Good morning.

Maybe now, Europe can put the Great Recession behind it. More than 17 years after Lehman Brothers collapsed during the subprime mortgage crisis, the investment bank’s London unit is finally closing. In a rare post-meltdown success story, insolvency practitioners at PricewaterhouseCoopers overseeing the administration of the international unit recovered nearly £28 billion ($37.5 billion) from the wreckage.

As a result, most of Lehman Brothers International Europe’s creditors were paid in full, including statutory interest. Brave investors who gambled on the unit’s debt, bought it for pennies on the dollar, and waited for administrators to unwind millions of trading positions made up to seven times their investment. High Court Judge Robert Hildyard ruled Wednesday that, having satisfied its debts, the administration can shut down for good, calling the case “remarkably successful” and noting it’s “unlikely to ever be repeated.” Former Bear Stearns investors can only dream.

*Presented by VanEck. Stock data as of market close on October 8, 2025.

Invest in a future built on semiconductors with the SMH ETF.

*Please see important SMH disclosures below.

Verizon Hooks Up With AST SpaceMobile For Space-Based Cell Coverage

Goodbye, extremely fake-looking cell tower “trees.” And hello, satellites.

Cellular’s going interstellar, with Verizon and AST SpaceMobile signing a deal to build out a space-based network next year. The move could create competition for Starlink, a division of Elon Musk’s SpaceX.

The tie-up will extend Verizon’s network to hard-to-reach parts of the US, as AST’s satellites are tapped for connectivity boosts as needed. More than 500,000 miles of the US are unreachable by traditional cell towers because of issues with terrain and land-use restrictions, T-Mobile said last year.

AST’s shares climbed following the announcement, adding to their roughly 275% annual gain.

Telecom’s Space Race

Verizon and AST initially announced a partnership last year, with the telco agreeing to invest $100 million in the satellite operator. AT&T also has a deal with AST to provide cell service from space to its customers through 2030 and previously teamed up with Google and Vodafone to pour $110 million into AST’s satellites.

That means two of the US’s largest telecom companies have picked AST as their favorite to win the sector’s space race. But while AST still needs to build and launch satellites to extend its coverage, rival Starlink has a huge off-planet presence:

- Starlink, which is partnered with T-Mobile and has about 650 satellites in orbit already, reached a deal last month that could greatly expand its coverage. Starlink said it’ll buy $17 billion in wireless spectrum licenses from Echostar, allowing its satellites to reach more than 400 US markets.

- AST, meanwhile, sent its first five commercial satellites into space about a year ago, ironically aboard a SpaceX rocket. It requires 45 to 60 satellites in orbit to provide consistent US coverage, a network it plans to have operational by the end of next year. But previous launches have been plagued with delays. The latest: Its second-gen prototype’s launch has been pushed back from August to at least December.

North Star: Musk said Starlink will stay exclusive to T-Mobile for about a year before opening up its tech to telecom competitors. When Starlink and its relatively huge network of satellites becomes widely available, AST will face pressure to turn massive investments into operational satellites and, ultimately, revenue. Other competitors could feel the heat from Starlink’s lift-off, too, like Globalstar, which Apple set aside $1.5 billion last year to boost.

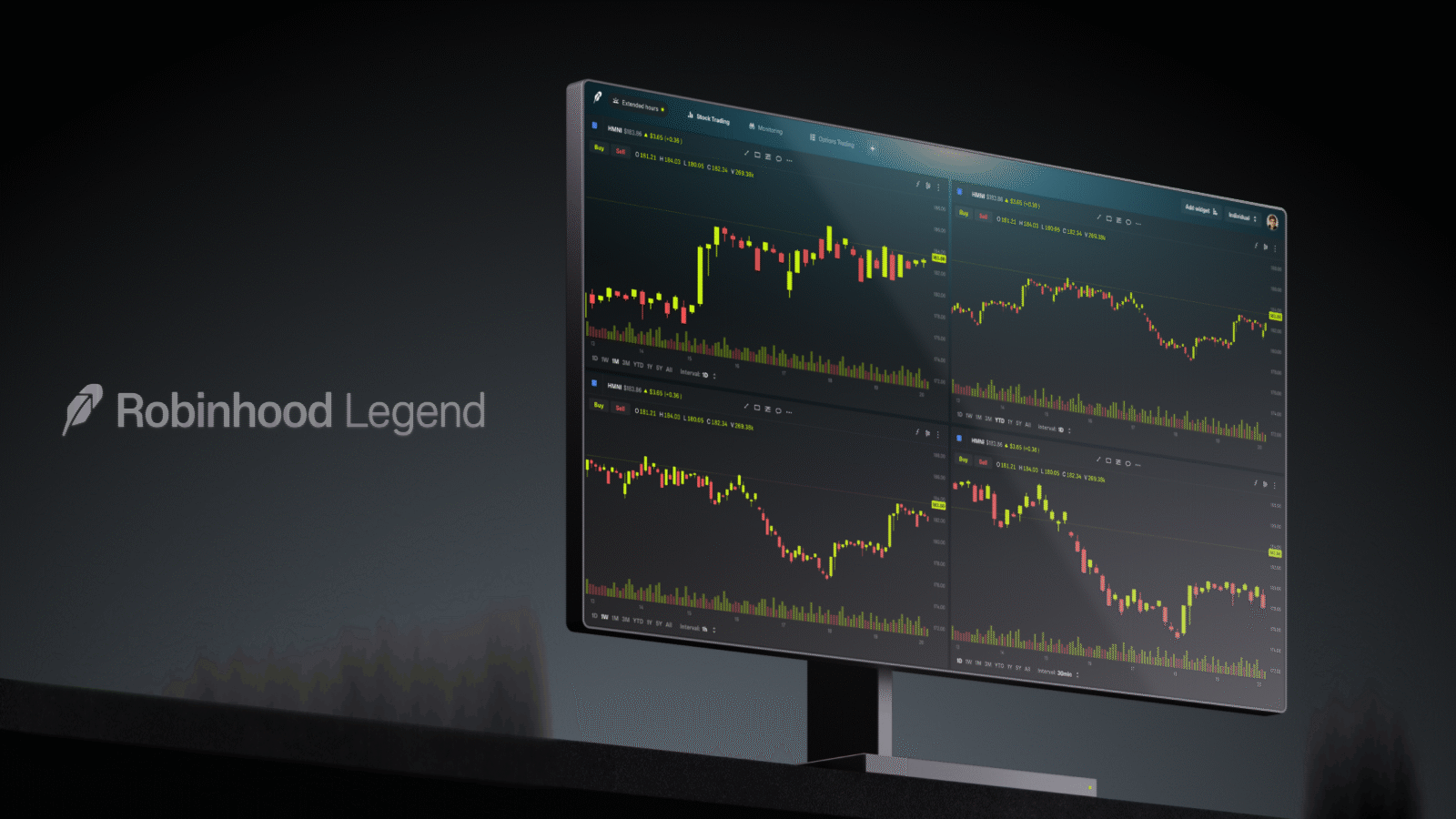

Trade Like A Legend. Pay Like A Tightwad

Legends don’t wait for platforms to load. They act as the markets move, in real time.

Robinhood Legend delivers sub-second data updates while you execute directly from charts. No tab-switching. No friction between spotting opportunities and seizing them. With Legend you can:

- Build custom layouts in seconds.

- Link widgets across multiple monitors.

- Place trades from watchlists, charts, or even options chains the second you see movement.

And there’s more to this Legend. Technical indicators that respond instantly. Custom intervals that adapt without lag. Multi-screen setups that sync seamlessly. The result? When trends emerge, you’re better positioned to move while competitors fumble with clunky UI.

Tools that cost thousands a month, right? Wrong: all free with your Robinhood account.

Jefferies Reveals Fund’s $715 Million Exposure to Failed First Brands Amid Relationship Scrutiny

Auto parts supplier First Brands’ bankruptcy is proving a first-class pain in the camshaft for Wall Street.

On Wednesday, Jefferies became the latest high-profile firm to disclose exposure to the smoke billowing from the company’s engine failure, in its case via one of its credit funds. The investment bank is also getting side-eyed by other lenders after reports that Jefferies made undisclosed fees from financing First Brands, which may have violated credit agreements.

Private Company’s Public Unraveling

Ohio-based First Brands, which makes everything from fuel and water pumps to brake hardware, wiper blades and spark plugs, grew rapidly through debt-fueled acquisitions. As a private company, it tapped the thriving private credit market. When the company filed for bankruptcy last month, in part due to the crushing pressure of auto parts tariffs, it listed over $10 billion in liabilities and nearly $6 billion in long-term debt.

And, when people started looking under the hood, it soon became obvious there was more to the story. It turned out First Brands had billions in poorly disclosed liabilities tied up in off-balance sheet financing, an accounting practice in which companies keep some liabilities off their main balance sheet. It’s legal when disclosed under the Financial Accounting Standards Board’s Generally Accepted Accounting Principles (GAAP) and can be used to improve metrics like debt ratios, but critics have argued that it can obscure a company’s true risk profile. Then comes the potential loophole: First Brands’ off-balance accounting was tied up mostly in invoices along its supply chain, and GAAP standards don’t require companies to classify trade payables, or what they owe to suppliers. First Brands’ bankruptcy filing revealed that a dozen of its 30 largest non-insider creditors have claims related to “trade payables.” As a creditor, Jefferies is taking a hit, but its relationship with First Brands has also come under the microscope:

- Jefferies pitched a failed $6 billion refinancing for First Brands to investors earlier this year, but it stalled when they asked for more information on the company’s accounting. The investment bank said Wednesday that one of its credit funds has a $715 million exposure to First Brands, more than Swiss investment bank UBS’s $500 million exposure. Shares in Jefferies, which Morgan Stanley analysts estimate has a direct exposure of $44 million, fell nearly 8% on the day.

- Other lenders were not pleased when the Financial Times approached them about a “side letter” Jefferies inked with First Brands to earn undisclosed fees exceeding the interest rate caps in its loan covenants. This, they said, may have violated their own credit agreements.

Credit Questions: The due diligence standards of the booming, $1.7 trillion private credit industry are also likely to come under scrutiny. Private credit lenders were one of the last lifelines for First Brands as it neared collapse, and are owed a total $276 million, but are behind more than six dozen creditors in the line to get their money back.

Traditional Advisors Typically Charge Fees Between 0.5% to 2% AUM, Or $1,000 To $3,000-Plus For Comprehensive Advising Plans. This is where Range differs — they’re an all-in-one wealth management platform for high-earning professionals making $250,000 per year or households making over $300,000. Even better, they use a flat fee structure with 0% AUM fees. Book your free demo today.

Equifax Fires Back at FICO in Credit Score Wars

What did you do in the credit score war, Equifax?

Last week, Fair Isaac (better known as FICO) announced a move that would allow it to bypass the Big Three consumer credit reporting middlemen — a.k.a., Equifax, Experian and TransUnion. This week, Equifax fired back, slashing prices on its own service that cuts out FICO scores, VantageScore 4.0.

Not So Fair Isaac

If there’s one thing seemingly everyone can agree on, from FICO to the credit-reporting firms to the mortgage credit specialists (known as tri-merge resellers) to mortgage borrowers and even politicians in Washington, it’s that the cost of a credit check is getting too high. It’s why the Federal Housing Finance Agency approved using VantageScore, from a company controlled by the Big Three bureaus, earlier this year as a way to inject some competition in the $13 trillion mortgage market.

It’s also why FICO’s announcement last week was such a big deal. Under its new system, FICO was allowing tri-merge resellers to license its credit reports directly, either for $4.95 (the same fee it charged the credit bureaus) plus $33 once a FICO-scored loan closed, or for a flat $10 per-pop fee. The move directly threatened an earnings hit of as much as 10% to 15% for the credit bureaus, Jefferies analysts estimated in a note to clients last week. “Direct licensing of the FICO score brings transparency, competition and cost-efficiency to the mortgage lending process,” FICO CEO Will Lansing said in a statement last week.

Equifax, it seems, took the call for competition to heart:

- VantageScore 4.0 credit scores will be available for $4.95 per report, with no added fees, through 2027, Equifax announced on Tuesday. The company will also offer free VantageScore reports to any mortgage lenders who are purchasing FICO scores.

- That could seriously test the grip of FICO’s market hold; according to analysts at BMO Capital Markets, FICO still holds a market share of more than 90%.

“The company is responding to FICO’s monopoly-like doubling of their mortgage credit score prices to $10 in 2026,” Equifax said in a statement.

Show Me the Equifax: The market share battle has already begun. In June, the Federal Housing Finance Agency said it would allow Freddie Mac and Fannie Mae to accept VantageScore 4.0 in addition to FICO scores. Investors aren’t quite so sure a true shakeup is coming: Fair Isaac’s share price fell nearly 9% on Wednesday, but remained up more than 14% since its splashy announcement last week. Equifax, which climbed 0.7% on Wednesday, is still down more than 4% since FICO said it would bypass it.

Extra Upside

- “Stealing Childhood”: Denmark’s government is planning to ban social media for people under 15 years old, Prime Minister Mette Frederiksen said.

- Pouring Cold Water on Hot Cocoa: Cocoa prices hit a two-year low, and analysts are warning money managers have taken “historically weak” positions in the “extremely oversold” commodity.

- Is Gold The Right Choice For Your Retirement? If you have $1 million or more, download “Gold: Is the Return Worth the Risk?” and get “13 Retirement Investment Blunders to Avoid” as a bonus.***

*** Partner

Just For Fun

Disclaimers

*Important Disclosures

VanEck Semiconductor ETF (SMH): Average Annual Total Returns Quarter End as of 6/30/2025* (%)

*Returns less than one year are not annualized.

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Please call 800.826.2333 or visit vaneck.com for performance current to the most recent month ended.

*Investing involves substantial risk and high volatility, including possible loss of principal. Visit vaneck.com to read and consider the prospectus, containing the investment objectives, risks, and fees of the funds, carefully before investing. Past performance is no guarantee of future results. VanEck mutual funds and ETFs are distributed by VanEck Securities Corporation, Distributor, a wholly owned subsidiary of VanEck Associates Corporation.

**All investing involves risk.

Brokerage services are offered through Robinhood Financial LLC, (“RHF”) a registered broker dealer (member SIPC), and clearing services through Robinhood Securities, LLC, (“RHS”) a registered broker dealer (member SIPC). While there is no additional cost to use Robinhood Legend, there are other fees associated with your brokerage account. Review the fee schedule for more information.

Options trading entails significant risk and is not appropriate for all customers. Customers must read and understand the Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount.