Good morning.

Krispy Kreme found a donut hole in its plans to supply McDonald’s with donuts to sell as part of its breakfast menu at 14,000 US locations: it’s too costly. Last year, the two companies announced the partnership, which formally kicked off six months ago.

But, on Tuesday, they said the deal would wind down in July after Krispy Kreme donuts made it into just 2,400 McDonald’s. While the Golden Arches diplomatically said the collaboration “met our expectations,” Krispy Kreme soon found it didn’t have a business case. “Ultimately, efforts to bring our costs in line with unit demand were unsuccessful, making the partnership unsustainable for us,” Krispy Kreme CEO Josh Charlesworth said, not glazing over the hard truth.

*Stock data as of market close on June 24, 2025.

Jerome Powell is Finally Getting Specific

One way to coax some timeline specificity out of Jerome “wait-and-see” Powell? Put him on the witness stand.

On Tuesday, that’s where the Fed’s top central banker spent a good chunk of his day, testifying before the House Financial Services Committee, where he clarified exactly what data he is waiting to see before moving to cut federal interest rates (today he’ll face another round of questioning from the Senate Banking Committee). The Capitol Hill field trip comes as consensus in the Fed’s ranks is starting to dissipate.

Mr. Powell Goes to Washington

Simply put, Powell says he needs to see just how impactful and inflationary tariffs are — which he says will be clearer after the release of June and July price data. Why the lag? While tariffs arrived in full force starting in April, their widely expected inflationary effect still isn’t quite reflected in consumer prices thanks to a massive amount of stock front-loading and a reluctance to raise prices for already wary consumers. For instance, Toyota had avoided price hikes on US cars up until last week, when it told Bloomberg that its automobiles would cost (a little bit) more starting in July. Consumers, meanwhile, are growing more weary: Tuesday also delivered a fresh batch of consumer confidence data courtesy of the Conference Board, which showed increased pessimism in June driven by a tough-to-crack job market. Which of course puts Powell in a corner: a turgid economy and soft job market would normally call for rate cuts, if not for signs that more inflation is the way.

Still, the central banker is leaving the door open to the possibility that tariffs won’t be as impactful as widely expected, saying Tuesday, “We’re perfectly open to the idea that the pass through [effect of tariffs] will be less than we think. And if so, that’ll matter for our policy.” That may be as much a message to inquisitive lawmakers as it is to his own underlings, some of whom are growing impatient with Powell’s approach:

- After the Fed maintained its current level of interest rates for the fourth consecutive time at its meeting earlier this month, Fed Vice Chair for Supervision Michelle Bowman on Monday said she’d support a rate cut as soon as July: “All considered, ongoing progress on trade and tariff negotiations has led to an economic environment that is now demonstrably less risky… it is time to consider adjusting the policy rate.”

- That makes Bowman the second Fed official to break ranks, after Fed Governor Christopher Waller told CNBC on Friday he sees only a small risk of tariff inflation, and that the Fed could cut rates by July.

Wake Me Up When September Comes: Bowman and Waller’s remarks are just the latest sign of dissension in the Fed’s ranks. Minutes from the central bank’s June meeting last week revealed that among the 19 policymakers, 10 are projecting two rate cuts this year, two are projecting one rate cut, and seven are projecting no more cuts at all (an increase from just four members seeing no rate relief during their March meeting). Bettors on prediction market Kalshi view two rate cuts as the most likely option (though still at just 30% odds), while CME Group’s FedWatch tool shows investors are widely expecting a quarter-rate cut in both the Fed’s September and October meetings, with a nearly 40% chance of another quarter rate cut in December. Powell, as per usual, remained opaque, telling lawmakers Tuesday that “Many paths are possible here.”

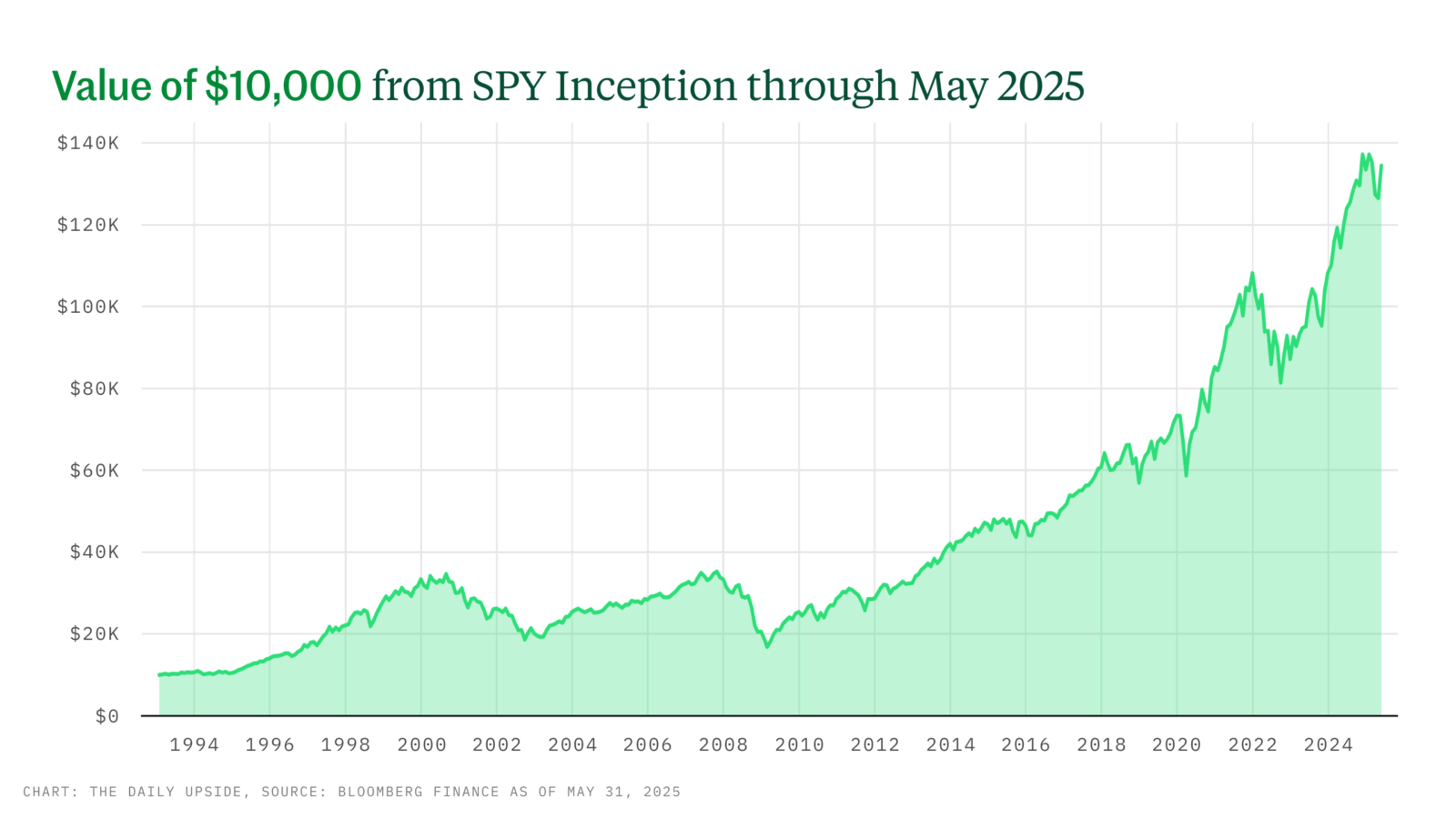

In 2024, The Average Company In The S&P 500® Vastly Underperformed

In fact, only 29% of the companies in the S&P 500 beat the S&P 500 itself, with the average stock returning 14.8% versus 24.9% for the broader market.1

From another angle, the top 10 stocks drove 60% of the market’s return last year.1 This striking stat serves as an important reminder: missing out on top performers can drag down returns, and identifying them ahead of time is notoriously difficult.

What’s the solution?

Gain access to the entire index, which State Street Global Advisors’ SPDR® S&P 500® ETF Trust (SPY) has allowed investors to do since 1993, when they sparked the ETF industry.

With SPY, instead of spending $160,000 to buy each S&P 500 stock individually, investors can gain that same broad exposure for just $555.2

You’ll get exposure to the Magnificent Seven, and whatever the next Magnificent Seven might be.

Carnival Cruises Past Market Expectations in Boon for Shares

The world’s largest cruise company sailed well beyond Wall Street’s expectations in its latest quarter.

Carnival raised its full year profit guidance on Tuesday as bookings appeared to show travellers are unwilling to let tariffs get between them and Tampa and they won’t allow geopolitics to close off their seaway to Greece.

A Rising Tide Lifts All Stocks

The choppy waters predicted for the cruise industry this year were based on the very real risks of trade wars and real wars, and all the economic disruption that one or both of those things would cause to travel demand. In late April, those worries seemed justified when Carnival competitor Norwegian Cruise Line missed Wall Street’s profit and revenue estimates when it reported its first quarter results and warned of cracks in the consumer spending hull.

Cue Carnival’s results on Tuesday, which had investors smiling ear-to-eye like the sunkissed revelers on the deck of the 1,132-foot Jubilee as it pulls up to Cozumel. The company’s second quarter revenue of $6.3 billion was up 9% year-over-year, and net income of $565 million, up from $92 million in the same period last year, was $185 million better than the guidance it issued in March. Customer deposits were at a record $8.5 billion in the quarter, 2026 prices are at record highs and bookings are level with last year’s record pace. In a call with analysts, CEO Josh Weinstein offered some background on the good news:

- April showers, in this case, brought a flowering of May bookings. Weinstein said travelers were hesitant to book in April after President Donald Trump announced a round of planned global tariffs, but demand returned in the weeks that followed, suggesting consumers are inclined to leave staycations back in the pandemic years.

- Carnival shares rose 6.9% on Tuesday, and the industry leader’s good news helped propel peers Norwegian up 4.3%, Royal Caribbean up 2.5%, and Viking up 3.4%. In the last year, Carnival shares have risen 56% thanks to strong consumer demand, and continued resilience coupled with a deescalation in the Middle East, which threatened to drive up fuel prices, buttressed its appeal on Wall Street.

Wait and See: Weinstein said the Middle East conflict hasn’t impacted Carnival, but told analysts not to read too much into that yet: “While it has not yet had any discernible impact on our business, this is all unfolding too quickly in real time to try to project how it could impact our future business.” What could dent cruise industry revenues could be a new, much less heated geopolitical trend: port taxes. In recent months Alaska, Hawaii, Norway, and Mexico have all introduced levies on cruise ships or passengers, with cruise ship industry lobbies filing lawsuits in multiple jurisdictions in attempts to block them.

Wall Street: This AI Stock Is A ‘Strong Buy.’ With 44 patents and a summer 2025 FDA submission, the company making heart disease easier to detect with AI is due for a breakout year. Invest in HeartSciences current unit offering for 500% potential upside in 1 year based on analyst projections.**

AstraZeneca and Daiichi Sankyo Treatment Wins First of Its Kind FDA Blessing to Treat Lung Cancer

AstraZeneca paid Japan’s Daiichi Sankyo a whopping $1 billion upfront back in 2020, and tacked on a potential $5 billion in milestone payments, for the chance to co-develop the antibody-drug conjugate DS-1062 outside of Japan.

On Tuesday, the treatment, marketed as Datroway, was given the greenlight by the US Food and Drug Administration to treat a specific lung cancer, making it the first therapy of its kind to be approved for treating the disease.

Incremental Payoffs

Antibody-drug conjugates have been likened to precision-guided missiles by many in the medical and scientific community. That’s because they can be designed to target cancer cells and mostly spare healthy cells, something not afforded by conventional chemotherapy treatments that target all rapidly dividing cells, not just cancer cells (hence outcomes like hair loss).

Datroway was already approved for treating a form of breast cancer earlier this year, and AstraZeneca CEO Dave Fredrickson noted the approval “provides a much-needed option to patients with advanced EGFR-mutated lung cancer whose disease has become resistant to past treatments, regardless of the driving mutation.” The approval was, for a time, seen as something of a toss-up because of the results of one study, but AstraZeneca revised its filing to narrow its approval for only patients with EGFR-mutated lung cancer. For now, the approval breakthrough represents a small financial opportunity, but it opens the door to further payoffs:

- JPMorgan analysts said Tuesday that the lung cancer approval for Datroway will “de-risk what we see as a $0.5 billion peak in-market sales opportunity.” The drug’s previous approval for breast cancer treatment, they said, had done the same for a “$0.4 billion peak in-market sales potential.”

- Datroway’s next big test will be Phase III data from a study in triple-negative breast cancer that the company expects to have this quarter. JPMorgan views that as a $1 billion opportunity for sales. Later in 2025, there will be data on the treatment’s use for newly diagnosed lung cancer patients, which could open up considerably more opportunities.

Extending the Cliff: AstraZeneca missed first-quarter revenue expectations when it reported in April, while a stronger-than-expected profit was not enough to offset concerns about weaker sales of core cancer and respiratory drugs. Like many other major pharma companies, it’s also facing a series of patent cliffs for key treatments like Farxiga, the diabetes drug that brought in $7.7 billion last year and currently faces a loss of US exclusivity. While Datroway won’t plug that hole on its own, the results are worth more than money in cases like these.

Extra Upside

- ‘Systemic Failures’: The National Transportation Safety Board blasted Boeing and the Federal Aviation Administration for “systemic failures” that led to a door plug panel blowing off a passenger jet last year.

- Bet On It: Predictions market Polymarket is closing in on a $200 million funding round that puts it close to a so-called unicorn valuation of $1 billion.

- It Would Cost $160,000… to buy one share of each S&P 500 company. But with SPY, you can have exposure to each of these names for just $555. Get the power of the S&P 500® with SPY, the most traded ETF.3*

* Partner

Just For Fun

Disclaimers

*Footnotes:

1Bloomberg Finance, L.P., as of January 9, 2025, based on the S&P 500 Index.

2Bloomberg Finance L.P., as of March 31, 2025.

3Bloomberg Finance, L.P As of December 31, 2024.

Important Risk Information

Investing involves risk including the risk of loss of principal.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETFs net asset value. Brokerage commissions and ETF expenses will reduce returns.

Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions.

Passively managed funds invest by sampling the index, holding a range of securities that, in the aggregate, approximates the full Index in terms of key risk factors and other characteristics. This may cause the fund to experience tracking errors relative to performance of the index.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

All information is from SSGA unless otherwise noted and has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor.

The S&P 500® Index is a product of S&P Dow Jones Indices LLC or its affiliates (“S&P DJI”) and have been licensed for use by State Street Global Advisors. S&P®, SPDR®, S&P 500®,US 500 and the 500 are trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and has been licensed for use by S&P Dow Jones Indices; and these trademarks have been licensed for use by S&P DJI and sublicensed for certain purposes by State Street Global Advisors. The fund is not sponsored, endorsed, sold or promoted by S&P DJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of these indices.

Distributor:

State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC, an indirect wholly owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. Certain State Street affiliates provide services and receive fees from the SPDR ETFs. ALPS Distributors, Inc., member FINRA, is the distributor for DIA, MDY and SPY, all unit investment trusts. ALPS Portfolio Solutions Distributor, Inc., member FINRA, is the distributor for Select Sector SPDRs. ALPS Distributors, Inc. and ALPS Portfolio Solutions Distributor, Inc. are not affiliated with State Street Global Advisors Funds Distributors, LLC.

Before investing, consider the funds’ investment objectives, risks, charges and expenses. To obtain a prospectus or summary prospectus which contains this and other information, call 866.787.2257 or visit ssga.com. Read it carefully.

Not FDIC Insured * No Bank Guarantee * May Lose Value

United States: State Street Global Advisors, One Iron Street, Boston, MA 02210-1641.

© 2025 State Street Corporation — All Rights Reserved.

Adtrax: 8052684.1.1.AM.RTL SPD003984

Expiration 06/30/26

**This is a paid advertisement for HeartSciences Regulation A+ offering. Please read the offering circular at https://invest.heartsciences.com/