Buffett’s Berkshire’s Short Term Interest Rate Path Differs From Megarich Peers

Warren Buffett’s Berkshire Hathaway’s investment strategy faces a cash conundrum with interest rates poised for a cut.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Larry Ellison, Elon Musk and Mark Zuckerberg: add up the net worth of the world’s three richest people, by Bloomberg or Forbes’ calculations, and you have roughly $1 trillion.

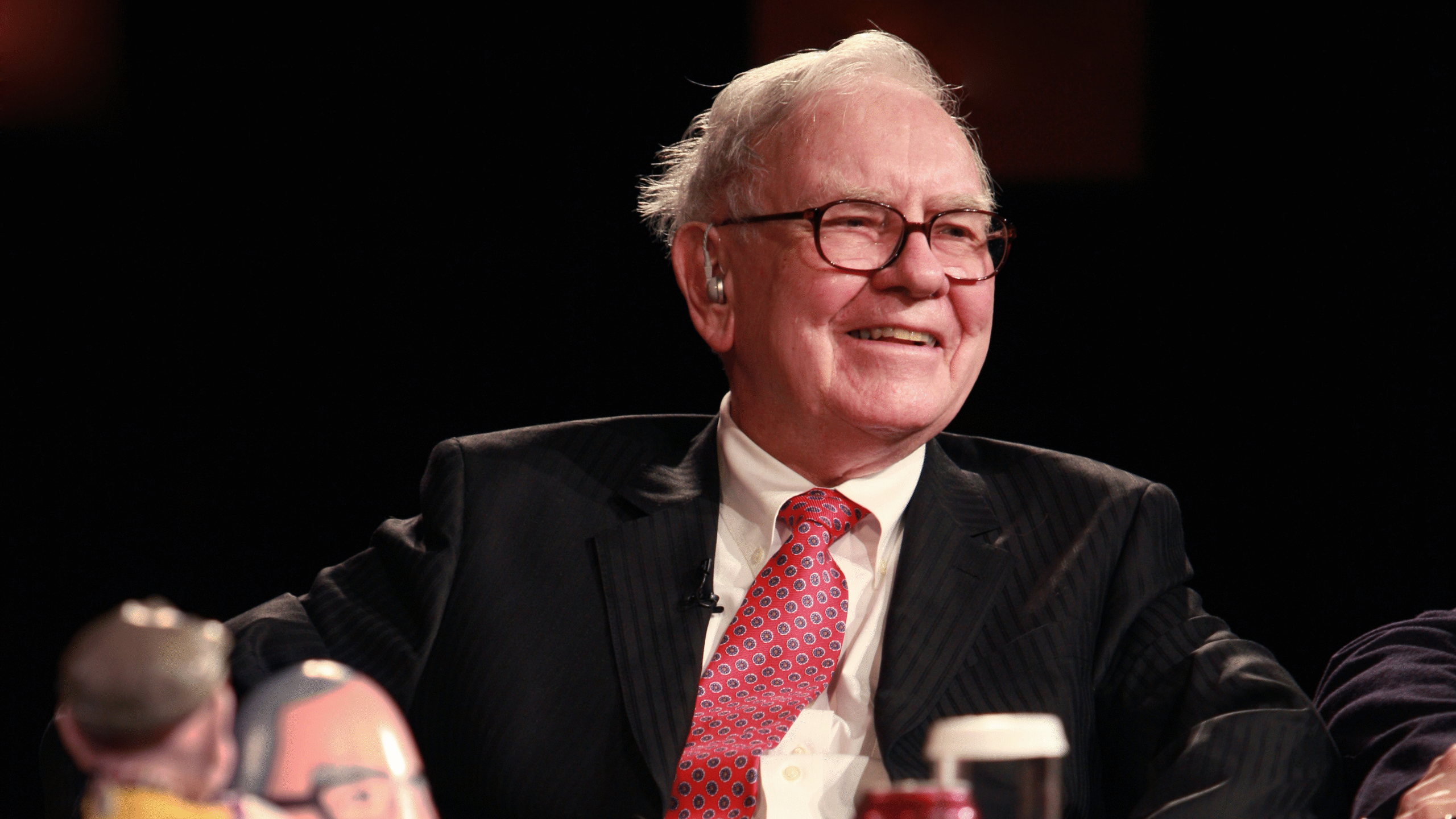

That’s about equal to the market capitalization of Berkshire Hathaway, whose CEO Warren Buffett manages to get by with a mere $148 billion to his name. If the Federal Reserve cuts rates today, as expected, Buffett’s fundamentals-minded conglomerate is likely to face pressures distinct from the vanguard tech companies behind the wealth of his rich list peers.

Not Given to Animal Spirits

The market expects the Fed to cut its current funds rate range of 4.25% to 4.50% by a quarter point today, and Wall Street is forecasting a series of subsequent cuts into late next year. ING and Goldman Sachs, among others, believe that could take the funds rate as low as 3% to 3.25% in time for Christmas 2026. As a result, animal spirits on the trading floor are hopeful that, by reducing the opportunity to earn money from interest, the Fed will prompt investors to shift money into the stock market. The most bullish bulls think the S&P 500 will top 7,000 by the end of the year, which would be a near-6% gain from Tuesday. If that comes true, this would likely continue the rally that’s been led by Big Tech firms like Ellison’s Oracle, Musk’s Tesla and Zuckerberg’s Meta.

Then there’s Buffett’s patient, measured conglomerate. Berkshire Hathaway has spent recent years building up a $344 billion war chest of cash and equivalents. It’s been a net seller of stocks for 11 straight quarters, with Buffett choosing to wait out valuations he views as unreasonably high. It’s hard to argue with the strategy given his perspective: If you don’t think businesses or equity are available at a fair price while risk-free bonds with decent rates are, why not take the easy road? But that calculation could soon come at a cost:

- Barron’s estimated this week that Berkshire, given its considerable cash and US Treasury bill holdings, would see a $3 billion reduction in its annual interest income if the Fed cuts rates by a point in the next year. With taxes factored in, that would equal $2.5 billion or 5% of Berkshire’s operating profit (not to mention the “interest and other investment income” line at Berkshire’s insurance unit already fell 3% to $2.5 billion in the second quarter).

- Berkshire still maintains a mammoth $300 billion equity portfolio, with a $66 billion Apple stake as its crown jewel. But the net selling in recent quarters, including $4 billion in Apple shares in the second quarter, could see Buffett’s conglomerate miss out on gains if investors continue their preference for “risk-on” technology bets.

Value Proposition: Disclosures last month revealed Berkshire took positions in potentially undervalued stocks, like a $1.6 billion stake in struggling insurer UnitedHealth. Buffett, who is set to step down as CEO at the end of the year, may simply view bargains as the best way to profit from a rate cut-induced rally, figuring they have more to gain than highly valued megacaps. Plus, there’s still heaps of labor market and tariff uncertainty, and Berkshire remains something of a safe haven. In the last five years of extreme inflation, pandemic, global conflict, interest rate hikes, economic upheaval and more, the S&P has risen 95%, Apple 112% and Berkshire 123%. Plus, Buffett will always have one thing over Ellison, Musk and Zuckerberg: no matter how his company and fortune fares, the cost of living means his dollars go farther in Omaha.