Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

On Main Street, it’s the year of lifting lockdowns. On Wall Street, it’s the year of lifting lockups.

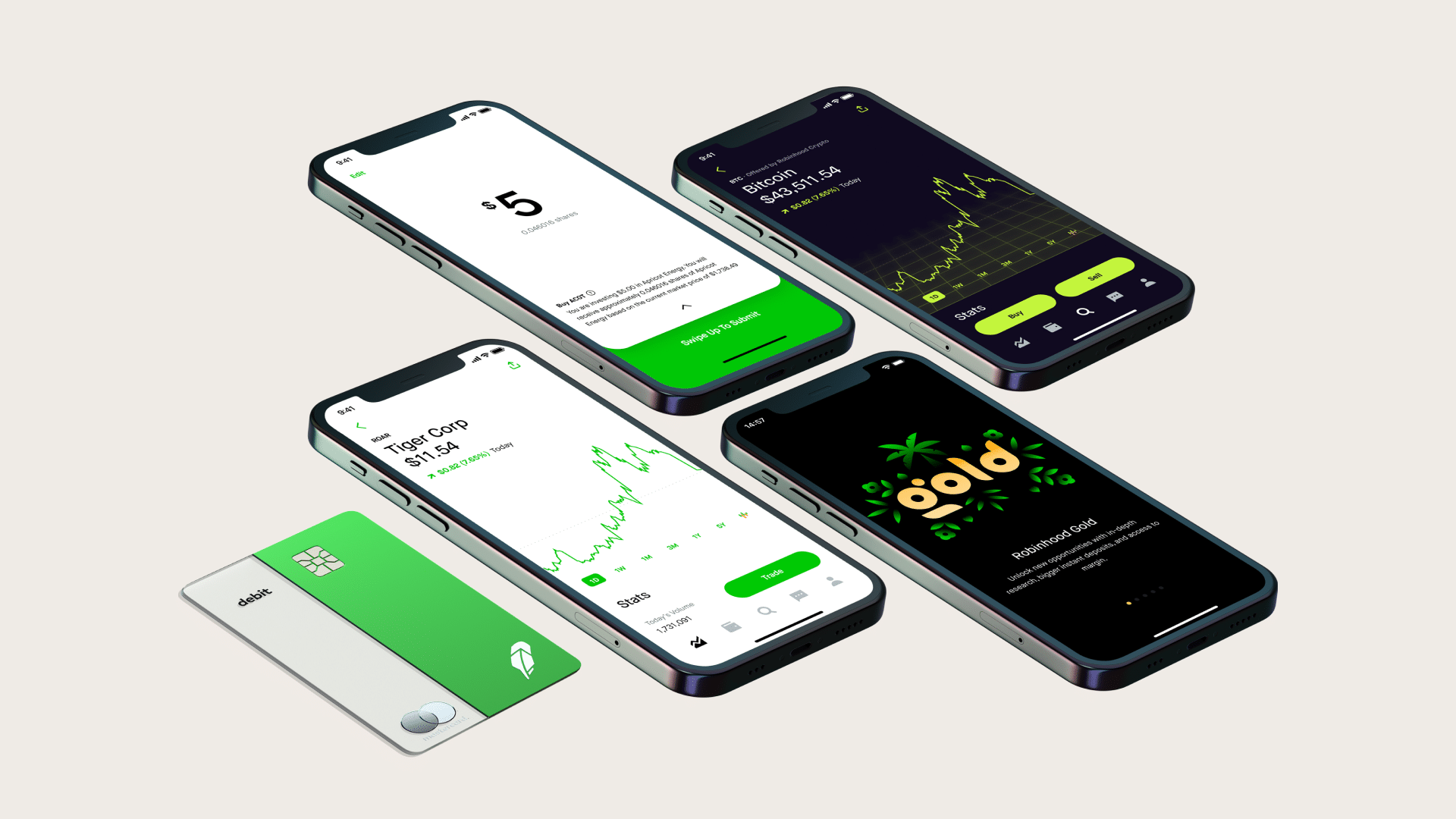

When retail trading app Robinhood lists its shares later this month, the firm’s employees will have a privilege that just a few years ago would have seemed absurd. They will not be bound to a traditional six-month lockup period and instead be permitted to sell 15% of their Robinhood holdings immediately, along with another 15% after three months.

Sharing Shares is Caring

Lockup deals are arrangements between companies heading for public markets and their underwriters — typically big banks and financial institutions. The deals bar employees and early-stage shareholders from immediately dumping stock once a company is listed, to help avoid sparking a huge selloff.

But that concern seems somewhat antiquated in 2021. The world is seeing record-breaking IPO volumes and in the U.S. alone, 276 IPOs raised $94 billion from January to June. Many firms are experiencing massive day-one pops in share price, and with insatiable investor appetite reducing the risk of selloffs, a growing number of firms are relaxing lockups to boost the availability of their shares:

- In the last year, data warehouse company Snowflake let employees sell up to 25% of their vested stock three months after its IPO. Airbnb went a step further, allowing employees to offload 15% of their holdings in the company’s first seven days of trading.

- These tiered lockups, in which pockets of shares are released over a staggered timeline, can help prevent unfavorable price swings. In 2019, for example, Uber lost $2 billion in market cap in one day when its shares subject to a traditional lockup were released all at once.

Pamela Marcogliese, a partner at law firm Freshfields Bruckhaus Deringer, told The Wall Street Journal it comes down to bargaining power, “In the last couple years, companies finally had so much leverage that they could negotiate this.”

Unlocking Morale: Another reason tech startups in particular are relaxing lockups is the piping hot job market. Increasing flexibility with compensation can act as an added incentive for employees to stick around, alongside all the foosball tables and bean-bag chairs.