Good morning.

All three major indexes are down year to date, the bond market is in a slump, and we could be on the verge of a global trade war. But Peter Mallouk ain’t worrying about a thing.

In fact, the Creative Planning CEO believes markets and the overall economy are right where they’re supposed to be. “There’s just enough uncertainty to wonder what in the world is this administration going to do in the next 60 days, but it’s probably not going to have this go on for years,” he said on his podcast last week. The stock market could sink even further in the short-term, but clients shouldn’t keep cash on sidelines: “Cycles of weakness are the periods of time that are the gift to the investor,” he said.

Here at Advisor Upside, we have to admit, we’re digging the positivity.

AUM Fees May Shrink Next Year. Do Advisors Care?

Sometimes, it’s OK to get a little creepy.

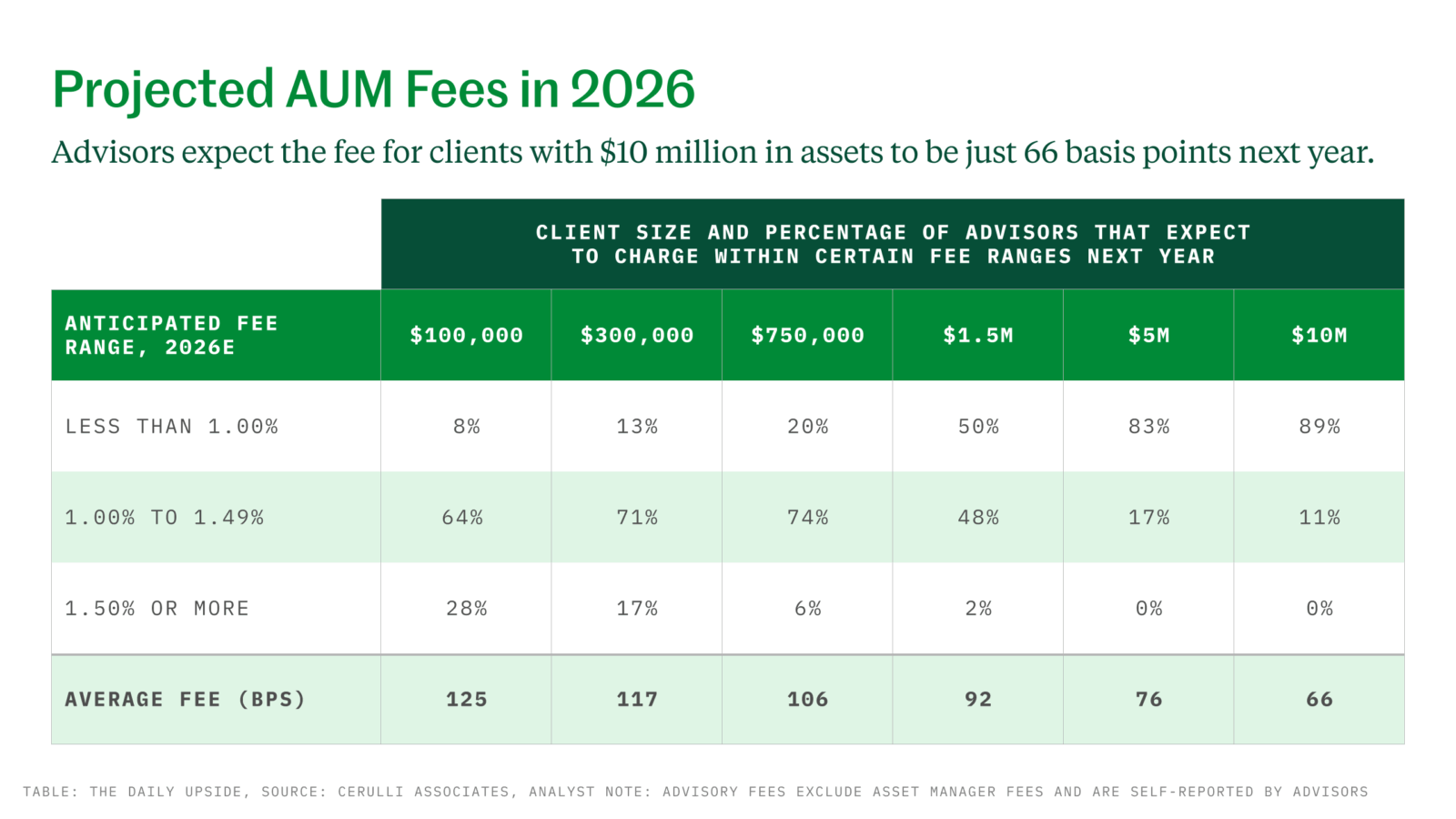

Advisors’ traditional AUM fees have remained stubbornly resilient, even as industry experts have been expecting them to drop for the better part of a decade. Now, advisors are also dealing with “service creep,” where clients expect additional services like tax and estate planning at the same price, and that’s starting to eat into bottom lines. “While this slow, yet steady, compression of fees may not greatly affect revenues overnight, advisors are being asked to provide more comprehensive services,” said Cerulli associate director Andrew Blake. “Today’s clients expect additional services for the same or lower fees, effectively reducing advisor ROI.”

Read the Fee Leaves

The industry already has a complex array of fee structures from fixed or AUM fees to flat fees for limited specific work, and even subscriptions paid on a monthly or yearly basis. According to Cerulli, clients with more than $10 million can expect to pay just 66 basis points on their assets next year, and that’s about half the 125 basis points expected on accounts with just $100,000. “There is only so much work you can do for a client,” said John Power of financial planning firm Power Plans, adding that advisors just can’t justify $50,000 a year on a $5 million portfolio.

For advisors that only offer standard Modern Portfolio Theory portfolios that rebalance every quarter, the value just isn’t there, said John Bell, an advice-only planner and CFP at Free State Financial Planning. Robo-advisors offer similar services at less than half the price, and charging 1%, even while offering comprehensive planning, is simply high, he said. However, there is a market for families that need planning but not ongoing management. “Now, if a client finds value and is OK with the cost, who am I to say that is wrong? The client can always vote with their feet,” he said.

Who’s Your Insurance Agent? Some 44% of advisors said they derive at least 90% of their revenue from advisory fees, but that could jump to 54% by next year. With pressure on fees, there are two ways forward for advisors: Increase AUM or offer expanded services, said Barry Flagg of Triangulum Financial. One of the highest margin services that clients have a “desperate need” to plan for is life insurance. With few advisors qualified to give advice on insurance, it adds value to the clients and opens up a new line of business.

“Life insurance is the last, largest, most-neglected — and worst-performing — asset in clients’ financial plans,” he said. “Given the lack of competition, it also adds a higher-margin line of advice.”

Value Investing, Redefined For Modernity

What does it mean to be a value investor in 2025?

After many consecutive years where growth ran supreme, market dynamics have shifted, and suddenly the notion of “margin of safety” is en vogue once again.

But value investing does not mean the same thing it did in the 1970s.

Advisor Upside sat down with Allspring’s Bryant VanCronkhite to discuss Allspring’s approach to value investing. We discussed:

- How the Mag 7 fits into a value investors framework.

- Value traps, and how “cheap” isn’t necessarily an indicator of opportunity.

- What does it mean to have a competitive moat, and how a flexible balance sheet can be a strategic asset.

Many call themselves value investors — but not all understand how to apply that framework in today’s landscape.

Advisors Weigh In on FINRA’s Side Hustle Rule Proposal

Kid’s little league program needs a new umpire? Play ball.

Advisors and firms are reacting to a recent proposal from the Financial Industry Regulatory Authority that would relax oversight on advisors’ side hustles that don’t affect their work as wealth managers. The proposed rule would also tighten disclosures on their outside investments. It’s a delicate matter, but many advisors agree FINRA shouldn’t have a role in their gigs as, say, golf instructors or Uber drivers, and also feel controls over their personal investments, like buying and selling crypto, could be an overreach.

Do the Side Hustle

The proposed FINRA rule 3290 has already received more than 70 comments, and while many support the first half of the rule, far fewer are in favor of the second half that could limit outside investments. As a replacement to FINRA rule 3270, the new rule would eliminate the need for advisors to report to their firms that they work side gigs that have no impact on their careers as financial professionals. If an advisor makes a mean rum and Coke, proponents say do your best impression of Tom Cruise in “Cocktail.”

John Bell, who runs Free State Financial Planning, supports the change and said he works one day a week at his local golf course. He gets paid for it, but he mainly does it for the free golf. “Why should FINRA tell me what I can and cannot do when it is unrelated to the financial services industry?” he told Advisor Upside. “My answer: ‘Stay out of my business and mind your own.’” The comment period ends May 13.

Outside Investments. The second half of FINRA’s proposal, which would replace FINRA rule 3280, appears more controversial. Licensed advisors would be required to have written approval from their firms to personally buy and sell assets like crypto, commodities, derivatives, real estate, and more. And that requirement would extend to their spouses, partners, children, and anyone living in their household. FINRA argues that if it focuses its attention less on outside jobs and more on outside investment activity, it will increase investor protection. But many advisors feel it’s a confusing overstep.

“I do not understand how an advisor buying precious metal currency, a second home or life, health, auto and homeowners insurance or opening a checking account at a bank would be a risk to clients,” Daniel Forrester, an advisor with Truist Advisory Services, said in a public comment.

- ETF Inflows Hit $1.1 Trillion — What comes next?

- How Does What’s Happening In The World Affect What’s Happening In Crypto? Find out.

Social Security Backs Off From 100% Clawbacks

Isn’t it nice when people have a change of heart?

The Social Security Administration announced a departure from its plan to withhold the entirety of most benefit payments for recipients who in the past were mistakenly overpaid. Instead of withholding 100% of benefits, the administration reduced that to 50%, a change that came amid concerns about how the more stringent policy would affect retirees. Still, the 50% withholding is a big step from the 10% rate instituted last year under Biden-era Social Security Commissioner Martin O’Malley. It’s an issue that affects people across wealth levels, but it stands to have the biggest financial impact on retirees who are reliant on Social Security as a major source of income.

“The decision to lower the default withholding rate [from 100%]…is a humane step forward in the right direction. But the real fix is in modernizing the system to prevent overpayments before they happen,” said Aaron Cirksena, founder of MDRN Capital. “Something has got to be done.”

Extra Upside

- E*crypto. Morgan Stanley looks to offer crypto trading on E*Trade.

- Death and Taxes. Republic lawmakers want to abolish the estate tax. Rich families’ advisors are saying no.

- Fixed Income Expertise. Investors often rely on bonds for stability, but the right partner can make a difference. Learn more.*

*Partner

Edited by Sean Allocca. Written by Emile Hallez, Griffin Kelly, and Lilly Riddle.

Advisor Upside is a publication of The Daily Upside. For any questions or comments, feel free to contact us at advisor@thedailyupside.com.