Good morning.

It’s no longer a private matter.

While President Donald Trump has called for expanded access to private markets and alternatives in 401(k)s, two senators are urging regulators to hold on. Bernie Sanders and Elizabeth Warren sent a letter to SEC Chair Paul Atkins and Labor Secretary Lori Chavez-DeRemer this week, asking them to provide a framework that will protect retirement investors from an executive order they say “pushes risky assets” in defined contribution plans. While some view 401(k)s as the perfect accounts for alts, since they typically have long lock-up periods, many in the wealth industry have reservations, arguing that alts are illiquid, opaque and potentially dangerous to the average American working toward what they hope will be a comfortable retirement.

It appears the senator from Vermont doesn’t want Americans to “feel the burn.”

Semiconductor Firms Are Big Winners In The AI Boom

Four tech giants — Alphabet, Amazon, Meta, and Microsoft — plan to spend over $300 billion on AI infrastructure this year.* And most of that is going directly to the companies making the chips that power AI.

VanEck Semiconductor ETF (SMH) tracks the semiconductor bellwethers behind this build out. Along with Nvidia, TSMC, and Broadcom, SMH tracks some of the most liquid US-listed chipmakers.

Get diversified exposure as AI adoption and innovation spread across industries.

This Week’s Highlights

Why This Commonwealth Team Decided to Move to Osaic

They might be the biggest, but are they the best?

LPL’s $2.7 billion acquisition of Commonwealth, which closed this summer, set off a recruiting frenzy. While the majority of advisors are expected to join LPL’s network, some are looking elsewhere. Florida-based Hinck Private Wealth Management is the latest former Commonwealth team to align with Osaic, underscoring how LPL’s vast resources don’t necessarily make it every advisor’s preferred destination. Many Commonwealth advisors cite LPL’s culture, tech platforms and size as reasons to go in a different direction.

“The least amount of change and disruption to our clients was important to us,” said Thomas Hinck, managing partner at Hinck Private Wealth. “We also wanted incredibly good service with quick responses and not ‘take a number, we’ll get back to you.’”

Culture Shock

Commonwealth advisors often point to a great culture as what made the firm special, and fear losing that at LPL. “We were concerned about LPL’s size and their desire to get much bigger,” Hinck told Advisor Upside. “LPL says they’re going to keep the Commonwealth personal touch intact, but for how long?” After meeting with an LPL recruiter, Hinck said: “It felt like they were relying on Commonwealth executives to sell the deal, not LPL.” Plus, Hinck Private Wealth would’ve had to transition to LPL’s in-house clearing platform, instead of sticking with Fidelity’s National Financial Services system.

LPL, the largest independent broker dealer in the US, said it’s committed to preserving Commonwealth’s approach. “Unlike other firms, LPL will provide to Commonwealth advisors an advanced experience that starts with a frictionless, paperless conversion, avoiding disruption to their clients and ensuring the continuity of their businesses,” the company said in an email. “We are focused on the opportunities that matter most to advisors while honoring the community and culture that make Commonwealth such a respected company in our industry.”

New Direction. Since LPL announced the Commonwealth deal this spring, several former Commonwealth firms and advisors have migrated to Osaic:

- Joelle Spear previously advised at a firm in the Commonwealth network, but when she launched her own firm, Spear Wealth Management, in August, she did so with Osaic.

- West Virginia-based Virtus Wealth joined Osaic at the start of September.

While LPL President Rich Steinmeier remains confident the firm will retain 90% of the roughly 2,900 Commonwealth advisors, the growing list of teams choosing Osaic and other firms suggests otherwise. Hinck called that projection “very hopeful thinking.”

M&A Not OK. Hinck Private Wealth is no stranger to mergers. The team started at A.G. Edwards before moving through Wachovia and Wells Fargo. But inefficiencies and Wells Fargo’s infamous cross-selling scandal pushed them to go independent with Commonwealth. “I’m saddened this happened,” Hinck said. “We chose Commonwealth because it reminded us of A.G. Edwards. You mattered to them. You didn’t matter to Wells Fargo. They just cared about loans and lending. You were just a number.”

What’s the Difference Between 351 Exchanges and Exchange Funds?

Advisors are taking advantage of two tax-deferral and diversifying strategies for high-net-worth clients that can sound pretty similar: 351 exchanges and exchange funds. (We mixed them, too.)

The reason for the increase in popularity is that after several years of high equity market returns, clients may have large stock positions and are likely sitting on sizable unrealized capital gains, which may make it difficult to rebalance portfolios without a significant tax bill. Either one of these tax-advantaged strategies can help clients diversify, but they are complex and costly to enact. Keep in mind, advisors will want to consult with tax and legal experts, along with fund issuers, to ensure a smooth transition. But, while both strategies have the word “exchange” in their names, 351 exchanges and exchange funds address different client needs, so knowing the difference matters.

The 411 on 351 Exchanges

A 351 exchange allows advisors to take a client’s already-diversified portfolio and put its holdings into an actively managed exchange-traded fund without immediately triggering capital gains. These funds can accept liquid, long securities, usually equities or fixed income. However, some emerging market securities and most derivatives aren’t eligible, said Brittany Christensen, head of business development at Tidal Financial Group, a white-label ETF provider which has created some of these ETFs. No single security can occupy 25% of what a client contributes, and no more than 50% of the holdings can be in fewer than five securities. That includes both single stocks and any holdings in index funds that are put in the strategy.

These are a relatively new option for financial advisors. Matt Nelson, managing partner and wealth manager at Perspective 6 Wealth Advisors, said he sees them being used to help clients who have sprawling portfolios on which rebalancing would incur a sizable tax hit. The 351 exchanges are also commonly used by advisors who initially relied on direct indexing to tax-loss harvest and need another tax-mitigating strategy, he added.

That’s a Game Exchanger

Exchange funds, on the other hand, may be a better option for clients who own a highly concentrated stock position and need to diversify while deferring taxes. The fund usually tries to match the performance of an index, such as the S&P 500 or the Nasdaq 100. These strategies have been around for a while, but they have become popular lately because of the rise in equity valuations and more people getting stock compensation as part of their jobs. “Exchange funds are not a panacea, but they can provide a means to reduce your risk via diversification,” said William Connor, partner at Sax Wealth Advisors. “It’s not going to eliminate your capital gain.”

A unique aspect of traditional exchange funds is that 20% of the holdings need to be in a real asset, like real estate, said Evan Rothschild, senior wealth advisor at Focus Partners Wealth.

For clients who don’t want to use traditional exchange funds that include real estate, there are synthetic exchange funds that use options, he said.

While both are tax-deferral strategies, there are a few other differences for advisors to consider. Exchange funds are limited to accredited investors, have investment minimums of at least $100,000 and a lock-up of seven years. Aaron Brask, fiduciary investment advisor at Aaron Brask Capital, said the funds are typically limited partnerships and have high fees. Traditionally, a handful of investment banks have created them, although new players, such as Cache Capital Partners, are entering the space. Rothschild said his clients usually invest $1 million as a minimum, although some fund managers may execute the strategy with less. Because of the illiquidity of these funds, Rothschild said he only wants to use an exchange fund for 20% to 25% of a client’s portfolio.

Who’s Down to Launch an ETF?

With 351 exchanges, there are no eligibility exclusions, nor any strict holding periods. However, Jim Besaw, chief investment officer of GenTrust, said the point of these newly created ETFs is to hold the funds and not sell them immediately. There are also no strict minimums on asset size to pursue a 351 exchange, he said. Given the funds’ creation costs, including involving accountants, lawyers and the cost to work with a fund issuer, a client should have several hundred thousand in assets, if not at least $1 million to make it feasible.

Christensen said costs to launch a new ETF will vary. At Tidal, the initial upfront cost is $70,000 to $80,000, which includes startup costs and registration, in addition to legal fees and tax opinion costs. Once the ETF is launched, there is the ongoing expense ratio to manage the fund. “There’s definitely some fixed costs, and those vary pretty wildly depending on what type of solution or service provider you end up going with,” she said.

Because 351 exchanges are relatively new, Christensen cautions advisors to carefully review the ETF investment thesis and prospectus if they’re thinking of using the strategy. These ETFs will become publicly traded, unlike exchange funds, which stay private. “Do you know what’s going to happen to those securities once they’re in the ETF vehicle? Because you’re essentially giving them to a portfolio manager who is now going to manage it in line with what they’ve laid out in the prospectus,” she said. For example, that means a large-cap ETF can only accept large-cap stocks such as Apple or Tesla.

Don’t Lose Control. Aside from the costs, shifting assets to 351 exchanges or exchange funds means giving up a lot of flexibility, and for 351 exchanges, control over the assets. Mitch Hamer, founder and lead advisor at Intersecting Wealth, has looked at 351 exchanges for his clients. Because these are designed to be long-term holdings, advisors need to own the new ETF for the long-term and have faith that the ETF manager will execute the strategy in the same way they always have. He said there are other strategies that can be tax sensitive, such as using options, (which he prefers) or transferring highly appreciated securities to charities in a donor-advised fund. There’s also the possibility of gifting securities to children and grandchildren.

“I like these [351 exchanges] as a diversifier, but then you start to realize there are other tools out there, too,” Hamer said.

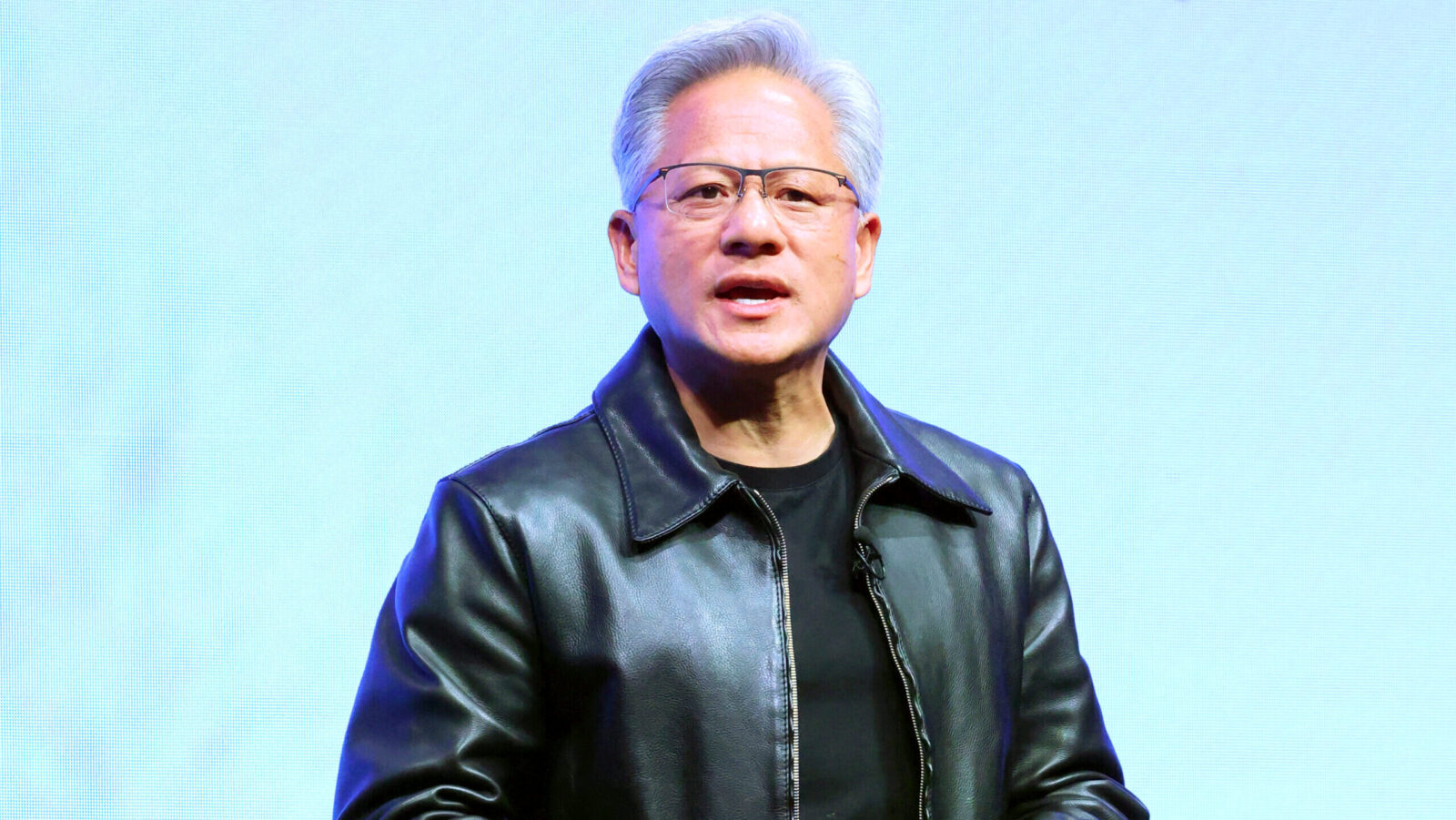

Wall Street GOAT: Nvidia Rides Deal Bonanza to $5 Trillion Market Cap

The $5 trillion market cap club has its founding member. And to no one’s surprise, it’s Nvidia.

The chip-designing king crossed the impressive milestone just days after its GTC conference in Washington, DC, which brought news of a bevy of promising new deals. Most pertinent, however, were hints from the White House early Wednesday morning that Nvidia may regain greater access to the massive Chinese market.

Nice to GTC You

“Trillion” is a very 2025 number. Nvidia’s latest market cap achievement comes just three months after it became the first company in the world to reach a $4 trillion valuation, and after CEO Jensen Huang said during a GTC speech that the company has secured half a trillion dollars worth of AI chip orders through just the next five quarters. It also comes just a day after OpenAI, currently valued at half a trillion dollars, took critical steps toward becoming a for-profit entity, a rising-tide development that propelled Microsoft and Apple into the $4 trillion club on Tuesday. As a reminder, Nvidia was worth only about $400 billion when ChatGPT debuted in late 2022. It reached the $1 trillion mark just months later, the $2 trillion mark in early 2024 and the $3 trillion level in June of that year.

Huang claimed that Nvidia is “probably the first technology company in history to have visibility into half a trillion dollars” in revenue. It’s not exactly surprising, either, especially given recent developments:

- Among the deals revealed at GTC are partnerships with Uber to power a fleet of 100,000 self-driving cars, with both Stellantis and Lucid to help each develop its own autonomous-car platform, and with companies such as Palantir, Eli Lilly and CrowdStrike.

- The half-trillion sales projection means the company is penciling in 2026 revenue above the $258 billion expected by Wall Street, Bernstein analysts told the Financial Times, suggesting that Nvidia might see US-China relations thawing faster than expected. President Trump said Wednesday that he will discuss allowing Nvidia to sell its high-end Blackwell chip with China’s President Xi Jinping at a summit later this week.

What Goes Up: While returning to China in full force would mark a major victory for Nvidia, the company, evidently, is doing fine without unencumbered access. In fact, its greatest headwind may be coming from home. Longtime industry runner-up AMD is forging an increasingly cozy partnership with OpenAI, while veterans like Qualcomm and Broadcom are attempting to crash the AI chip party and Big Tech players are laying the groundwork to develop in-house chips, reducing reliance on third parties like Nvidia. In the near term, however, the AI spending boom doesn’t appear to be slowing down anytime soon, with Meta, Microsoft and Google each saying yesterday that largely AI-driven capital expenditures for the year are likely to be higher than projected. Seems like there’s more than enough money to go around, even with stiffer competition.

Edited by Sean Allocca. Written by Emile Hallez, Griffin Kelly, John Manganaro, and Lilly Riddle.

Advisor Upside is a publication of The Daily Upside. For any questions or comments, feel free to contact us at advisor@thedailyupside.com.

Important Disclosures

*Source: CNBC as of February 2025.

Investing involves substantial risk and high volatility, including possible loss of principal. Visit vaneck.com to read and consider the prospectus, containing the investment objectives, risks, and fees of the funds, carefully before investing. Past performance is no guarantee of future results. VanEck mutual funds and ETFs are distributed by VanEck Securities Corporation, Distributor, a wholly owned subsidiary of VanEck Associates Corporation.

Fund holdings may vary. Visit vaneck.com/smh for a complete list of holdings.