Good morning.

Yahoo, a defining firm of Web 1.0, is looking to make a mark on Web 3.0. The company said Thursday that it’s adding new artificial intelligence features to its email service, including a “Catch Up” mobile feature that turns the act of clearing out an inbox into a game.

The company explains: “AI-powered summaries provide scannable email previews, giving users the option to ‘delete’ or ‘keep in inbox’ with a simple tap. The final reward? A celebratory screen for users to see how many emails they deleted, and how fast they did it.” We’re sure there’s more, but we overzealously swiped away the email with all the details.

Just How Much Data Does the Fed Need to Cut Rates?

Jerome Powell sees what we see and he hears the huffing and puffing (hard not to), but he’s not budging as far as anyone can tell.

Despite a slew of new data published Thursday and earlier this week showing inflation has cooled, Powell and the Federal Reserve are still almost universally expected to hold off on cutting interest rates when the monetary policy committee convenes again next week — opting instead to wait until their next meeting in September. As per usual, the central bankers are preaching that patience is a virtue.

Summer Hours

A Thursday report from the Bureau of Labor Statistics showed that the Producer Price Index, a closely watched inflation gauge that measures the prices paid to producers, rose just 0.1% in May. The lower-than-expected reading (economists mostly predicted a 0.2% increase) comes just after a Consumer Price Index report on Wednesday that showed consumer prices increased 0.1% month-over-month in May and 2.4% year-over-year — also lower than expectations.

Still, more inflation may be on the way. While the White House’s tariff regime has yet to spur another inflationary cycle, as many had feared or expected, don’t pop the champagne just yet. To see the impact of tariffs show up in inflation data, well, you may have to be a little more patient:

- The frontloading of inventory earlier this year, ahead of the tariffs, coupled with consumer belt-tightening likely means that price increases have been slow to reveal themselves in the real economy.

- “We believe the limited impact from tariffs in May is a reflection of pre-tariff stockpiling, as well as a lagged pass-through of tariffs into import prices,” Nomura senior economist Aichi Amemiya wrote in a note seen by CNBC. “We maintain our view that the impact of tariffs will likely materialize in the coming months.”

Hit the Gas: Traders don’t seem to be waiting for the data to show up. Treasury yields across maturities sank to their lowest levels in a week on Thursday as traders of interest-rate derivatives once again started pricing in two rate cuts this year, with the first expected in September. Bettors on prediction market Kalshi similarly view two cuts as the most likely outcome this year, with the odds set at 29% as of Thursday. “The inflation data have been very, very good for the last four months,” Tony Farren, rates sales and trading managing director at Mischler Financial Group, told Bloomberg. “How many months of tame inflation data can the Fed ignore?”

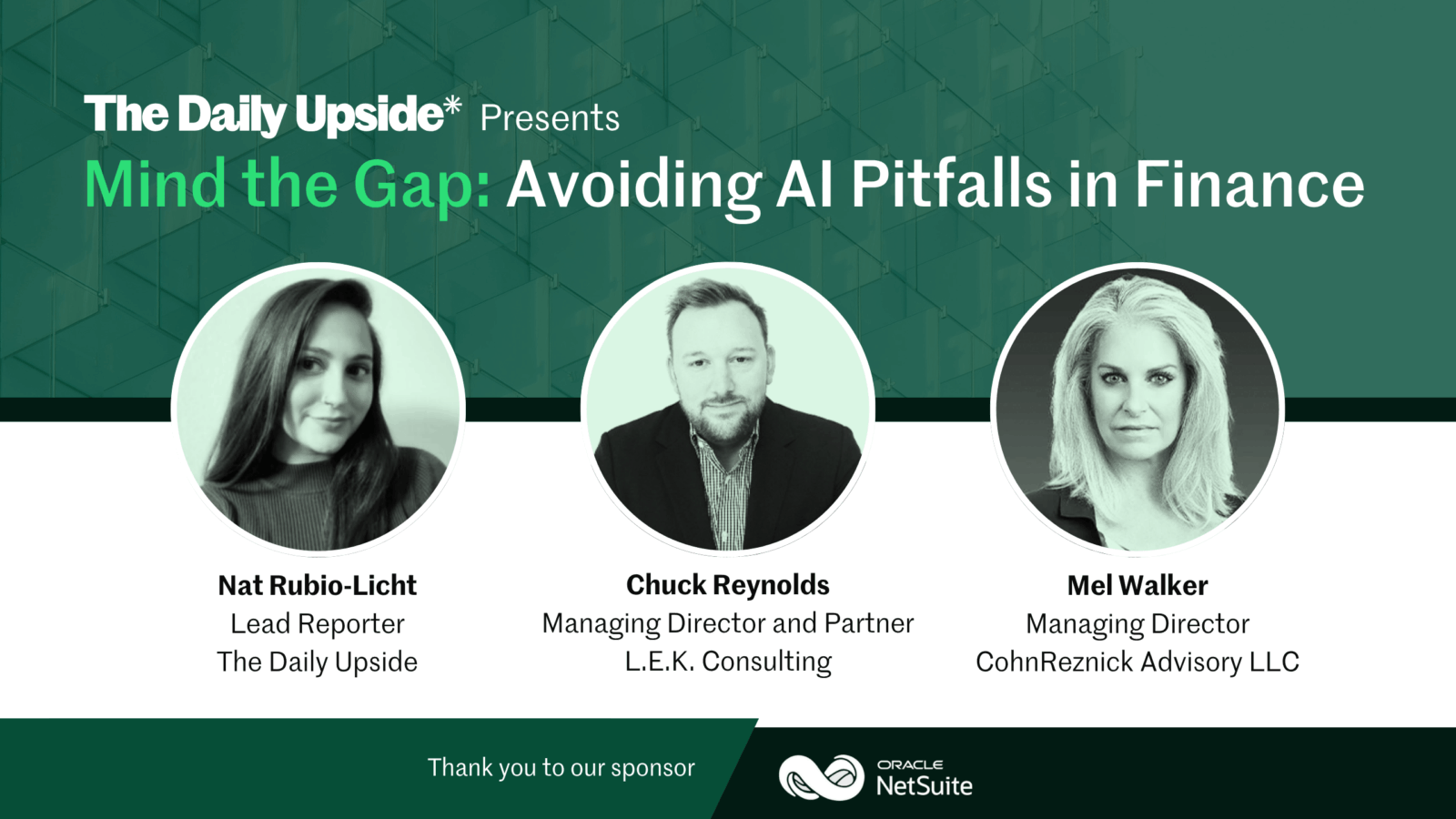

Avoiding AI Pitfalls: What Finance Leaders Need to Know

AI adoption has accelerated across business functions, but for finance teams, the stakes have remained uniquely high. Move too fast, and you risk compliance issues and costly inaccuracies. Move too slow, and you fall behind.

That’s why The Daily Upside hosted a can’t-miss webinar featuring our lead tech reporter, Nat Rubio-Licht, alongside experts from L.E.K. Consulting and CohnReznick. Together, they unpacked how finance leaders can drive performance with AI, without compromising oversight or risk management.

Europe Delays Stricter Banking Rules to Keep ‘Level Playing Field’ With US Rivals

The European Union’s executive arm is holding off on implementing new banking rules that could be tantamount to putting a potato sack around the legs of the region’s lenders in the middle of a 100-yard dash against their US counterparts.

The European Commission announced Thursday that the so-called Fundamental Review of the Trading Book, a boring technocratic name if there ever was one, will be delayed one year until 2027. It would place stricter rules on the region’s investment-bank trading desks at a time when the US seems increasingly less inclined to impose similar regulations of its own.

Waiting on a Party of One (Country)

The new rules are part of the Basel III international banking reforms that were introduced in 2017 and designed in response to the 2008 financial crisis. Basel III is meant to create global standards for the way banks measure risk and enhance their ability to withstand shocks (a.k.a. prevent another systemic implosion worthy of an Oscar-winning Matt Damon-narrated documentary). Specifically, the Fundamental Review of the Trading Book will tighten how banks measure and hold reserves against their capital markets activities, zeroing in on investment banking.

Investment banking, of course, is on an earnings tear on both sides of the Atlantic, with trading desks cashing in on volatile equities even as US tariff policy has curbed M&A activity. JPMorgan Chase and Morgan Stanley reported record revenue from their equity traders in the first quarter, while investment banking fees rose 12% at JPMorgan and 8% at Morgan Stanley. Deutsche Bank, Germany’s largest lender, reported its highest quarterly pre-tax profit in 14 years in the first quarter, with its trading unit netting record revenues. Income at France’s largest bank, BNP Paribas, slipped in its latest quarter, but the equities desk was a bright spot with a record result. Were the EU to implement the new rules now, however, the region’s investment banks could look across the Atlantic and see a US administration less inclined to follow suit:

- Last year, the Federal Reserve softened its proposed Basel III rules after intense lobbying from the banking industry. That was even before the second Trump administration, which promised a deregulation-focused agenda, came into power. Last month, the Financial Times reported that US officials plan to roll back bank capital requirements in the next few months.

- In January, as Trump entered office, the UK put its own new capital rules on hold until 2027, with the Bank of England stating that it wanted to see what the US does first, in the interest of its own “competitiveness and growth considerations.” The European Commission made a similar case Thursday, noting that “concerns regarding the international level playing field and the impact on EU banks remain high.”

Waiting Game: Banks are still waiting for a potential recovery in dealmaking, which would further boost investment fees, but that will require clarity from the Trump administration on trade policy. On May 29, Goldman Sachs President John Waldron told a conference that he saw a “quite good” outlook for investment banking, adding that the “pipeline is strong all over the world.” He did, however, flag volatility as an obstacle to deals. Earlier this week, Bank of America CEO Brian Brian Moynihan said at a conference that his bank expects investment banking fees to fall to $1.2 billion in the second quarter from $1.6 billion a year earlier. He said that’s “not where we want to be” but also flagged that there are “great prospects.”

Gecko’s AI Robots Represent the ‘Boring’ Future of Bots

A yinzer unicorn is born: Pittsburgh startup Gecko Robotics announced yesterday it raised $125 million, pushing its valuation over the billion-dollar mark. The AI infrastructure company is now worth $1.25 billion.

Gecko’s AI-powered robots climb, crawl, fly, and swim around power plants, oil rigs, and other large-scale operations to scan equipment and check for issues (call them inspector gadgets). One big selling point of machines like Gecko’s is that they can perform tasks that are hazardous for humans.

A World of Wall-Es

Companies like Tesla and Boston Dynamics have shown off humanoid robots that do backflips, tend bar and dance. But the future of robotics may be less bipedal.

Specialized bots built to perform industrial tasks are winning the most capital investment. More than 70% of the $2.3 billion raised by robotics companies in the first quarter of 2025 was directed toward task-centric tech, such as Gecko’s. Pitchbook found that humanoid robots consistently carve out a much smaller slice of venture investment.

Training robots to be jacks of all trades is more complicated and expensive than creating a master of one. Humanoid robots cost between $50,000 and $200,000 to make, while task-focused machines ring in at $5,000 to $100,000 each, Reuters reported.

Not to mention that “human”-shaped isn’t optimal for all tasks. Here’s a handful of examples:

- Ati Motors raised $20 million in January to keep building boxy, wheeled bots that lug heavy loads around factory floors. And straight from the Wall-E universe, ViaBot’s Roomba-like robots collect trash in parking lots.

- A four-legged bot built by Boston Dynamics (its name is Spot) is used to perform inspections at hazardous sites — recently, it trotted through a power facility that humans can only safely enter during its annual scheduled downtime.

Boring’s the Beginning: Humanoid robots could one day perform a variety of complicated tasks and carve out their own niche not met by single-minded machines. But for now, they haven’t hit that technological bar. “If somebody claims that they are commercially finding a general-purpose robot, they are over-promising and they will under-deliver,” Boston Dynamics strategy chief Marc Theermann told Reuters. In the meantime, robots built for straightforward tasks are powered up and punching in for work.

Extra Upside

- Chiming In: Shares in fintech Chime soared 37% in the company’s Nasdaq debut Thursday, a potentially good bellwether for future fintech IPOs.

- Energy Watch: Oil prices have risen close to 9% so far Friday after Israel launched strikes on Iran, leading to concerns about the region’s energy supplies.

- Keep June 24 Circled. That’s the final day BOXABL’s accepting investors in preparation for their next home-manufacturing phase. 50,000+ people have bought shares already. Join for $0.80/share while you can.*

* Partner

Just For Fun

Disclaimer

*This is a paid advertisement for Boxabl’s Regulation A offering. Please read the offering circular at https://www.boxabl.com/invest#circular