In this Q&A, with Connor Fitzgerald of Wellington Management, Fixed Income Portfolio Manager of Hartford Dynamic Bond ETF, we unpack the themes shaping fixed income and dive into how Hartford Funds’ dynamic bond strategy seeks to identify mispriced assets. Let’s hop into it.

Q: “What risks are most mispriced in fixed income today — and where do you see the market underestimating opportunity?”

A: Valuations across risk assets, particularly yield spreads in many credit sectors, are pricing in a lot of good news reflecting the combination of a favorable tax environment, improving investment backdrops, rising productivity, and rate cuts that could support strong earnings growth.

However, at the same time, we expect consumption to continue to moderate as households continue to work through the inflation shock of the past five years and tighter financial conditions. The moderation in consumption should contain upside surprises in inflation and keep the Fed on a dovish footing. Taken together we think US interest rates are attractive and so should support attractive returns in US fixed income.

Q: “What structural shifts are shaping fixed income returns beyond the current rate cycle?”

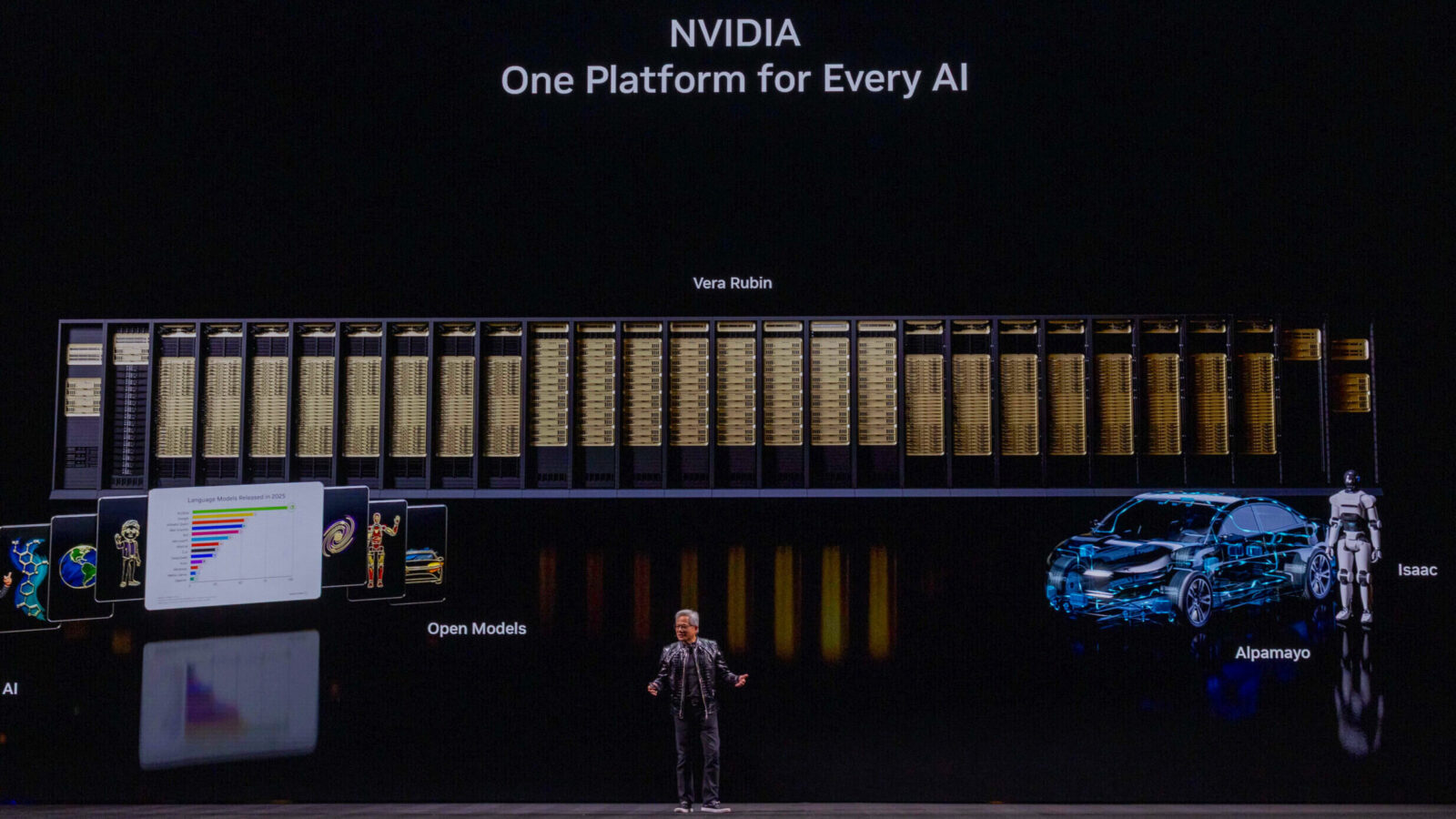

A: Artificial Intelligence (AI) is an area we believe has the potential to affect growth, productivity, and the US labor market. On one hand, more individuals are using AI at work, which could offset productivity dips, similar to past technology adoption cycles. Alternatively, with near zero job growth right now and many companies not currently looking to expand their workforce, the debate centers around whether it is lack of demand for labor or lack of supply. Some demographic factors which may be contributing include lower immigration than recent years and little population growth.

We also think it is reasonable to assume there are some companies holding out on hiring while they explore AI and automation, even if they don’t say it explicitly. While it is unclear if AI is truly part of the labor market story today, if / when it is, this could be a significant deflationary force. Implications could include lower rates on the back of higher unemployment and disinflation. Market participants are aware of the AI risks so the real question is “when” it will matter. We are on the lookout for companies talking about AI and their uses/implementation and we believe AI impacts to very much be on the investable horizon.

Q: “What characteristics should financial professionals consider in fixed income strategies today — flexibility, duration management, credit exposure?”

A: All of the above. There is a great deal of uncertainty on the path of fiscal deficits, productivity and trade policy which likely will lead to greater interest rate and credit spread volatility. Therefore, a strategy that responds to shifting fixed income market valuations by reducing duration and credit exposure when interest rates and credit spreads are overvalued and then adds both when valuations improve has the potential to preserve capital when fixed income market returns are negative and generate higher relative returns when they recover.

Q: “What makes a dynamic bond strategy truly ‘dynamic’ — and how should financial professionals evaluate that?”

A: We believe fixed income market pricing is often pushed to extremes inconsistent with fundamentals and reasonable expectations for forward-looking returns due to asset owners’ preference for income/yield at any price. A dynamic strategy is designed to move in the opposite direction of the biases of large, fixed income investors acting as a liquidity provider during periods when large asset owners are forced sellers and selling into periods of robust demand when valuations are stretched. Portfolios managed in this capacity maximize exposure to asset classes and securities with high expected returns and minimize exposure to asset classes and securities with low expected returns.

Financial professionals should evaluate dynamic strategies based on their risk-adjusted total return particularly during periods of heighted interest rate and credit spread volatility. Dynamic bond portfolios should perform best in periods of notable risk-on and risk-off moves – and it is our belief that we are entering a multi-year theme of elevated volatility in fixed income markets amidst a backdrop of geopolitical tension, tight valuations, inflation volatility, global central bank divergence and potential asset allocation changes. An environment marked with heavy uncertainty is ripe with opportunity for dynamic, total-return oriented fixed income.

Q: “What’s one misconception financial professionals have about bond markets right now?”

A: The biggest misconception is that you need to reach for yield by going down in quality in high yield or giving up liquidity in securitized sectors to realize attractive returns. The yield differential between US Treasuries and credit sectors are at all-time lows, but overall yields are attractive. The contribution to total returns from credit spreads is inversely correlated to the price you pay for it – when credit spreads are tight we believe it is imperative to hold a meaningful treasury allocation for two reasons (1) Insulate the portfolio from negatively skewed total return; (2) Maintain dry powder to deploy when volatility creates attractive income and capital appreciation opportunities.

See how the Hartford Dynamic Bond ETF can help you navigate today’s fixed income markets. Explore the fund.

Disclaimer

Investors should carefully consider a fund’s investment objectives, risks, charges and expenses. This and other important information is contained in a fund’s full prospectus and summary prospectus, which can be obtained by visiting hartfordfunds.com. Please read it carefully before investing.

ETFs are distributed by ALPS Distributors, Inc. (ALPS). Advisory services are provided by Hartford Funds Management Company, LLC (HFMC). Certain funds are sub-advised by Wellington Management Company LLP. HFMC and Wellington Management are SEC registered investment advisers. Hartford Funds refers to Hartford Funds Distributors, LLC, Member FINRA, and HFMC, which are not affiliated with any sub-adviser or ALPS.

Important risks for Hartford Dynamic Bond ETF: The Fund is new and has limited operating history. Investing involves risk, including the possible loss of principal. Security prices of the Fund’s underlying holdings will fluctuate in value depending on general market and economic conditions and the prospects of individual companies. The market price of the Fund’s shares will fluctuate in response to changes in the Fund’s net asset value, intraday value of the Fund’s holdings, and the supply and demand for shares. • The Fund is actively managed and does not seek to replicate the performance of a specified index. • Fixed income security risks include credit, liquidity, call, duration, event, inflation and interest-rate risk. As interest rates rise, bond prices generally fall. • The Fund may engage in active and frequent trading to achieve its objective. As a result, the Fund is expected to have high portfolio turnover, which will increase its transaction costs and could increase an investor’s tax liability. • Investments in high-yield (“junk”) bonds involve greater risk of price volatility, illiquidity, and default than higher-rated debt securities. • Foreign investments, including foreign government debt, may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political, economic and regulatory developments. These risks may be greater, and include additional risks, for investments in emerging markets. • Derivatives are generally more volatile and sensitive to changes in market or economic conditions than other securities; their risks include currency, leverage, liquidity, index, pricing, valuation, and counterparty risk. • Restricted securities may be more difficult to sell and price than other securities. • Obligations of U.S. Government agencies are supported by varying degrees of credit but are generally not backed by the full faith and credit of the U.S. Government. • The Fund may effect creations and redemptions partly or wholly for cash, rather than in-kind, which may make the Fund less tax-efficient and incur more fees than an ETF that primarily or wholly effects creations and redemptions in-kind.