Good morning, and happy Monday.

One part of the federal government arose from deep sleep for a timely data dump on Friday. The US Bureau of Labor Statistics reported before the weekend that consumer prices rose 0.3% in September, pushing the annual rate of inflation to 3%, the highest since January. The promising takeaway for investors was that both figures came in below economists’ expectations.

So did core CPI, a narrower measure of inflation that will inform this week’s meeting of the Federal Reserve’s monetary policy committee. Stripping out volatile food and energy costs, the core reading posted a 0.2% gain last month and a 3% annualized rate, which most analysts said is tame enough for the committee to lower interest rates for the second month in a row. This marked the first and, so far, only piece of economic data released since the federal government shutdown began last month. Yes, policy wonks rejoiced.

Hedge Fund Assets Reach Record $5 Trillion With Most Inflows Since 2007

The last time this many people piled into hedge funds, the only great recession anyone might have been aware of was Larry David’s hairline.

According to a new report published by Hedge Fund Research, the hedge fund industry saw total global assets under management reach a record $5 trillion in the three months ended September 30, the most since Q3 2007. During the quarter, assets rose by $238.4 billion, including $33.7 billion in new allocations, the most since 2007.

Hot Hand

“While risk-on sentiment has dominated recent months, risks have also evolved, with managers participating in acceleration of these trends through year-end but also positioning for sentiment and trend reversals across equities, commodities, currencies and cryptocurrencies,” said HFR president Kenneth Heinz. He noted that institutional investors are likely to increase their allocations to funds that have proven they can balance the risk-on attitude (think AI boom) with planning for defensive reversals (see trade turmoil). To that end, two segments of the hedge fund industry have stood out this year:

- Equity hedge fund managers, the stock traders of the industry who chart markets with cutting-edge sophistication, garnered 7.2% in investment returns and grew their assets by $96.7 billion in the third quarter, HFR said. Their investor net inflows were $18 billion, bringing their assets under management to $1.5 trillion.

- Then there are macro hedge funds, the watchers of all things geopolitics and macroeconomics, who leverage their knowledge of developments to gain an edge trading bonds, commodities, currencies, equities and other assets. Macro strategies’ assets grew by $33.5 billion overall during Q3, with clients pouring in $1.7 billion net, bringing total macro capital to $759 billion.

Human Touch: While the artificial intelligence boom has been a boon for equity hedge funds, Citadel CEO Ken Griffin doesn’t expect AI to take over jobs in the financial industry any time soon. “With GenAI, there are clearly ways it enhances productivity, but for uncovering alpha, it just falls short,” he told the JPMorgan Robin Hood Investors Conference in New York last week, according to a Bloomberg report.

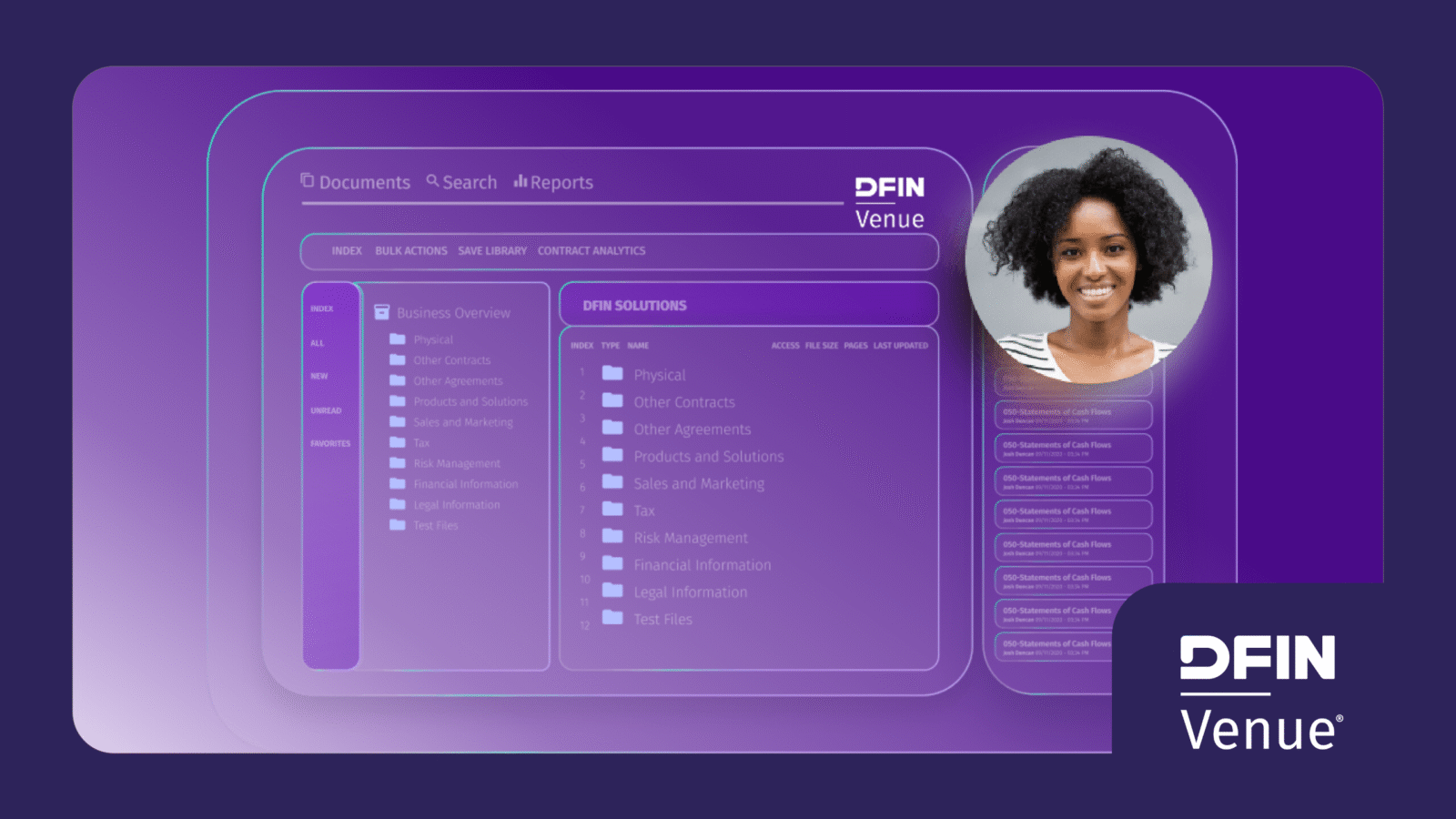

DFIN Introduces The Newly Revamped Venue VDR

When confidentiality, cash and careers are on the line, your corporate deal is too important to settle for a “good enough” data-sharing platform.

Instead, discover how key decision makers are accelerating their projects with DFIN VenueTM Virtual Data Room (VDR) — the revamped solution for more streamlined, secure dealmaking.

What should you expect from the new Venue?

- Faster setup with user-friendly navigation and tools to self-launch VDRs while managing multiple data rooms on demand.

- Responsive data rooms with greater storage space and organization for data-heavy transactions.

- Expert support and guidance provide valuable support, so you can focus your time on executing and closing.

Give your VDR the technical performance it deserves — so you can get back to closing the deal.

Alibaba Tackles American Tech Giants Head-On

Nothing like a little competition, along with a bit of state-imposed exile, to breed innovation, right?

Cut off from high-end American chips and increasingly boxed out of the international AI supply chain, China’s domestic AI industry is starting to stand on its own two feet. Case in point: Alibaba, which last week announced a new consumer-focused chatbot to challenge ChatGPT, new AI-powered smart glasses (dubbed Quark AI Glasses) to challenge Meta’s growing glasses line, and said it’s increasingly finding workarounds to its lack of access to Nvidia’s best GPUs. Game on.

Bending the Quark of History

Pre-sales for the Quark AI Glasses begin on Friday, just in time for China’s multi-day Black Friday equivalent, Singles’ Day, Alibaba said. Shipments are slated to begin in early December; the glasses will retail at $660, undercutting the $799 price tag for the latest line of Meta-Ray Ban smart glasses launched last month. Helping consumers through the sales event will be the company’s latest chatbot, running on its Qwen3 model, which Alibaba hopes can crack a market already dominated by chatbots from ByteDance, Tencent and DeepSeek.

But as is the case with American tech giants, Alibaba’s chatbots are a mere consumer-facing sideshow to the real moneymaker: cloud services for enterprise clients. The company earlier this year pledged 380 billion yuan, or $53 billion, over the next three years toward cloud infrastructure. And already, the company appears to be making critical strides for the AI age:

- In a newly published peer-reviewed paper, Alibaba’s Cloud division claimed it developed a new “pooling system” to reduce the number of Nvidia GPUs needed to run multiple large-language models by 82%.

- It’s a potentially massive development for Alibaba, which has been forced to rely on a limited supply of Nvidia’s lower-powered H20 chips for its AI cloud services amid tightened US export controls.

Ready For Prime Time: The company’s reach is extending far beyond China’s borders, too. In a significant win for Alibaba, Airbnb CEO Brian Chesky told Bloomberg last week that his company has been “relying a lot” on Alibaba’s “very good … fast and cheap” open-source Qwen model to power its AI customer service agent (which is also built in part on open-source models). Why? “I didn’t think [ChatGPT] was quite ready,” said Chensky, who is reportedly close friends with OpenAI CEO Sam Altman. It’s business, it’s not personal.

Exposure to the FinTech Revolution in a Single ETF. Crypto is transforming finance, and the SPDR® Galaxy Digital Asset Ecosystem ETF (DECO) enables you to capture broad exposure to the future of finance, from blockchain to crypto. DECO combines crypto with companies building the digital asset economy, all in one actively managed fund. Learn more about DECO.*

Can Beyond Meat’s Meme-Stock Star Turn Last Beyond Last Week?

Last week, the meme-stock phenomenon roared back so strongly that you could practically smell the 2021 stimulus checks burning.

A surge in Beyond Meat shares early in the week, which abated Thursday and Friday, reintroduced markets to the disruptive force of Reddit and social media-inspired retail traders whose frenetic activity once helped destabilize multiple hedge funds.

Blast from Reddit Past

The meme-stock phenomenon, born during the pandemic, refers to hordes of investors coordinating on social media sites like Reddit to buy shares in specific companies, typically struggling ones. Not because they think they’re poised for a turnaround, but because by creating a maelstrom of sudden demand, they can drive up share prices. Short-sellers are then forced to buy back shares to cover their positions, which sends prices even higher. Of course, things can crash just as quickly because there’s no innate business value driving the demand. GameStop and AMC were the most famous examples of meme stocks in their 2021 heyday, and the London-based hedge fund White Square Capital famously had to shut down after incurring losses from bets against GameStop. New York City hedge fund Melvin Capital, which also suffered heavy losses from bets against GameStop, closed in 2022 after it was hit by that year’s market slump.

Another stock targeted back then was Beyond Meat, which made a glorious, and then unglorious, return to meme-stock status last week. Its shares fell to record lows earlier this month, little more than 50 cents, after the struggling company said its creditors agreed to a debt swap that would substantially dilute existing shareholders. Meme-stock traders saw an opportunity and piled in, pushing the company to a peak gain of 1,300% during Wednesday trading. But the frenzy was as short-lived as it was seismic:

- Citigroup analysts said that retail investors accounted for 16% of single-stock trading volume on Tuesday, the highest on record since 2018.

- But Beyond Meat shares were up only 267% over the previous five days as of Friday’s close, having given up almost all of their peak gains.

History Lesson: Beyond Meat reported a 20% year-over-year revenue decline in its latest quarter, so this was not a fundamentals-driven rally. In fact, even with its meme pops, the stock is down so far this year. Before that, they fell for four straight years: by 47% in 2021, 81% in 2022, 27% in 2023, and 57% in 2024.

Extra Upside

- Escalation: The US cut off all trade talks with Canada, citing a TV advertising campaign by the province of Ontario that features a clip of Ronald Reagan criticizing tariffs for causing “artificially high” prices.

- De-escalation: President Trump plans to meet Chinese President Xi Jinping in South Korea on Thursday as the two work to ease tensions between the world’s two biggest economies.

- Stocks Give You Growth, But What Gives You Stability? Corporate bonds can. They offer more predictable returns than stocks, and higher yields than Treasuries. Webull gives you access to corporates with transparent pricing and tools that compare yields, maturities, and ratings. Get corporates to help stabilize your portfolio.**

** Partner

Just For Fun

Disclaimers

*Important Risk Information

State Street Global Advisors (SSGA) is now State Street Investment Management. Please click here for more information.

For full fund disclosure, please visit: DECO: SPDR® Galaxy Digital Asset Ecosystem ETF.

Investing involves risk including the risk of loss of principal.

Distributor: State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC, an indirect wholly owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. Certain State Street affiliates provide services and receive fees from the SPDR ETFs. State Street Global Advisors Funds Distributors, LLC is the distributor for certain registered products on behalf of the advisor. SSGA Funds Management has retained Galaxy Digital Capital Management LP as the sub-adviser. State Street Global Advisors Funds Distributors, LLC is not affiliated with Galaxy Digital Capital Management LP.

Before investing, consider the funds’ investment objectives, risks, charges and expenses. To obtain a prospectus or summary prospectus which contains this and other information, call 866.787.2257 or visit ssga.com. Read it carefully.

Not FDIC Insured * No Bank Guarantee * May Lose Value

© 2025 State Street Corporation – All Rights Reserved.

AdTrax Code: 8474496.1.1.AM.RTL

Exp Date: 10/31/26

**Securities trading is offered to self-directed customers by Webull Financial LLC, member SIPC, FINRA. All investments involve risk, including the possible loss of principal. You should consider your investment objectives carefully before investing. This is not a recommendation, investment advice, or a solicitation for the purchase or sale of a security. High-yield, fractional and corporate bonds have additional risks, including default. Yields and prices are subject to change. Additional info: webull.com/policy