Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Who would pay more than five cents for a nickel? Certainly not a nickel trader, because despite its name the Thomas Jefferson-fronted coin is made of 75% copper.

On Tuesday, those traders were left counting their pennies when the price of real nickel surged an unprecedented 250%, at one point topping $100,000 per ton. The resulting squeeze hit the world’s largest nickel producer and a big Chinese bank, while the London Metal Exchange suspended trading.

Nickel Traders Get Dimed

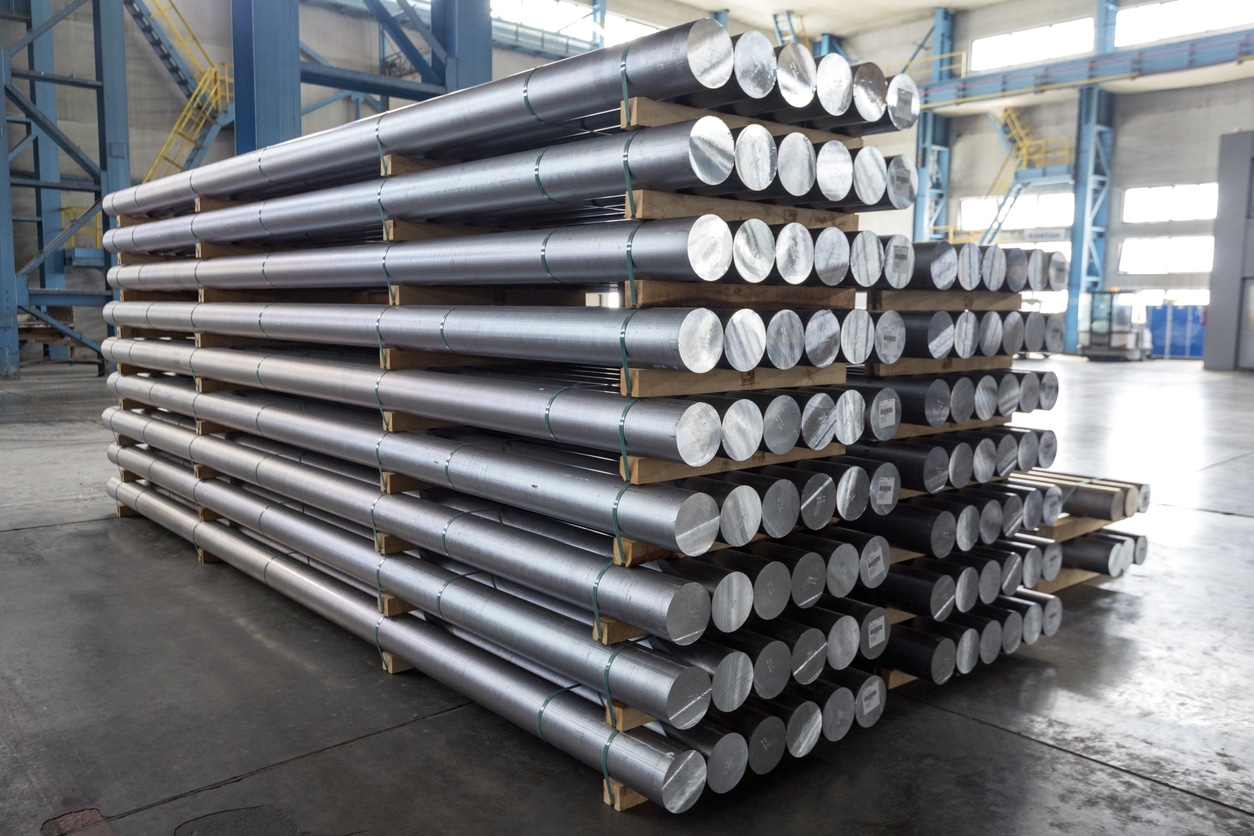

Some 75% of the nickel supply is mixed with chromium to create stainless steel, which is used in appliances, utensils, and machinery. It’s also important for electric vehicle batteries, and Morgan Stanley said Tuesday that the input cost of making a single EV rose $1,000 this week. But the good news for consumers is that nickel is not oil — none of these things are everyday purchases. Nickel’s role in the economy is small enough that prices haven’t led terrified economists to throw around words like “recession” and “stagflation” the way oil sometimes does.

The bad news is for nickel traders, and it’s bad because of how they trade nickel:

- Miners and commodities investors frequently take short positions on the London Metal Exchange (LME) to hedge against their metal holdings. In normal times, this means price fluctuations tend to balance out, but when there is a huge spike like Tuesday everyone in a short position is left to pay what are suddenly huge margin calls.

- Tsingshan, the world’s biggest nickel producer, lost more than $2 billion on Monday and could face billions of additional losses after prices kept soaring Tuesday, according to Bloomberg. China Construction Bank, Tsingshan’s broker, was given extra time by LME to pay hundreds of millions in margin calls.

Why the Sudden Spike? No surprise here – it’s Russia. The country’s invasion of Ukraine has led to general fears of commodity shortages, and Russia produces 17% of the world’s top-grade nickel supply.

The Fixer: Thankfully, nickel processing is about to get a boost from Chinese miner Zhejiang Huayou, which is opening several new nickel plants in Indonesia. Analysts forecast the metal will fall to $20,000 a ton after the first quarter of 2022 and stay there until at least 2025.