Good morning and happy Monday.

Anyone who read the 2005 classic “Freakonomics” might recall the story of two brothers with contrasting names: Winner and Loser. One fell into a life of crime. And the other — Loser — became an NYPD detective. That story personified research that author Steven Levitt published showing that a child’s name has no bearing on their life’s direction. Later, Levitt pointed to a story about the success of Marijuana Pepsi Jackson (now Vandyck), who earned a PhD in higher education leadership but doesn’t smoke or drink much soda.

Fund companies, take note. Giving your child a hopeful name does not ensure long-term success. Case in point: After four years, Goldman Sachs is closing and liquidating its $17 million Future Consumer Equity and $12 million Future Planet Equity ETFs — “future” just wasn’t to be. And another not-so-small-potatoes firm, Fidelity, disclosed on Friday that its $14 million Enduring Opportunities Fund, launched in 2019, faces the same fate.

What’s in a name, after all?

Active Strategies Are Coming for Model Portfolios

Passive ETFs have been surpassed.

Active ETFs are the No. 1 strategy asset managers plan to add to their model portfolios within the next year and a half, per a recent Morningstar report. Active ETFs also had more than $165 billion in net inflows through May, and they recently outnumbered passive funds for the first time ever, according to Bloomberg Intelligence data, with more than 500 strategies launched last year alone.

The data reflect a broader strategic shift toward actively managed funds, which are rapidly gaining popularity and expected to reach $4 trillion in assets under management by 2030, according to BlackRock. Still, active ETFs make up just 10% of all industry assets, and not all of the newly launched funds will survive, experts said.

“There’s not a lot of silver bullets,” said Gavin Filmore, an executive at Tidal Financial Group, which manages upwards of 80% of its assets in active strategies. “There’s no doubt the ETF industry is super competitive; you have juggernauts eating up a lot of the asset flow. But you do have people that break through.”

America’s Next Top Model

With the differentiation and lower fees that active ETFs offer, it comes as no surprise that most model portfolios launched so far in 2025 feature them over active mutual funds. When it comes to crafting portfolios, both their tax advantages and innovation are reasons to include active ETFs, said Jen Wing, CIO of GeoWealth. “Some things you’re seeing are Bitcoin ETFs, more niche offerings that can compliment the active parts of portfolios, buffered strategies,” Wing said. “You’re seeing this shift in the ETF space where active ETFs are becoming one of the leading vehicles for product innovation.”

Financial professionals are picking up on the active ETF frenzy:

- 44% of model portfolios included at least one active ETF as of March, with the average allocation to active ETFs in those models coming in at 33%, per the Morningstar report.

- The average weight allocated to active ETFs has risen over the past few years from 12% in 2021 to nearly 20% in Q1 2024, according to a recent BlackRock report.

A Little Leverage. Global ETF issuer GraniteShares also recently joined the active ETF fray, submitting a request to the SEC on Wednesday to launch and rename several YieldBoost ETFs, which optimize yield from options strategies linked to investments like Tesla or the Nasdaq. The move reflects the increased uptake of leveraged ETFs — which saw inflows of $10.95 billion in April, surpassing a five-year high.

“This is a way of unlocking yields in high-flying tech names that are not typically known for generating income, like Nvidia,” said Matt Lamb, a GraniteShares portfolio consultant. “So it’s not a surprise to see more and more demand for these types of products.”

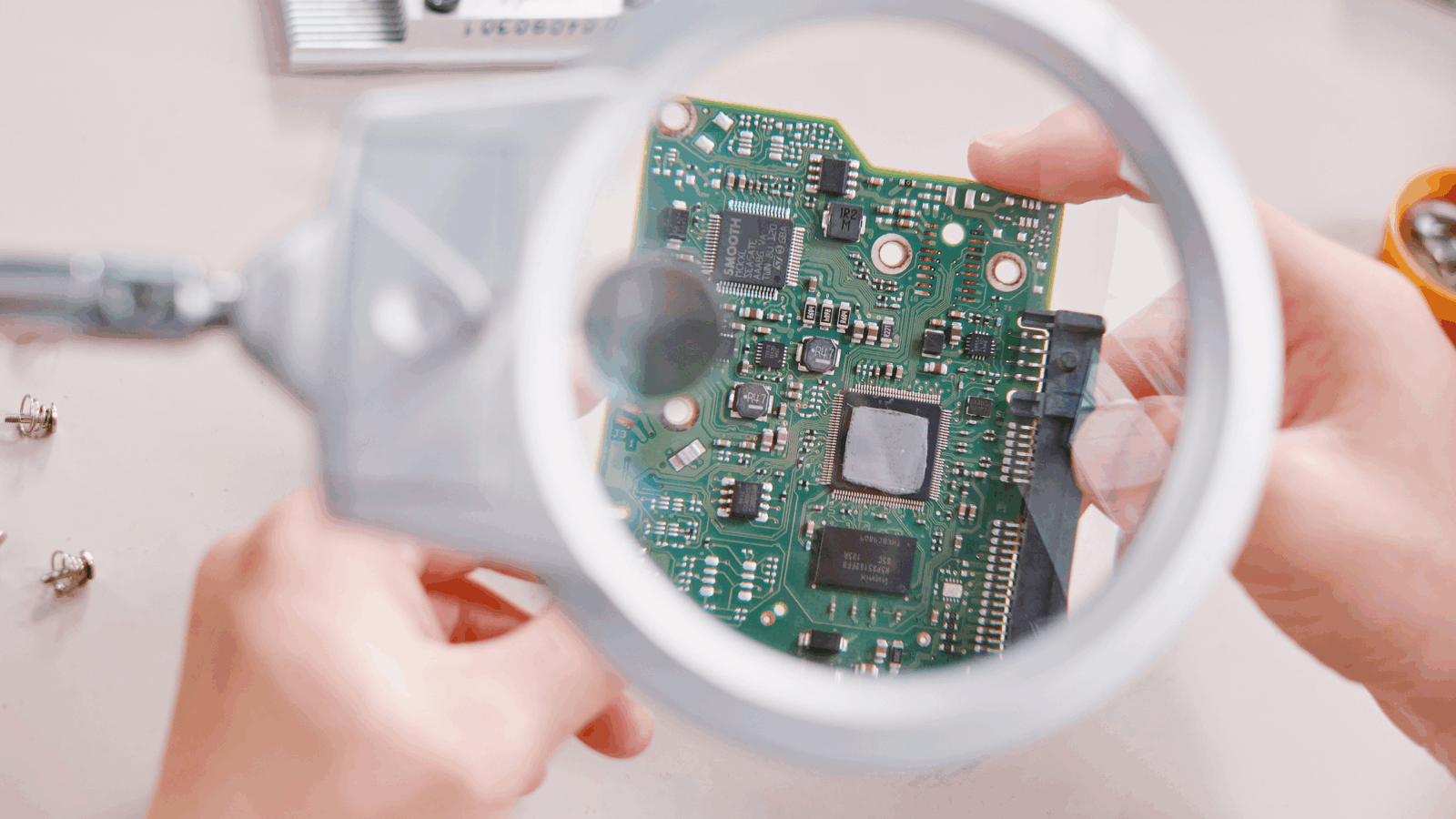

Semiconductors Are Back In Focus

As the US enters a period of fiscal tightening, investors are re-evaluating sectors with long-term tailwinds and newly reset valuations. Semiconductors stand out. Tariff rollbacks have provided a near-term catalyst, while long-term drivers like AI continue to build the case for semis.

The VanEck Semiconductor ETF (SMH) offers exposure to the 25 top US-listed companies involved in semiconductor production and equipment. Top holdings include Nvidia, TSMC and Broadcom. For investors seeking to benefit from the normalized valuations in this space, SMH offers a diversified approach to investing in this industry.

Prefer targeted exposure to chip designers like Nvidia and ARM without manufacturing exposure? Explore the VanEck Fabless Semiconductor ETF (SMHX).*

Vanguard Changes Leadership on 44 Funds, Including World’s Largest

Now you see them, now you don’t.

Vanguard removed numerous co-portfolio managers last week from more than 40 mutual funds and ETFs, following additions it made to many of the same fund teams earlier this year. It’s business as usual for the company to change management on its extensive roster of products, but the scope in this case turned some heads. “It is unusual for them to make so many changes, in such quick succession,” said Jeff DeMaso, editor of The Independent Vanguard Advisor. The changes, which shifted leadership roles, also affected the world’s biggest mutual fund, the $1.8 trillion Vanguard Total Stock Market Index Fund. Some of the other notable funds seeing changes are the $1.4 trillion 500 Index Fund, the $105 billion Dividend Appreciation Index Fund, and the $63 billion Real Estate Index Fund.

It Takes a Village

Vanguard uses teams for portfolio management rather than emphasizing individuals, though some of the funds that lost staff now have one portfolio manager. “Vanguard follows a team-based approach to portfolio management, and together, the team brings decades of experience to the management of our clients’ assets,” a Vanguard spokesperson said. “The portfolio managers who were added to funds in February 2025 bring extensive investment management experience to their roles, ensuring continuity and excellence in portfolio management.”

There are seven products that went from having two portfolio managers to one, DeMaso noted:

- The $2 billion Vanguard Global Minimum Volatility and $178 million US Multifactor funds lost John Ameriks, with Scott Rodemer remaining as portfolio manager.

- The $1 billion US Momentum Factor, $598 million US Value Factor, $386 million US Quality Factor, $349 million US Multifactor, and $278 million US Minimum Volatility ETFs similarly lost Ameriks and are now overseen by Rodemer.

Taste Test: It’s worth pointing out that portfolio managers on index funds aren’t picking stocks and instead are focused on tracking indexes and minimizing taxes, DeMaso said. Still, something he noted about the 81 co-manager positions assigned in February is that a mere four of them ate their own cooking, or were personally invested in the funds they were appointed to, at least as of the end of 2024. “It makes you wonder where they invest their money,” he said at the time.

Will AI Give the Free Markets ETF an Edge?

Michael Gayed got an idea last November, shortly after President Donald Trump was elected — design an ETF around opportunities created by deregulation.

There wasn’t anything like it at the time, and there was a big reason for that, Gayed told ETF Upside. The data analysis necessary to enable such a fund to get ahead of likely regulatory changes would have required an unreasonably large team of managers. Artificial intelligence, however, could help the fund take on tasks that weren’t practical before, such as parsing the smallest bits of public information to identify potential changes to regulations. “There’s no other fund out there that’s focused on deregulation,” he said. “We built out an entire AI that looks at things ranging from executive orders, legislative actions, speeches, and myriad information on the government side.”

Changing Tides

The Free Markets ETF, which launched June 10, represents a collaboration among several companies. The actively managed product is subadvised by Sykon Asset Management, Point Bridge Capital, and Gayed’s firm Tactical Rotation Management. “The combination of those three groups working together is just powerful,” said Michael Venuto, chief investment officer at Tidal, which provides third-party services to the Free Markets ETF. “It’s doing rather well. I’m quite impressed with the organic flows.”

The ETF represents about $12 million in assets and saw more than 400,000 shares traded on its first day, Gayed said. At least some of the interest in the new product is attributable to his own brand — he publishes The Lead-Lag Report and has a large social media following. He asked an audience of small business owners via a poll on X whether tax cuts, tariffs, or deregulation would affect them the most, with the latter winning by a considerable margin, he said. “You can argue that this is Trump’s last real play … Deregulation is the one thing people can agree on.”

Some other details about the Free Markets ETF:

- It charges 76 basis points.

- Its top holdings are First American Government Obligations money markets, Uranium Energy, the iShares Bitcoin Trust ETF, McKesson and Robinhood.

Free as Free Can Be: The tightly regulated utilities sector is less volatile than the broader market, but that may change with deregulation, Gayed said. While such a shift could create opportunities for active managers, the ETF also has significant allocations to gold and bitcoin. “Those are sort of your purest expression of free markets,” he said.

Extra Upside

- Emerging Demand: The Avantis Emerging Markets Equity ETF reached a milestone of $10 billion.

- Direct to Consumer: Nuveen snapped up direct indexing firm Brooklyn Investment Group.

- Breakthroughs Begin With Semiconductors: SMH offers efficient ETF exposure to the semiconductor giants powering AI, with diversified holdings across design, manufacturing and equipment. Explore the VanEck Semiconductor ETF (SMH).*

* Partner

Edited by Sean Allocca. Written by Emile Hallez, Griffin Kelly, and Lilly Riddle.

ETF Upside is a publication of The Daily Upside. For any questions or comments, feel free to contact us at etf@thedailyupside.com.

Disclaimer

*Investing involves substantial risk and high volatility, including possible loss of principal. Visit vaneck.com to read and consider the prospectus, containing the investment objectives, risks, and fees of the funds, carefully before investing. VanEck mutual funds and ETFs are distributed by Van Eck Securities Corporation, Distributor, a wholly owned subsidiary of Van Eck Associates Corporation.

Not intended as a recommendation to buy or sell any names referenced herein. Fund holdings will vary.