Good morning.

The number of Americans who filed new unemployment claims rose to 236,000 last week, up from 192,000 the week before, the Labor Department said Thursday. While that remained within the range that has held steady over the past year, it was more than economists expected, and the 44,000 week-over-week increase was the most since 2021.

The announcement came one day after Federal Reserve Chair Jerome Powell said the central bank believes “there’s an overstatement” of 60,000 in federal jobs data. The roughly 40,000 jobs per month the US economy has added since April, he said, “may actually be negative,” to the tune of 20,000 jobs per month lost. The problem has long been the Labor Department’s so-called birth-death model, the way that it counts jobs at newly opened or newly closed companies. The tally has frequently led to overstatements that later required downward revisions. Then again, as they say, the beauty of being an economist is that it’s the one job that pays you well for being wrong.

Oh no, Ozempic! Eli Lilly’s New Weight-Loss Drug KOs Rival Treatments

How do you swear in Danish? Our AI chatbots are much too polite to help us out here, but we suspect you would have heard them all echoing outside the offices of Novo Nordisk yesterday.

Eli Lilly, its leading rival in the burgeoning weight-loss drug market, announced trial results for an experimental obesity drug that helped patients lose more weight than with any other treatment on the market.

Feeling Dizzy

Indianapolis-headquartered Lilly is now the heavyweight of the weight-loss drug market, with its Mounjaro (for diabetes) and Zepbound (for obesity) knocking Danish rival Novo Nordisk’s formerly dominant Ozempic/Wegovy offering against the ropes. Shares of Lilly are up over 30% in 2025, and last month it became the first pharma firm to reach a $1 trillion valuation. Novo, with its slashed forecasts amid turnaround struggles, has, by contrast, seen its Copenhagen-listed shares fall 48.7%, wiping out nearly all its gains since Wegovy won FDA approval for weight-loss treatment in 2021.

Lilly’s new coup is retatrutide. The injectable treatment, which the marketing department will surely christen with a name that sounds less like a forgettable Weezer album, targets three hormones that help regulate a patient’s appetite and metabolism. There’s the well-known GLP-1, which is affected by Novo’s Wegovy and Lilly’s Zepbound, and there’s GIP, which is affected by Zepbound. Retatrutide adds glucagon to the list. A 68-week clinical trial of 445 people with obesity and knee arthritis found those taking a weekly 12-milligram dose of retatrutide lost an average of 71.2 pounds, or 28.7% of their body weight. This is a big deal: Zepbound averages 21% weight loss and Wegovy, 15%. Analysts at BMO, in their bull case scenario, said retatrutide might achieve an average 25% weight loss. The trial also saw reports of major reduction in arthritis-related knee pain. Full results in a peer-reviewed journal are forthcoming but, in the meantime, there is one rather nauseating caveat:

- Retatrutide’s tolerability data, which records how patients handle treatment, showed about 18% of patients on the 12-milligram weekly dose ceased treatment due to side effects like nausea (which 43% of patients reported). JPMorgan analysts noted this is “somewhat worse vs. Zepbound, though not surprising.”

- Lilly said patients’ dropouts were “highly correlated” to their starting body mass and were the result of “perceived excessive weight loss.” The company said dropouts among those with a BMI of 35 or more were 12%, closer to Zepbound and Wegovy’s rates, suggesting it could position the drug for patients with a higher starting BMI.

No Letting Up: Lilly is not letting up. Earlier this week, the company said it will drop $6 billion on a new manufacturing facility in Huntsville, Alabama, to produce its experimental obesity pill, orforglipron, and other next-generation obesity and metabolic disease treatments. That follows a February commitment of at least $27 billion in new spending for four new US plants.

Will 2026 Mark the Return of Multifamily Investing?

After two years of high rates and price volatility, apartment-building investment may be on the brink of a rebound. So where should investors focus in 2026 — and why?

Join Origin Investments Co-CEO David Scherer and CBRE’s Spencer Levy at 1 pm CT on December 18 for a data-driven outlook on what’s in store for “multifamily” investing. They’ll break down the signals worth watching, point to cities on the rise, and share why 2026 could be a great year to commit capital.

Spencer Levy advises global investors, chairs the Real Estate Roundtable’s Research Committee and hosts the most downloaded podcast in commercial real estate. The one-hour session includes a live Q&A for questions submitted when registering.

Disney Licenses Play Dates for Mickey Mouse, ChatGPT in $1B OpenAI Deal

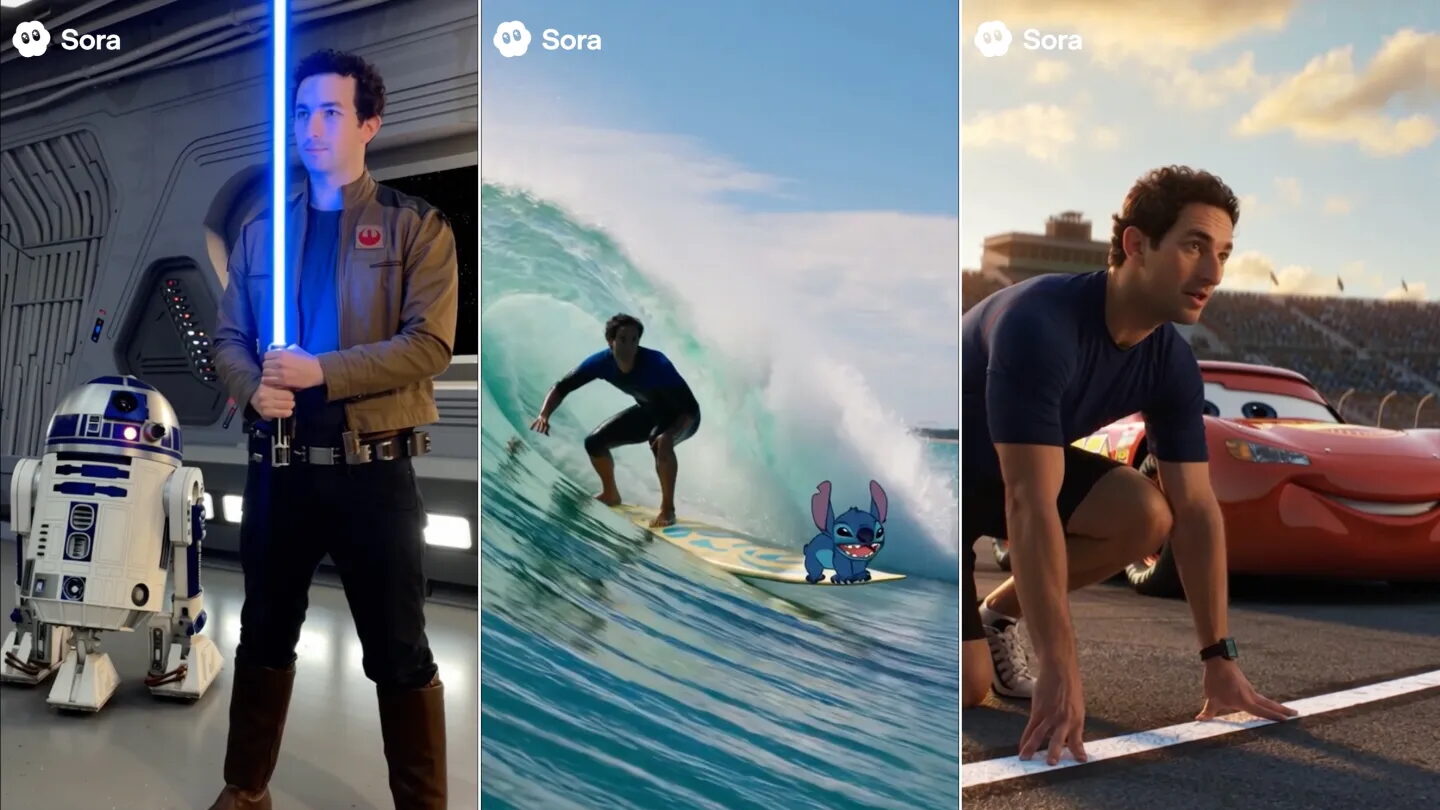

Sora users can legally make fan edits of themselves swimming next to Ariel, Disney’s mermaid celebrity, under a $1 billion deal that the entertainment giant announced yesterday with OpenAI.

Video-generator Sora and ChatGPT got Disney CEO Bob Iger’s go-ahead to use more than 200 copyrighted characters across the universes of Disney, Marvel, Pixar and Star Wars. But any Ariel edits will be with the princess after she gave her voice to Ursula because the deal doesn’t include talent voices.

Some user-generated Sora videos will make their way onto Disney+, and ChatGPT (which got an update yesterday) will become available to Disney employees. The tie-up could become a template for Hollywood, which in the past has pushed back against AI getting its hands on its precious IP.

Joining the Dark Side

Disney has defined modern copyright law, lobbying Congress for decades to expand protections for its characters. The company’s known for suing anyone who violates those copyrights, including creators as small as an Etsy vendor that sold 200 Baby Yoda plushies.

So it was no surprise that the House of Mouse also cracked down on AI companies, which built their models by scraping the internet without any concern for copyrights. Disney and Universal jointly sued image-generator Midjourney this summer (Warner Bros. Discovery later hopped in, too), and Disney sent a cease and desist letter to AI chatbot Character.AI in September.

When OpenAI launched Sora this fall, and its users created celebrity deepfakes that flooded the web, Hollywood reacted:

- Major talent agencies were quick to criticize the video platform. WME told OpenAI the company couldn’t use any of its clients, while CAA said it was a “significant risk,” and UTA called the tech “exploitation, not innovation.” The Motion Picture Association, meanwhile, said OpenAI needed to take immediate action to address copyright violations.

- The union SAG-AFTRA and actor Bryan Cranston somewhat embraced the tech (like a side hug), coordinating with OpenAI to put up guardrails around how Sora could use actors’ names and likenesses. CAA and UTA praised the results of the team-up in October, suggesting a path forward for Hollywood’s relationship with the AI giant.

Playing Favorites: OpenAI seems to have landed the leading role in Hollywood’s AI story. Disney on Wednesday sent a cease and desist letter to Google, CNBC reported, in which Disney alleged the tech giant violated its copyrights to train AI models. Still, Disney has always been quick to monetize trending tech, like when it invested $1.5 billion into Epic Games in a deal that brought Disney characters into the video game “Fortnite.”

AI Is Transforming Finance — Fast. Join The Daily Upside with BILL experts Julien Denaes and Noel English to learn real-world strategies that cut manual work, boost accuracy and free your team for deeper insights. Get actionable takeaways to outpace competitors and master modern finance. Watch on demand now.

Coca-Cola Tabs its Next CEO

There may only be one New Coke if we’re lucky. There is, however, a new Coca-Cola CEO, and that’s OK.

Starting March 31, current Coke COO Henrique Braun will take over the sodapop giant as CEO, the company said this week. His mission? Navigating a murky new era that threatens more hard times for soft drinks.

Sprite Makes Right

The good news for Braun? He’s taking over a Coke with a decided advantage in the Soda Wars. The company’s namesake soda remains America’s No. 1 soft drink, according to a market share report from trade publication Beverage Digest earlier this year, while Sprite has edged out Pepsi as America’s third-favorite soft drink (No. 2? Dr. Pepper). Meanwhile, the company’s global footprint allowed it to navigate this year’s trade war more easily than rivals.

The bad news for Braun? The intra-soda wars are nothing compared to a larger War On Soda being waged by health- and cost-conscious consumers. The company has been fortifying defenses on both fronts:

- While consumers continue to shift to lower-sugar beverage options, Braun’s predecessor, James Quincey, spent his nine-year stint acquiring major non-soda brands such as sparkling water drink Topo Chico, protein milk brand Fairlife and sports drink Body Armor.

- Amid rising economic anxiety this year, Coca-Cola has also rolled out a line of smaller, cheaper versions of its products to cater to cost-conscious and lower-income consumers.

The company’s subtle transformation is starting to reveal itself: While global soda sales have been flat so far this year, Coca-Cola reported on its latest earnings call that its water, coffee, tea, and sports drink unit has achieved 3% growth.

Don’t Need Fixing: Like Braun, current CEO Quincey rose to the top job after long serving as Coke’s COO. And like Braun, Quincey entered the job at a time of softening sales and slowing momentum, ultimately securing the company’s industry-leading position while diversifying into growing markets. Those are footsteps in which Braun seems eager to follow, writing in a statement: “I will focus on continuing the momentum we’ve built with our system.” Forty years after the New Coke fiasco, everyone seems to have remembered the important lesson: Why fix what isn’t broken?

Extra Upside

- Cover Jinx: Time announced the “architects of AI” as the magazine’s annual Person of the Year on Thursday as the fallout from Oracle’s quarterly earnings miss a day earlier dragged down AI stocks including Nvidia and Coreweave.

- Can You Dig It: Provo-based Ionic Mineral Technologies says it discovered 16 minerals including lithium and germanium at a Utah site that could prove the United States’ most significant reserve of critical minerals.

- Are You Interested In Gold? CME Group’s suite of gold futures provides a capital-efficient way to trade almost 24 hours a day (with short maintenance breaks). Try different contract sizes to find alignment with your portfolio and strategy. Find your ideal fit today.*

* Partner