Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Fiscal policy in Japan these days is like a giant game of tug-of-war.

On one side is a highly sensitive central bank, which insists on maintaining an ultra-loose fiscal policy that the rest of the world has all but abandoned in the fight against inflation. On the other side is the government of the day, which is struggling to preserve purchasing power as its currency sinks like an unlucky stone. On Thursday, the latter side won, and the government intervened to bolster the yen for the first time since 1998, after the currency fell to a 24-year low.

Rate Hike? Take a Hike

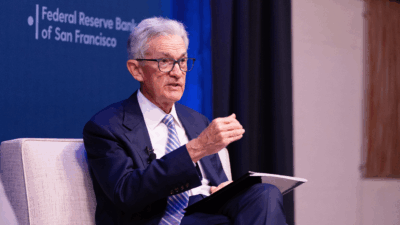

Japan’s economic recovery following the pandemic has remained on fragile footing, in part because the country is still unwinding public health restrictions while other economies are back to something approximating business as usual. That’s led to a very cautious central bank, hesitant to touch interest rates. Just hours after the US Federal Reserve made history by introducing its third consecutive 75-point rate hike on Wednesday, taking its benchmark rate between 3% and 3.25%, the Bank of Japan said it was keeping rates negative at minus 0.1%.

Since investor funds usually flow to places with higher interest rates, the suddenly even bigger gap between US and Japan made it more likely the yen, which had already lost 20% this year against America’s surging dollar, would keep falling. By Thursday, the yen fell to 145 against the dollar, the lowest since the Asian financial crisis 24 years ago (aka the last time the government stepped in to prop up the currency). Prime Minister Fumio Kishida’s government ran out of patience and stepped in:

- The yen rose as much as 2.3% against the dollar to 141 after the intervention was revealed, which Vice Minister of Finance Masato Kanda described as “decisive action” According to the Japanese news agency Kyodo, Japan is selling dollar-denominated assets from its holdings, including US Treasuries.

- “At best, their action can help to slow the pace of yen depreciation,” Christopher Wong, a currency strategist at Oversea-Chinese Banking Corp, told Bloomberg News. “The move alone is not likely to alter the underlying trend unless the dollar, US Treasury yields turn lower or the BOJ tweaks its monetary policy.”

Pounded: Japan is not alone. The US dollar has been a rising tide against all major currencies, including the Euro and the Canadian dollar, because the Fed has been so aggressive in acting against inflation. The Bank of England on Thursday followed the Fed with its own rate hike, albeit only a half point, and a slight rebound in the UK pound still left it at its lowest level since 1985.