Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Tired of sky-high prices at the pump. Don’t hold your breath waiting for a reprieve.

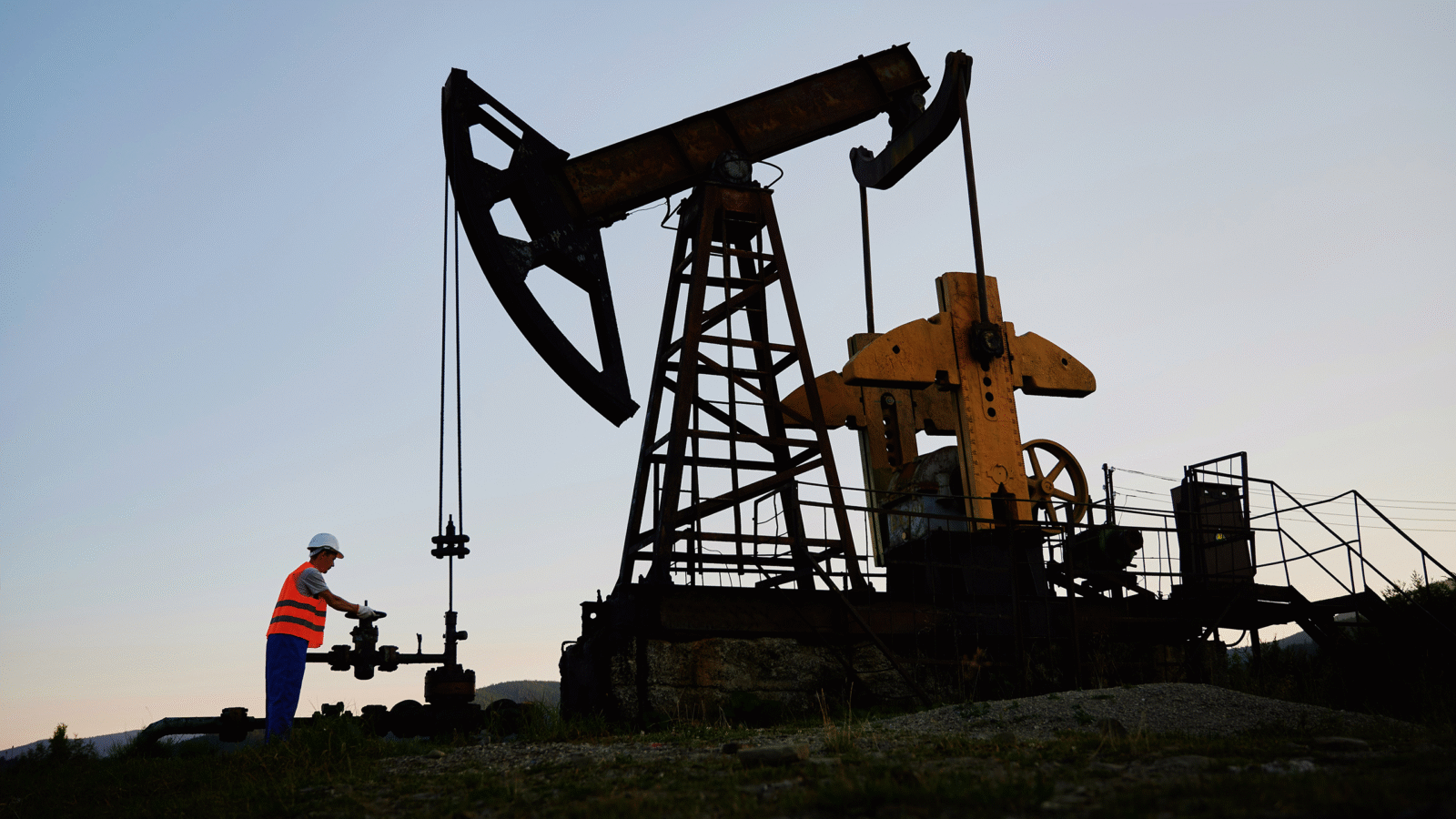

On Wednesday, members of OPEC+, which includes 13 core OPEC and 10 non-core nations and collectively accounts for half the world’s oil production, admitted to wildly missing oil-production targets so far this year. Worse yet: the group says considerable roadblocks remain.

Settling for a “Psychological Impact”

Stepping back in time: in May 2020, OPEC+ joined forces to coordinate production decreases aimed at re-balancing the suddenly overstocked global oil market (remember negative oil?). Since then, the group has collectively pumped 562 million barrels less than stipulated in the agreement, according to data from OPEC’s Joint Technical Committee — setting the stage for today’s dearth.

In light of today’s $5+ per gallon, OPEC+ agreed in principle to raise production to 42 million barrels per day in May. But a new, independent assessment has found that OPEC+ has fallen short by a whopping 3 million barrels per day, prompting wide concern as to how long the supply-demand imbalance will persist:

- New targets, discussed in a virtual meeting Wednesday and set to be formally approved today, will rely heavily on so-called spare capacity in Saudi Arabia and the United Arab Emirates. Saudi Arabia, in particular, will have to produce 11 million barrels per day in August — a level it’s only reached twice in its history.

- Speaking with President Biden at the G-7 meeting on Monday, France’s Emmanuel Macron said the UAE’s Sheikh Mohammed bin Zayed al Nahyan privately claimed his country was already at maximum capacity, while the Saudis can only increase “a little bit.”

Throwing more cold water on its ability to re-balance the market, one OPEC member told The Wall Street Journal that any planned increase is “meaningless” and “only made for its psychological impacts on the market,” in light of Russian sanctions currently crimping supply.

G-7 Solutions: World leaders at the G-7 meeting this week discussed a potential solution of imposing a price cap on Russian oil, which, in theory, would force other producers to lower their prices. Analysts at Swedish bank SEB claim that move would likely backfire, causing Russia to retreat from the market altogether, and cause prices to surge to $200 per barrel. Time to dust off your Schwinn 7-speed.