion of stock in the third quarter, the company announced Saturday, including big tranches of Apple and Bank of America stock. It bought a mere $1.5 billion.

Deal or No Deal

Berkshire is now sitting on more than $325 billion in cash, which Edward Jones analyst Jim Shanahan told Reuters “begs questions about whether Buffett thinks stocks are overvalued or an economic downturn is coming, or is trying to build cash for a big acquisition.”

So, are stocks overvalued? Some market participants are indeed worried we’re in a “melt-up,” the opposite of a meltdown. That’s what happens when a variety of circumstances — like Fed interest rate cuts and solid economic growth — push stocks to unsustainable levels. The S&P 500 has hit nearly four dozen record highs this year, and its price-to-earnings ratio is a steep 24.5, well above historic averages. The cyclically adjusted ratio is even higher, prompting Goldman Sachs to warn of a yearslong market slide.

Recession fears, meanwhile, have greatly receded — Goldman pegs the odds at 15% for the next 12 months, thanks in part to the economic growth that’s helping push stocks higher. Which begs the question: What is Buffett looking to acquire?

- Earlier this year, Berkshire completed its staged acquisition of a truck stop chain it bought in 2017, and last month it took full control of its energy subsidiary. But Buffett has bemoaned what he calls a lack of “meaningful deals” for over two years now. With price-to-earnings ratios still high, it’s unlikely the frugal nonagenarian CEO spends big until — or unless — valuations come down.

- Piling up cash seems to be the plan for now: Berkshire has been a net seller of stocks for eight quarters; its $69.9 billion worth of Apple shares at the end of September is down 67% from a year ago. Berkshire said Saturday that investment gains propelled profits to $26 billion in the quarter, a marked improvement from a roughly $12.7 billion loss a year ago due to unrealized investment losses.

Buyback Backtrack: Berkshire shares are up 25% this year, besting the blue chip S&P 500’s 20%, but investors will be saddened to hear Berkshire didn’t repurchase any of its own shares in the third quarter.