Good morning.

Finally, the world’s rich can write off those Aperol Spritz as part of their global tax strategy.

The ultra-high-net-worth are flocking to Italy to take advantage of a bella vita-friendly tax incentive: a flat fee of roughly $233,000 a year that exempts new residents from paying taxes on foreign income and inheritances, according to Bloomberg. Milan has become the epicenter, driving up prices on everything from luxury real estate around Lake Como to premium tickets to see AC Milan at the San Siro. For clients seriously eyeing an escape from the US, it’s not just la dolce vita: The relocation can let them take in the food, the history, and the subtle art of tax avoidance. But better move fast because politicians are voting this week to raise the fee in 2026.

Who knew that buying a palazzo next to George Clooney’s could be a tax benefit?

*Presented by Capital Group. Stock data as of market close on October 22, 2025.

Consider an ultra short bond fund to pursue current income and capital preservation.

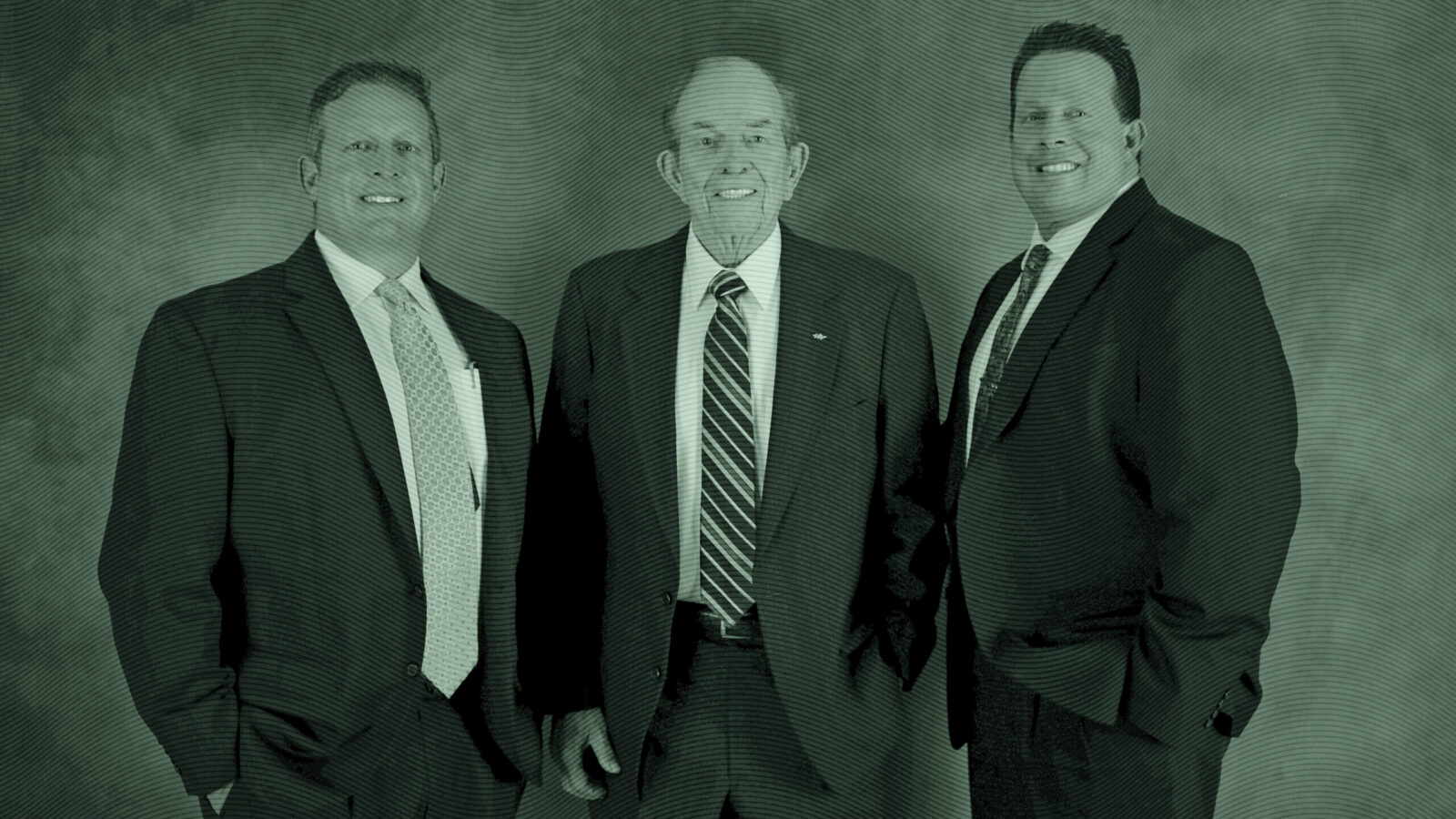

Why This Commonwealth Team Decided to Move to Osaic

They might be the biggest, but are they the best?

LPL’s $2.7 billion acquisition of Commonwealth, which closed this summer, set off a recruiting frenzy. While the majority of advisors are expected to join LPL’s network, some are looking elsewhere. Florida-based Hinck Private Wealth Management is the latest former Commonwealth team to align with Osaic, underscoring how LPL’s vast resources don’t necessarily make it every advisor’s preferred destination. Many Commonwealth advisors cite LPL’s culture, tech platforms and size as reasons to go in a different direction.

“The least amount of change and disruption to our clients was important to us,” said Thomas Hinck, managing partner at Hinck Private Wealth. “We also wanted incredibly good service with quick responses and not ‘take a number, we’ll get back to you.’”

Culture Shock

Commonwealth advisors often point to a great culture as what made the firm special, and fear losing that at LPL. “We were concerned about LPL’s size and their desire to get much bigger,” Hinck told Advisor Upside. “LPL says they’re going to keep the Commonwealth personal touch intact, but for how long?” After meeting with an LPL recruiter, Hinck said: “It felt like they were relying on Commonwealth executives to sell the deal, not LPL.” Plus, Hinck Private Wealth would’ve had to transition to LPL’s in-house clearing platform, instead of sticking with Fidelity’s National Financial Services system.

LPL, the largest independent broker dealer in the US, said it’s committed to preserving Commonwealth’s approach. “Unlike other firms, LPL will provide to Commonwealth advisors an advanced experience that starts with a frictionless, paperless conversion, avoiding disruption to their clients and ensuring the continuity of their businesses,” the company said in an email. “We are focused on the opportunities that matter most to advisors while honoring the community and culture that make Commonwealth such a respected company in our industry.”

New Direction. Since LPL announced the Commonwealth deal this spring, several former Commonwealth firms and advisors have migrated to Osaic:

- Joelle Spear previously advised at a firm in the Commonwealth network, but when she launched her own firm, Spear Wealth Management, in August, she did so with Osaic.

- West Virginia-based Virtus Wealth joined Osaic at the start of September.

While LPL President Rich Steinmeier remains confident the firm will retain 90% of the roughly 2,900 Commonwealth advisors, the growing list of teams choosing Osaic and other firms suggests otherwise. Hinck called that projection “very hopeful thinking.”

M&A Not OK. Hinck Private Wealth is no stranger to mergers. The team started at A.G. Edwards before moving through Wachovia and Wells Fargo. But inefficiencies and Wells Fargo’s infamous cross-selling scandal pushed them to go independent with Commonwealth. “I’m saddened this happened,” Hinck said. “We chose Commonwealth because it reminded us of A.G. Edwards. You mattered to them. You didn’t matter to Wells Fargo. They just cared about loans and lending. You were just a number.”

Ready To Help Your Clients Navigate What’s Next?

Most investors believe alternatives add resilience to portfolios, especially in choppy markets. The challenge — and opportunity — is ensuring these strategies also build confidence and deliver value.

Traditional stock-and-bond allocations are under pressure in the face of trade wars, recession risks, and persistent inflation — factors that State Street Investment Management cites in their ETF Impact Report 2025-2026 as main concerns keeping investors up at night.

Across the industry, your peers are already adapting. Alternative ETF assets nearly tripled to $149 billion last year, and active ETFs pulled in $330 billion* — clear signals that investors (and the advisors they’re working with) are seeking new tools for today’s uncertain environment.

State Street Investment Management’s latest research offers you a lens into the ETF strategies helping advisors like you meet the moment:

- Alternatives that enhance diversification.

- Active fixed-income approaches for evolving rate cycles.

- Buffered approaches to help manage downside risk.

*Morningstar Direct, as of February 28, 2025.

Waiting Until 70 to Claim Social Security? It’s Just Not a Financial Reality for Most

It has become all but a given that most people don’t wait to start claiming Social Security benefits until 70, and new data show that the strategy to max out monthly payments is a luxury.

Simply, most plan to claim younger out of necessity. While 10% of US workers intend to claim before they qualify for maximum monthly payments at age 70, 44% say they will likely file before 67, the “full retirement age,” survey data from Schroders show. Given that Social Security is designed to disproportionately benefit lower-wage workers who rely on the monthly payments to replace more of their preretirement income, that might not seem surprising. But the trend in financial services has been to emphasize the rewards of waiting as long as possible. That isn’t necessarily helping, said Nevin Adams, the former chief content officer at the American Retirement Association. After all, it’s hard to tell people they’re leaving money on the table, when no one knows how big their table, or lifespan, will be, among other factors.

“The retirement industry, which for years has made the mistake of trying to scare people to death, is now trying to shame them to death,” Adams said.

Not Claiming Ignorance

It’s hardly lost on folks that they would get bigger monthly payments by waiting, but financial realities can make that goal difficult, he noted. Data from the Schroders 2025 US Retirement Survey support that:

- 70% said they were aware of the maximum payments from claiming at 70.

- Among those who said they would claim earlier than that, 37% said they simply wanted access to the money. While 36% were worried about the future of the Social Security system, 34% needed the monthly income and 15% were advised to start earlier.

What works for one person may not work for another, and that’s the case with claiming Social Security, which is complicated by income, wealth, physical health, costs of living and myriad other factors. There’s plenty of guidance out there showing the benefits of waiting as long as possible to claim, but there also seems to be growing recognition that such a strategy isn’t optimal for everyone.

“It really is a very individual decision,” Adams said. “I started mine at full retirement age (67) … I don’t have any regrets.”

- Capturing income, cushioning downside. Learn more about the Goldman Sachs Premium Income ETFs.

- Estate planning done right — Lockshin’s systematic approach to deeper client relationships.

How Wealthy Women Are Changing the World of Art Investing

Let us paint you a picture …

A well-diversified portfolio traditionally includes stocks, bonds, maybe a little real estate and perhaps some gold or private equity. But today, a growing share of wealthy investors’ assets are buying up prized artworks. High-net-worth collectors allocated an average of 20% of their wealth to art this year, up from 15% in 2024, according to the latest Art Basel and UBS survey. Ultra-high-net-worth investors with over $50 million in assets allocated 28% of their portfolios to art.

Notably, women — long stereotyped as more risk-averse — are now outspending men, reflecting greater earnings, financial literacy and inheritance, the research found. “A big part of the story is who has the wealth,” said Paul Donovan, chief economist at UBS Global Wealth Management. “We’re seeing a major global demographic shift in the growing wealth of women and the increasing share of female HNWIs.”

Sisterhood of Dada

Wealthy women investors are not only spending more on art than men, but they’re also more willing to fill out their collections with works from lesser-known artists and pieces from less-traditional media. Much of that shift is being fueled by the Great Wealth Transfer, which is first putting tens of trillions of dollars in women’s portfolios. “More wealth and inheritance in women’s hands means broader taste and greater openness to new works,” Donovan told Advisor Upside.

The study, which looked at data from last year and the first half of this year, found:

- Women’s average spending on art and antiques was 46% higher than men in 2024, and about 7% of women spent more than $1 million on art in the first half of 2025.

- Paintings are still king (or queen) in the art world, but compared with men, women are more likely to have photographs, films, digital art and emerging media in their collections.

- High-net-worth women also have larger shares of works by female artists and new talent.

The Young Folks. Millennials and Gen Z are showing similar patterns. The Facebook generation led spending on decorative art and jewelry. Meanwhile, the TikTok crowd prefers handbags and digital art. Gen Z particularly likes sneakers, spending nearly five times higher on shoes than any other age group.

“Collectors are showing greater openness to discovery,” said Donovan. “Keep women and next-gen collectors front of mind: They’re shaping discovery and broadening what gets seen and bought.”

Extra Upside

- New Boss. FPA appoints Dennis Moore as CEO after a stint as interim head.

- Hop, Skip, and a… Jump buys transcription service in first-ever deal for the fintech firm.

- Why Pay More For Bond Income? With the Xtrackers USD High Yield Corporate Bond ETF (HYLB), investors don’t have to. HYLB offers a diversified, credit-focused approach, delivering attractive income potential with a low 0.05% expense ratio. Explore the high-yield advantage.**

** Partner

Edited by Sean Allocca. Written by Emile Hallez, Griffin Kelly, John Manganaro, and Lilly Riddle.

Advisor Upside is a publication of The Daily Upside. For any questions or comments, feel free to contact us at advisor@thedailyupside.com.

Disclaimers

*Before investing, consider the funds’ investment objectives, risks, charges and expenses. To obtain a prospectus or summary prospectus which contains this and other information, call 1-866-787-2257 or visit www.ssga.com. Read it carefully. Investing involves risk. ALPS Distributors, Inc. (fund distributor); State Street Global Advisors Funds Distributors, LLC (marketing agent). 8313238.2.1.AM.RTL SPD004221

**All investments involve risk, including loss of principal. Information on the fund’s investment objectives, risk factors, charges, and expenses can be found in the fund’s prospectus at Xtrackers.com. Read it carefully before investing. For current holdings and more info Xtrackers USD High Yield Corporate Bond ETF | HYLB Distributed by ALPS Distributors, Inc. 107866-1 (10/25) DBX006933 (10/26).