Good morning.

US Federal Reserve policymakers voted to cut interest rates Wednesday as expected, lowering the benchmark overnight borrowing rate 25 basis points to a range of 3.75% to 4%. For those betting on another cut at the Federal Open Market Committee’s next meeting in December, Fed Chair Jerome Powell’s message was clear: Don’t central bank on it.

“A further reduction in the policy rate at the December meeting is not a foregone conclusion; far from it,” he said at a news conference. “There were strongly different views today, and the takeaway from that is that we haven’t made a decision about December.” In traditional Fedspeak, that translates into, “Maybe, maybe not.”

*Stock data as of market close on October 29, 2025.

Wall Street GOAT: Nvidia Rides Deal Bonanza to $5 Trillion Market Cap

The $5 trillion market cap club has its founding member. And to no one’s surprise, it’s Nvidia.

The chip-designing king crossed the impressive milestone just days after its GTC conference in Washington, DC, which brought news of a bevy of promising new deals. Most pertinent, however, were hints from the White House early Wednesday morning that Nvidia may regain greater access to the massive Chinese market.

Nice to GTC You

“Trillion” is a very 2025 number. Nvidia’s latest market cap achievement comes just three months after it became the first company in the world to reach a $4 trillion valuation, and after CEO Jensen Huang said during a GTC speech that the company has secured half a trillion dollars worth of AI chip orders through just the next five quarters. It also comes just a day after OpenAI, currently valued at half a trillion dollars, took critical steps toward becoming a for-profit entity, a rising-tide development that propelled Microsoft and Apple into the $4 trillion club on Tuesday. As a reminder, Nvidia was worth only about $400 billion when ChatGPT debuted in late 2022. It reached the $1 trillion mark just months later, the $2 trillion mark in early 2024 and the $3 trillion level in June of that year.

Huang claimed that Nvidia is “probably the first technology company in history to have visibility into half a trillion dollars” in revenue. It’s not exactly surprising, either, especially given recent developments:

- Among the deals revealed at GTC are partnerships with Uber to power a fleet of 100,000 self-driving cars, with both Stellantis and Lucid to help each develop its own autonomous-car platform, and with companies such as Palantir, Eli Lilly and CrowdStrike.

- The half-trillion sales projection means the company is penciling in 2026 revenue above the $258 billion expected by Wall Street, Bernstein analysts told the Financial Times, suggesting that Nvidia might see US-China relations thawing faster than expected. President Trump said Wednesday that he will discuss allowing Nvidia to sell its high-end Blackwell chip with China’s President Xi Jinping at a summit later this week.

What Goes Up: While returning to China in full force would mark a major victory for Nvidia, the company, evidently, is doing fine without unencumbered access. In fact, its greatest headwind may be coming from home. Longtime industry runner-up AMD is forging an increasingly cozy partnership with OpenAI, while veterans like Qualcomm and Broadcom are attempting to crash the AI chip party and Big Tech players are laying the groundwork to develop in-house chips, reducing reliance on third parties like Nvidia. In the near term, however, the AI spending boom doesn’t appear to be slowing down anytime soon, with Meta, Microsoft and Google each saying yesterday that largely AI-driven capital expenditures for the year are likely to be higher than projected. Seems like there’s more than enough money to go around, even with stiffer competition.

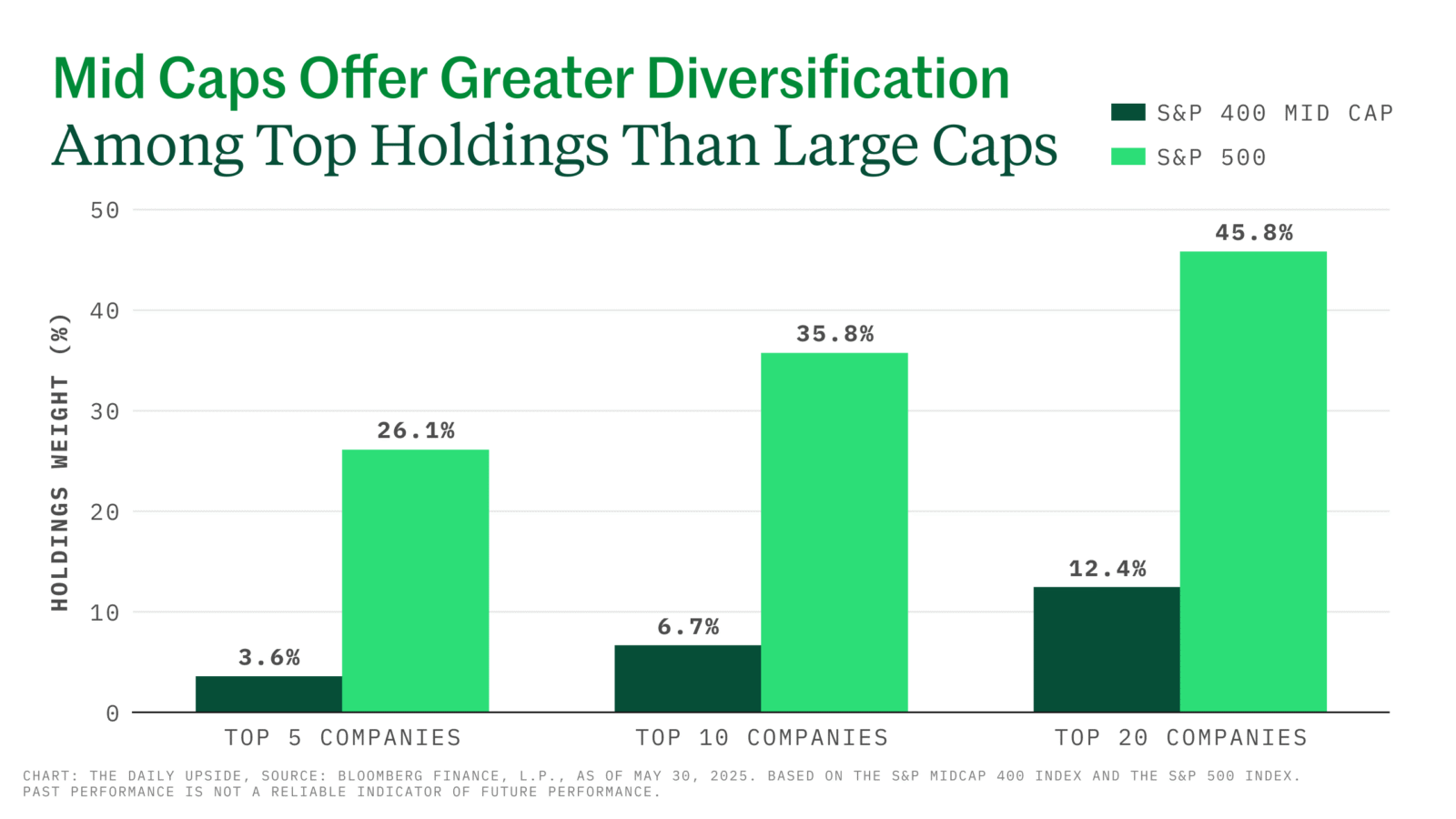

Big-Cap Tech Weighs Heavy. Mid Caps Spread The Bet

The top 10 companies account for 38% of the S&P 500®’s market weight.¹ Banking exclusively on mega caps means you’re putting an outsized bet on a few big names.

Mid caps don’t pose that risk. First, over the past 30 years, they’ve quietly outperformed large caps by 2% annually.2 Just as crucially, the S&P MidCap 400® isn’t as concentrated.

- Its top 10 holdings make up just 7% of the index.³

- The largest sector accounts for 22.20% versus 31.61% exposure for the largest in the S&P 500®.⁴

- Information Technology makes up just 11.15% of the MidCap 400, compared to 31.61% in the S&P 500®.5

State Street’s SPDR® S&P MidCap 400® ETF (MDY) taps into US economic strength without piling into risky, overcrowded names.

Fiserv Loses Nearly Half Its Market Cap After ‘Abysmal’ Quarter

“Abysmal.” “Difficult to comprehend.” “Impossible to sugarcoat.”

These are not the words of film critics directed at a tedious new box office bomb. They’re how analysts at BTIG, Jefferies and William Blair described the third-quarter results of fintech Fiserv. It may not be Steven Spielberg’s idea of cinema, but on Wall Street, it was a Halloween horror show. Shares in the company fell 43% Wednesday; Fiserv’s worst one-day drop on record had been 19.5%.

Cry for Me, Because Argentina

Milwaukee-based Fiserv processes card transactions, loyalty programs, loans and other electronic payments. It does this for banks, credit unions and other financial institutions, which make up the bulk of its clientele. We’re talking basic financial plumbing here rather than crypto, energy or other tech more commonly associated with roller-coaster stock price volatility.

That’s why, when Fiserv executives said Wednesday that they now expect 3.5% to 4.5% in organic revenue growth this year, even the most clued-in analysts were left scratching their heads. Only three months ago, the company said that figure was on track for 10%. Something very dramatic clearly happened, pushing growth trends suddenly downward, especially since the previous outlook came with half the year already over. So what gives?

The obvious answer is slowing business. Fiserv now expects adjusted earnings to come in at $8.50 to $8.60 per share this year, radically lower than its July forecast of $10.15 to $10.30 or the $10.15 that analysts polled by FactSet expected. Its $5.2 billion in third-quarter revenue, up just 1% year over year compared with an 8% gain in the second quarter, also missed Wall Street’s $5.5 billion estimate. More interesting was Fiserv’s explanations:

- CEO Mike Lyons said on an earnings call that Argentina’s floundering economy, which he said “contributed 10 percentage points to our 16% organic growth rate [in 2024],” was the major culprit. From sky-high inflation to piles of dollar-indexed debt to vanishingly thin foreign reserves to declining industrial output, there are 40 billion reasons why the South American country recently took a $40 billion bailout from the US.

- Lyons explained that the previously rosy growth forecast was based on the company’s assumption that growth in other markets would offset Argentina (spoiler: it did not). He said Fiserv will now put in place an “action plan” that includes improving operations with artificial intelligence and doubling down on its small-business payments platform, Clover.

Not Buying It: “Management responses weren’t convincing on what drove the steep change in revenue assessment” and don’t “inspire confidence that there will be no more surprises,” wrote Diksha Gera, a fintech analyst at Bloomberg Intelligence.

One Legend Deserves Another. Robinhood knows you want instant updates, linkable widgets and the ability to place trades from charts the instant you spot an opportunity – and we built Legend to make it all happen. Wall Street tools that cost thousands a month? Free with your Robinhood account. Start trading like a Legend.**

Amazon Job Cuts Broaden Big Tech’s Layoff Barrage

Amazon workers woke up to a “Good morning” text on Tuesday telling them they’d been laid off, Business Insider reported. More than 14,000 Amazonians got the axe as layoffs at Big Tech companies continued to climb. Microsoft has cut 15,000 folks so far this year, and Intel said in April that it plans to part with 21,000 employees (20% of its workforce). HP, Blue Origin and Salesforce are said to be eliminating thousands of jobs as the tech sector embraces AI and automation.

Beyond tech, UPS has cut 48,000 roles this year. Paramount Skydance said Wednesday that 2,000 positions, or 10% of its workforce, will be cut. Target’s cutting 1,800 corporate jobs, or 8% of its workforce, in its first major layoffs in a decade, while the federal government has eliminated 100,000 roles so far this year.

Blurry Big Picture

Making sense of the onslaught of layoffs and predicting whether it’ll continue or ease up is complicated. Because of the government’s continued shutdown, the September jobs report is more than a month past due, and it’s unclear whether October will even get a count. However, non-government indicators suggest volatility in the job sector may continue:

- Payroll processor ADP reported Tuesday that private-sector job gains ticked up in the four weeks to October 11, which could signal the start of a recovery. At the same time, ADP called the improvement tepid and warned that future reports might show a pullback. ADP will release a larger report next Wednesday that could shed more light on the situation.

- Citi similarly estimated a modest uptick in unemployment for the week that ended October 18, while the Federal Reserve Bank of Chicago found unemployment stayed roughly the same from September to October.

Vicious Cycle: When layoffs rise, people spend less, which leads to tighter bottom lines and more layoffs. Wash, rinse and repeat. Wealthy shoppers are thought to have made up spending shortfalls so far, but they could skip their next Sephora haul if the government shutdown, which is already the second-longest in US history, continues to weigh down the economy. The cycle could also speed up if SNAP and other assistance benefits lapse, leaving consumers with less spending money. On the other hand, the Fed cut interest rates to a three-year low yesterday (despite inflation not yet dropping to the level officials are aiming for), which could slow the job market’s churn.

Extra Upside

- Flight Status: Boeing’s turnaround efforts took one step back and one step forward in its latest quarter: there was a massive $5.3 billion loss due to delays in the rollout of its new widebody jet, the 777-9, but revenues rose 30% to $23.3 billion.

- Closed Off: A federal judge blocked the Consumer Financial Protection Bureau’s new “open banking” rule that would let consumers have free control over sharing their bank account, credit card and financial products data following a challenge by the banking industry.

- How Mid Caps Can Beat Concentration Risk. Mid caps outperformed large caps over the past three decades while maintaining significantly less concentration risk overall. The S&P MidCap 400® ETF spreads portfolio exposure across sectors and companies more evenly than the top-heavy S&P 500®. Learn more about MDY.*

*Partner

Just For Fun

Disclaimers

Footnotes:

1 The Motley Fool: https://www.fool.com/investing/2025/08/24/the-ten-titans-stocks-now-make-up-38-of-the-sp-500/, as of August 24, 2025.

2 The S&P MidCap 400®: Outperformance and Potential Applications: https://www.spglobal.com/spdji/en/documents/research/research-sp-midcap-400-outperformance-and-potential-applications.pdf

3 Bloomberg Finance, L.P., as of May 30, 2025, based on the S&P MidCap 400 Index.

4 Source: Bloomberg Finance L.P., as of May 30, 2025. Weights are as of the date indicated, are subject to change, and should not be relied upon as current thereafter.

5 Source: Bloomberg Finance L.P., as of May 30, 2025. Weights are as of the date indicated, are subject to change, and should not be relied upon as current thereafter.

*Important Risk Information

Investing involves risk including the risk of loss of principal.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETFs net asset value. Brokerage commissions and ETF expenses will reduce returns.

Distributor: State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC, an indirect wholly owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. Certain State Street affiliates provide services and receive fees from the SPDR ETFs. ALPS Distributors, Inc., member FINRA, is the distributor for DIA, MDY and SPY, all unit investment trusts. ALPS Portfolio Solutions Distributor, Inc., member FINRA, is the distributor for Select Sector SPDRs. ALPS Distributors, Inc. and ALPS Portfolio Solutions Distributor, Inc. are not affiliated with State Street Global Advisors Funds Distributors, LLC.

Before investing, consider the funds’ investment objectives, risks, charges and expenses. To obtain a prospectus or summary prospectus which contains this and other information, call 866.787.2257 or visit ssga.com. Read it carefully.

Not FDIC Insured * No Bank Guarantee * May Lose Value.

Adtrax: 8539762.1.1.AM.RTL MID001285

Expiration: 10/31/26

**All investing involves risk.

Brokerage services are offered through Robinhood Financial LLC, (“RHF”) a registered broker dealer (member SIPC), and clearing services through Robinhood Securities, LLC, (“RHS”) a registered broker dealer (member SIPC). While there is no additional cost to use Robinhood Legend, there are other fees associated with your brokerage account. Review the fee schedule for more information. Options trading entails significant risk and is not appropriate for all customers. Customers must read and understand the Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount.