Good morning.

Consumers are pulling back this holiday season. That’s bad news for you, too, Fido, Buddy and Rex. Case in point: Pet-supply company Chewy, which reported its third-quarter earnings on Wednesday. While the pet-centric e-commerce firm did beat Wall Street’s revenue expectations ($3.12 billion, up 8% year-over-year), and it did post a profit of nearly $60 million, up from just $3.9 million a year ago, Chewy also offered slightly lower guidance for the fourth quarter.

Still, the company has been a significant beneficiary of an enormous pet-spending boom in recent years. According to the American Pet Products Association, US households are expected to spend a whopping $157 billion on their furry friends this year — up more than 60% since 2019. If another batch of rubber chew toys and treat-dispensing puzzles feels like overkill this year, we’re sure your dog won’t mind a stocking full of your old tennis balls. We hear Gen Z is calling the re-gifting trend “upcycling,” and it’s cool now. Just something to chew on.

*Presented by State Street Investment Management. Stock data as of market close on December 10, 2025.

SpaceX May Launch IPO Market To The Moon

Elon Musk once promised that SpaceX wouldn’t go public until it delivered humans to Mars (lest pesky shareholders prioritize short-term profits over the long-term project of Martian colonization). The Red Planet must be within shouting distance, judging by the financial buzz. No, turns out it’s a lot easier to land on the S&P 500 these days than on Mars, so why wait?

On Wednesday, Bloomberg reported that Musk’s aerospace company is moving ahead with plans to raise $30 billion for an initial public offering at an out-of-this-world valuation of $1.5 trillion, with a countdown clock set for mid- to late 2026. And while it may not be on course for Mars, the SpaceX rocket ship might yet deliver next year’s IPO market to a whole new stratosphere.

Reach For The Stars

SpaceX’s potential monster IPO would come after what has been a remarkable rebound year for public listings. Per another Bloomberg analysis published Wednesday, US IPO volume (not including SPACs and closed-end funds) is set to surpass $40 billion this year once medical supply company MedLine prices its IPO next week, easily besting last year’s total. Dealmakers on Wall Street are already preparing for an even bigger 2026. “The velocity of IPO pitch activity is overwhelming, in a good way, across every industry,” Jim Cooney, Bank of America’s head of Americas equity capital markets, told Bloomberg.

Already likely on deck for next year are names such as defense contractor York Space Systems and insurance firm Ethos Technologies, as well as crypto exchange Kraken and construction rental company EquipmentShare. But those names would be easily eclipsed by SpaceX, officially the world’s most valuable private company once again after a recent secondary share sale that valued the company at $800 billion. And it may be one of a handful of shooting stars to go public next year:

- Joining SpaceX, of course, might be the world’s second-most-valuable private company, OpenAI, which is similarly eying a $1 trillion valuation. (The difference between SpaceX and OpenAI? SpaceX claims to have been cash flow positive for several years now.)

- Other “centicorns,” or private companies valued at $100 billion or more, possibly making public market debuts next year include Anthropic, ByteDance, DataBricks and Stripe; for reference, the median market cap of an S&P 500 company is about $40 billion. Per Bloomberg calculations, Wall Street could soon usher some $2.9 trillion worth of private companies into public markets.

Two Tickets to Paradise: While Musk may not have a ticket to Mars yet, a SpaceX IPO would be a second ticket to becoming the world’s first trillionaire. The first, of course, is Musk’s recently secured and first-of-its-kind 12-figure pay package at Tesla, which requires the company to reach some moonshot sales goals. Take it as a valuable lesson: Shoot for the moon, twice if you can, for even if you miss, you’ll land atop the Bloomberg Billionaires Index.

The S&P 500 Remains a Trusted Portfolio Foundation

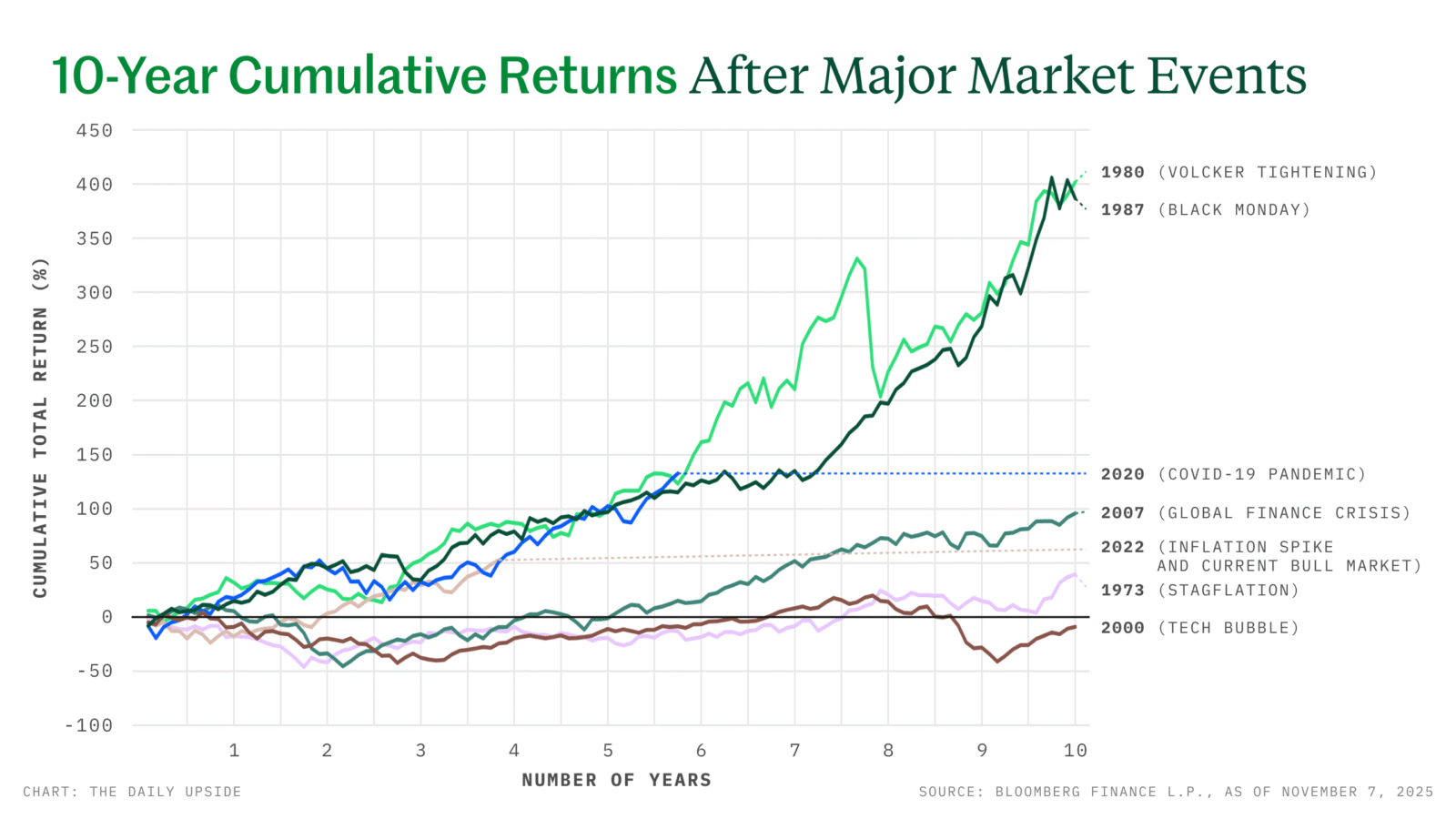

Building wealth starts with a foundation you can trust. That’s why so many investors look to the S&P 500® — diversified exposure to 500 leading US companies.1 And, it has weathered recessions and crises, all while returning an average 10% annually since 1989.2

As the first US-listed ETF and the world’s most traded,3 SPY makes accessing the benchmark simple. SPY has tracked the S&P 500® for 30+ years with unmatched liquidity. One in every four US ETF trading dollars flows through SPY,4 processing $41 billion daily.5

No stock picking. No guesswork. Just diversified exposure to American business in a single trade.

Will Fed’s Latest Rate Cut Be Powell’s Last?

On Wednesday, the Federal Reserve’s Open Market Committee delivered “no alarms and no surprises,” to quote the Radiohead song, as it cut its key overnight borrowing rate in line with Wall Street’s expectations.

After the latest quarter-point reduction to 3.5%-3.75%, however, there’s enough noise around future rate cuts to do the Thom Yorke-led Brit rockers proud.

Rose Colored Glasses

The 9-3 decision, which featured the most dissents since 2019, highlighted a split between FOMC members who think more cuts are needed to shore up the jobs market and those who believe further easing would inflame inflation. “Everyone around the table at the FOMC agrees that inflation is too high and we want it to come down, and agrees that the labor market has softened and that there is further risk,” Chairman Jerome Powell told reporters at a news conference. “Where the difference is, is how do you weight those risks and what does your forecast look like? It’s very unusual to have persistent tension between two parts of the mandate.”

The latest reading of policymakers’ preferred inflation gauge came in well above officials’ 2% target at 2.8%. Powell said the Fed expects that figure to slow to roughly 2.4% by the end of 2026 and unemployment to hold at 4.4%.

The FOMC’s post-meeting statement suggested the bar for future cuts is higher. The Fed’s so-called dot plot, which tracks anonymized forecasts of officials, puts the median view at just one rate cut in 2026. That means Powell, whose term ends in May, could have taken his last whack at the salami. For at least one more day, though, markets celebrated the third consecutive rate cut under his leadership:

- Rate-sensitive investments rallied on Wednesday. The small-cap Russell 2000 index rose 1.3% and the State Street SPDR S&P Homebuilders ETF climbed 3%. UBS analysts have found that, since 1970, stocks are at their best “when the Fed cuts in non-recession periods,” averaging a 15% annualized return.

- Others think the optimism is overblown. “The rose-colored glasses may come off once investors realize that the path to lower interest rates may take longer — or may not materialize at all — to the extent that they believe it will,” said Chris Zaccarelli, Northlight Asset Management’s chief investment officer.

Who’s Next: President Donald Trump said Tuesday that he will interview a “couple different people” to succeed Powell. He is expected to talk with Fed Governor Kevin Warsh and the presumed frontrunner, National Economic Council Director Kevin Hassett, this week. Other potential candidates, the Financial Times reported, include Fed Governors Christopher Waller and Michelle Bowman and BlackRock’s Rick Rieder.

Superfund Your Child’s 529. Contribute five years’ worth in one shot — $95,000 per person, $190,000 per couple — without gift tax penalties. Plus, many states offer tax deductions on contributions. Don’t miss this powerful wealth transfer strategy. Schedule your free Range demo to discuss how to optimize your family’s education funding plan and much more. All-in-one wealth management.

Aussie Ban on Teen Social Media Use Is Trending. Will It Go Viral?

Australian teens under 16 years old were kicked off major social platforms yesterday as governments and parents around the world grow increasingly skeptical that Big Tech will keep kids safe without intervention. The affected platforms include Facebook, Instagram, Kick, Reddit, Snapchat, Threads, TikTok, Twitch, X and YouTube. About 1.5 million, or 95%, of Australian 13- to 15-year-olds have used top social media sites.

Several other countries and US states are considering similar crackdowns, though few go as far as Australia’s.

Logged Out

Social media companies stand to lose billions in ad revenue if teens around the world are kicked off the platforms, not to mention the chance to get in front of potential lifelong scrollers early. A Harvard study found social platforms made $11 billion in revenue from ads targeted to kids and teens in 2022, with Snapchat, TikTok and YouTube garnering the bulk of those billions.

To avoid that fate, Meta expanded restrictions on teens’ Instagram accounts this summer to make the feeds they see PG-13. YouTube added age-estimating tech in July to better curate its platform to kids and teens, while Snap launched its version of driver’s ed, but for social media, in September.

It’s not enough for critics, some of whom are following Australia’s example:

- Malaysia plans to ban teens from social media starting next year. Denmark, Canada and Japan could be next as those countries debate bans of their own. A bill also sought to block teens from using some social sites in the US (called the RESET Act), but US lawmakers seem to have put it on the back burner in favor of other safety proposals that aren’t outright bans.

- Some states are becoming stricter: Florida plans to start booting anyone under 14 off social media and requiring parental approval for 14- and 15-year-olds. Nebraska passed a bill requiring parental approval for minors, too. More than 40 states have sued companies like Meta over concerns about teen social media addiction.

Easier Said Than Done: Companies including Google have warned that age limits are difficult to enforce. Australian teens have already found workarounds, including logging in with VPNs, or, as one teen told The Wall Street Journal, scanning their sibling’s face to fool facial analysis software.

Extra Upside

- It Ain’t Over til the Credits Roll: Warner Bros. Discovery shares rose Wednesday as investors bet that a bidding war between Netflix and hostile bidder Paramount is on the way.

- Unfulfilled Prophecy: Software giant and major AI player Oracle missed Wall Street’s revenue projections when it reported after the bell Wednesday, sending its shares down 11% in after-hours trading.

- Invest In The World’s Largest Economy. The S&P 500® has delivered 10% average annual returns since 19897. SPY, the world’s most traded ETF.8 Consider investing in SPY today.*

* Partner

Just For Fun

Disclaimer

1Although called the S&P 500, the index consists of 503 holdings because some companies have multiple share classes.

2 Bloomberg Finance, L.P, as of July 3, 2025, based on the S&P 500 Total Return Index for the period September 11, 1989 (inception) through June 30, 2025.

3 Bloomberg Finance L.P., as of September 30, 2025.

4 Bloomberg Finance, L.P., as of March 31, 2025.

5 Bloomberg Finance, L.P., as of March 31, 2025. Average daily trading volume calculated based on a 1-month average.

6 Morningstar as of October 31, 2025.

7 Bloomberg Finance, L.P, as of July 3, 2025, based on the S&P 500 Total Return Index for the period September 11, 1989 (inception) through June 30, 2025.

8 Bloomberg Finance L.P., as of September 30, 2025.

*Important Risk Information

State Street Global Advisors (SSGA) is now State Street Investment Management. Please click here for more information.

Before investing, consider the funds’ investment objectives, risks, charges, and expenses. To obtain a prospectus, which contains this and other information, call 1.866.787.2257 or visit www.ssga.com. Read it carefully.

Investing involves risk. ALPS Distributors, Inc. (fund distributor); State Street Global Advisors Funds Distributors, LLC (marketing agent).

Adtrax: 8579679.1.1.AM.RTL SPD004322

Expiration: 12/31/26