Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

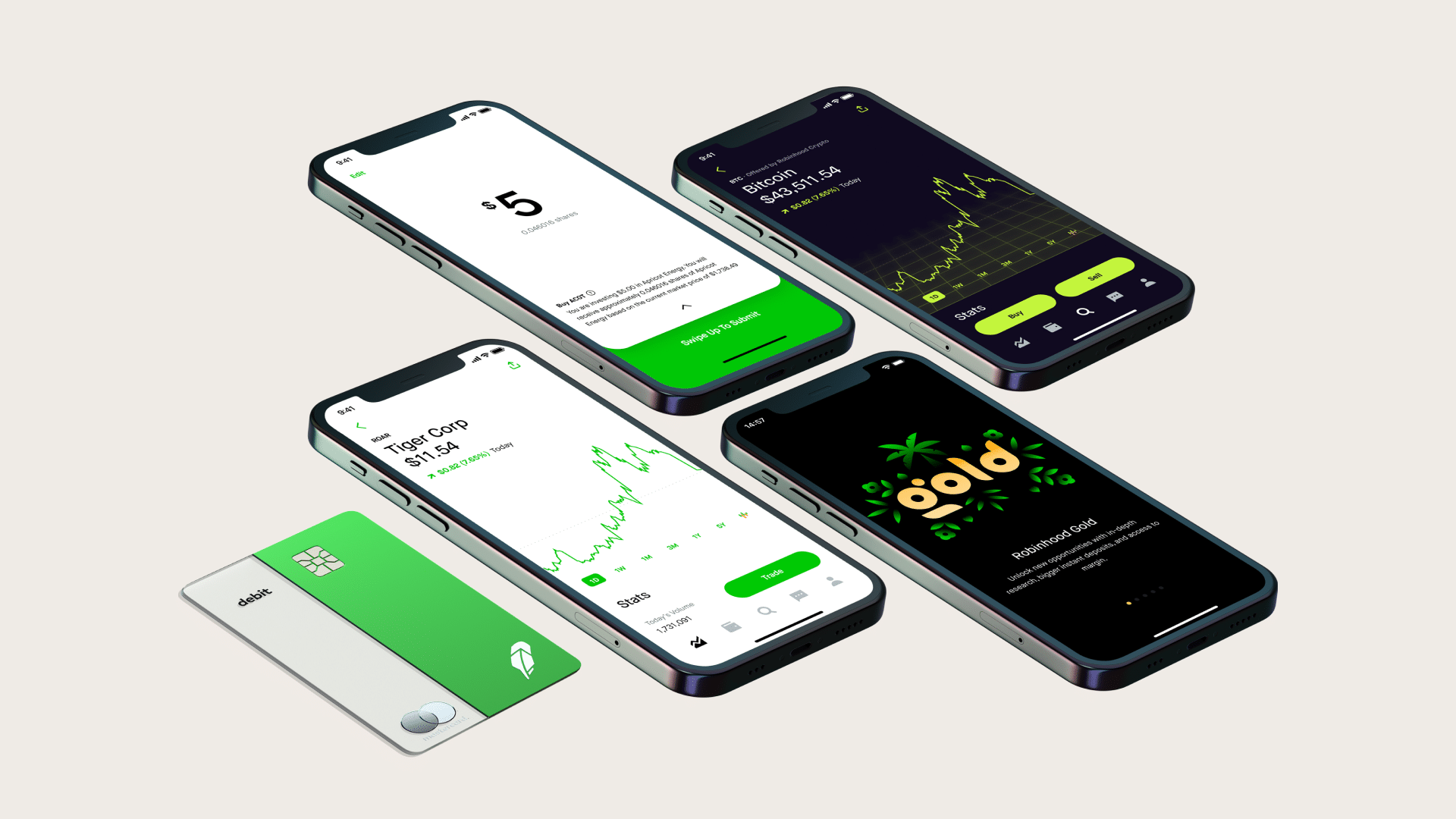

One of retail brokerage Robinhood’s best-known marketing gimmicks is giving away one free share of stock to everyone who opens an account or refers a friend. Primarily a novelty offer to rope in new users, roughly 98% of the freebie stocks are priced at $10 or less. But the promotion is having some costly implications.

Firms that Robinhood has leaned on heavily in its stock giveaway are now getting hit with massive paperwork fees for having tens of thousands of new shareholders. And regulators may soon step in at their defense.

An Unexpected Bill

Robinhood, like other brokerages, is required to deliver proxy materials to a public firm’s shareholders in advance of its annual meetings (AGMs). Those firms are then expected to reimburse the brokerages for the cost of distribution.

As Robinhood’s popularity surged through the pandemic, compounded by the wild Gamestop saga fueled by amateur Reddit traders, the firm handed out free shares to millions of new users — to the tune of $79 million in shares last year, more than double the $29 million in 2019. The result for some companies has been staggering proxy bills they never saw coming:

- Florida pharmaceutical company Catalyst discovered its total shareholders grew from 25,000 to 280,000 in one year after it was hit with a $234,000 bill from a Robinhood service provider for delivering proxy materials in advance of its 2020 AGM. The year before, Catalyst paid just $12,500 for all proxy distribution.

- Marathon Oil launched an investigation after its shareholder ranks grew 32 times from 2019 to 2020 and its proxy distribution costs grew 25 times. The firm quickly determined most of its new investors came through Robinhood.

Calls for a Crackdown: Catalyst and Marathon are appealing to broker regulators at the Financial Industry Regulatory Authority (FINRA) to intervene. Giving these firms an edge is a recent rule change to the New York Stock Exchange approved by the SEC, which bans brokers from seeking proxy distribution costs for investors they gave free shares to.

That won’t directly impact Robinhood, which isn’t an NYSE member, but FINRA often follows the NYSE on proxy issues, which could lead Robinhood back to the drawing board when it comes to promotions.